As the financial world transitions from a tumultuous 2023 into the promise of 2024, it stands on the precipice of a new era defined by resilience and unexpected turns. The closing chapter of 2023 witnessed European stocks rebounding with an impressive 12.64% annual gain, defying the previous year’s decline. In the United States, Wall Street showcased its enduring strength with the S&P 500 narrowly missing a record high, encapsulating a two-month rally. Tech stocks, recovering from the previous year’s slump, powered the Nasdaq to one of its best years in two decades, underscoring the sector’s remarkable comeback. Amid these developments, the global economic narrative was punctuated by mixed signals – inflation rates have shown a decelerating trend, yet central banks across the globe are poised for interest rate adjustments, shaping a complex yet cautiously optimistic outlook for 2024.

Key Takeaways:

- Stellar Performance of European Stocks: The Stoxx 600 index closed 2023 with an impressive gain of 12.64%, showcasing a strong rebound from its previous year’s decline of 12.9%. This upturn reflects a significant recovery in investor confidence and market conditions within the region.

- U.S. Market’s Steady Close: The S&P 500 index in the United States exhibited stability on the final trading day, maintaining the upward trend observed in the last two months of 2023. This steadiness is indicative of a resilient U.S. stock market amidst varying economic signals.

- Remarkable Rise in Germany’s DAX: Germany’s DAX index recorded a near 20% rise over the course of 2023. This growth occurred despite Germany facing economic headwinds, signalling strong market resilience and investor optimism in German equities.

- Substantial Gains in French and UK Markets: France’s CAC 40 and the UK’s FTSE 100 indexes saw gains of 16.4% and 3.64%, respectively. These figures highlight the positive momentum in European stock markets, with France outperforming the UK by a significant margin.

- Decline in U.S. Inflation Rates: The United States witnessed a notable reduction in annual headline inflation, dropping from 6.4% in January to 3.1% by November 2023. This decrease suggests effective monetary policies and a stabilizing economy.

- Inflation Reduction in Euro Zone and UK: The Euro Zone and the UK experienced significant inflation drops, with the Euro Zone falling to 2.4% from 8.5%, and the UK to 3.9% from 10.1%. These declines have set the stage for potential interest rate cuts in these regions.

- Nasdaq’s Exceptional Year: The Nasdaq index surged by 43% in 2023, marking it as one of the best performing years in the past two decades. This growth reflects a strong recovery and investor confidence in technology sectors.

- Tech Stock Revival: Companies like Nvidia and Facebook’s parent company, Meta, led a robust rally in tech stocks, with the Nasdaq rebounding from a 33% plunge in 2022 to a remarkable 43% increase in 2023. Nvidia’s stock price soared by an astonishing 239%.

- U.K. Housing Market Adjustment: The UK housing market recorded a 1.8% decline in house prices over the year to December, which was more significant than some forecasts but much lower than the up to 10% drop predicted earlier in 2023. This points to a cooling yet stable housing market in the UK.

FX Today:

- USD’s Steady Hold Amidst Diverse Economic Signals: The U.S. Dollar, tracked by the Dollar Index (DXY), experienced modest fluctuations around the 104.30 mark. Despite varying global economic indicators, the USD maintained a steady performance, supported by the 10-year Treasury yield’s slight decline from 4.23% to 4.20%.

- Inflation Trends Influencing Monetary Policy Expectations: U.S. headline inflation’s drop to 3.1% in November from 6.4% in January, coupled with the euro zone’s reduction to 2.4% from 8.5%, and the UK’s decrease to 3.9% from 10.1%, have fuelled market expectations of upcoming rate cuts. Analysts anticipate the Federal Reserve may start reducing rates as early as March 2024, with a 72.8% probability indicated by CME’s FedWatch.

- GBP’s Mixed Fortunes Amidst Housing Market Adjustments: The British Pound faced a challenging environment with a 1.8% year-to-year decline in house prices, contrary to earlier predictions of a more significant drop. This real estate market trend adds complexity to the Bank of England’s interest rate decisions in the coming year.

- Tech Sector’s Robust Recovery Drives NASDAQ Surge: Following a tough 2022, the tech-heavy NASDAQ rebounded impressively in 2023, closing the year up by 43%. This surge, led by significant gains in companies like Nvidia and Facebook’s parent company Meta, positions the NASDAQ just 6.5% below its record high from November 2021.

- China’s Yuan Stabilisation Efforts: China’s approach to stabilising the yuan diverged significantly from past strategies. Instead of direct interventions like in 2015, the People’s Bank of China (PBOC) and other regulators used a combination of market guidance and state bank purchases to control the currency’s value without depleting foreign reserves. This method, while effective in stabilizing the yuan, also led to reduced trading volumes and raised questions about the yuan’s role as a global reserve currency.

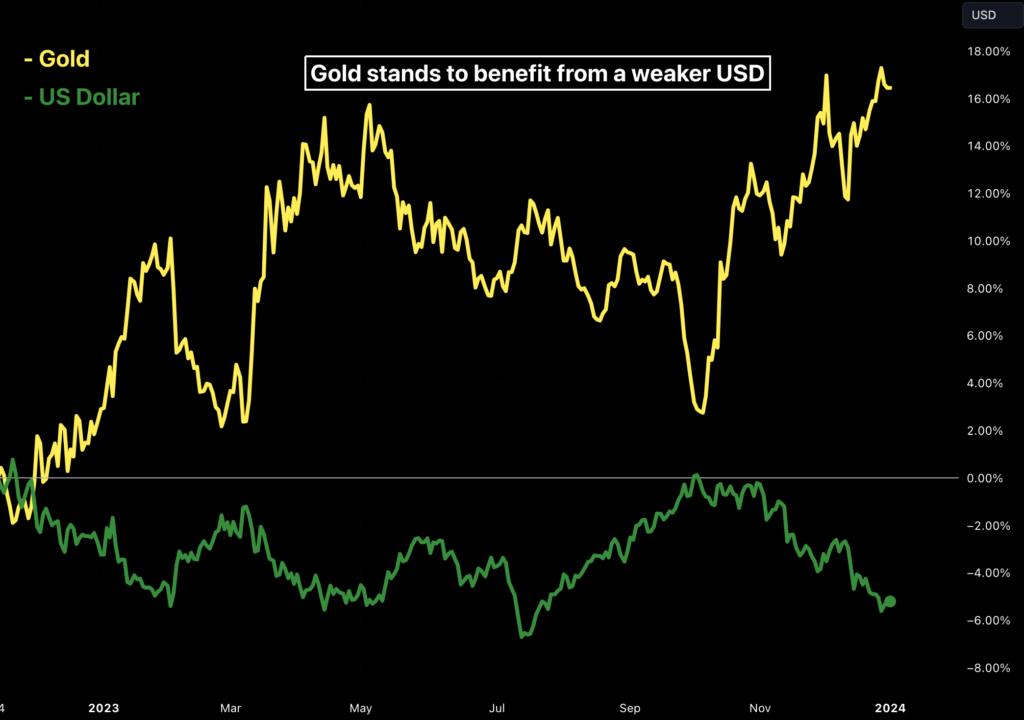

- Commodity Market Outlook and Gold’s Safe-Haven Status: The commodity markets, including gold and silver, showed signs of recovery after a period of general decline. The decrease in U.S. Treasury yields and a weaker dollar have supported gold prices. Gold’s status as a safe-haven asset was highlighted during times of banking stress and geopolitical conflicts in 2023, with expectations of continued support in 2024.

- UK’s GBP Analysis Amid Monetary Policy Changes: The GBP enters 2024 on a stronger footing against the USD, following dovish signals from the Federal Reserve. The Bank of England faces the challenge of balancing rate cuts to support the economy without reigniting inflation. Market expectations suggest the first rate cut in May 2024, with the possibility of adjustments based on inflation trends.

- US Equities’ Outlook: The S&P 500 and NASDAQ displayed strong technical performance in 2023, with the S&P 500 nearing January 2022 highs and the NASDAQ in uncharted territory with new highs. The outlook for 2024 remains cautiously optimistic, with attention on whether the tech sector can continue its growth and the impact of potential interest rate cuts.

- Crude Oil Market Dynamics: Oil prices fluctuated throughout 2023, reaching a high in September but declining sharply thereafter. The OPEC+ group’s production cuts and the shaky economic data from major oil consumers like China influenced market sentiments. The oil market in 2024 will likely continue to balance production decisions and global demand dynamics, with additional factors like interest rate cuts potentially impacting prices.

Things You Need to Know to Start Your Year

- Redefining Stock Market Expectations: Contrary to the predictions at the start of 2023, stocks displayed resilience while bonds showed mixed performances. The Federal Reserve’s strategy against inflation didn’t lead to a U.S. recession as anticipated, and the investments in Chinese stocks yielded mixed outcomes. This deviation from forecasted trends underlines the unpredictability of financial markets and the need for adaptive strategies in 2024.

- Emergence of AI in Tech and Beyond: The advancement of generative artificial intelligence stands as a pivotal technological development. Companies like Microsoft, Google, Meta, and Amazon are making significant investments in AI. This surge in interest, particularly in generative AI, is set to revolutionise various sectors, from software development to customer service, and even global business strategies. However, the actual adoption rate and its impact on productivity across industries remain to be seen in 2024.

- Antitrust Pressures on Big Tech: Tech giants may face increased regulatory pressures in 2024, especially with significant legal decisions pending against companies like Google. The enforcement of the EU’s new Digital Markets Act could lead to significant changes in how these tech companies operate, potentially increasing digital service options for consumers and presenting both challenges and opportunities for investors.

- Private Equity and Financial Sector Dynamics: Private equity firms, now publicly traded entities like Blackstone, are attracting attention with their inclusion in major indices like the S&P 500. The shift of private equity firms to public markets and the influx of retail investors into these spaces could reshape investment landscapes. Additionally, the increasing involvement of insurance premiums in private equity raises concerns about the sector’s impact on financial stability and the broader economy.

- Key Personalities and Global Political Impacts: As the world moves into 2024, the focus will be on influential figures like Sam Altman of OpenAI and potential political shifts, such as the outcome of the U.S. presidential election. The actions of these individuals and the geopolitical landscape, including the continuing tensions in regions like Ukraine, East Asia, and the Middle East, will significantly impact various sectors ranging from technology to defence and energy.

- Luxury Industry’s Shifting Dynamics: The luxury sector experienced a downturn in 2023, with a predicted more subdued growth in 2024. The pandemic-driven sales boom has faded, especially in the U.S., affecting middle-class consumer spending. Key to watch is the Chinese market, which is crucial for the luxury sector’s growth despite recent challenges, including COVID-19 lockdowns and geopolitical tensions.

- Defence Industry’s Technological Evolution: Low-cost drones and AI-driven technologies are increasingly vital in modern warfare, as seen in conflicts like Ukraine. This shift urges governments and defence contractors to adapt, moving from traditional hardware to more agile, tech-oriented solutions. The capability of large defence contractors to innovate in this fast-evolving landscape will be critical.

- Energy Sector’s Balancing Act: The OPEC+ oil production cuts contrasted with rising U.S. production, leading to a decline in the cartel’s global market share. The balancing of price support actions against a backdrop of fluctuating global demand, especially from major consumers like China, will continue to influence oil market dynamics.

- Renewable Energy’s Cost Challenges: High interest rates and inflation have increased the costs of renewable energy projects, potentially slowing down the energy transition in 2024. The offshore wind industry, in particular, faces significant hurdles, which could impact sector leaders like Ørsted.

- AI’s Role in Corporate Strategies: The integration of AI into corporate strategies, especially in the tech sector, is accelerating. The adoption of generative AI technologies could redefine business models and productivity across industries. Companies that can effectively leverage AI for innovation and efficiency may gain a competitive edge.

- Global Monetary Policy Shifts: Central banks globally are expected to implement over 150 rate cuts in the next 12 months, marking a significant shift from the pandemic-era monetary policies. This change could impact global investment patterns, currency valuations, and economic growth trajectories.

- Banking Sector’s Stability: The banking sector’s resilience, especially in times of geopolitical and economic stress, remains crucial. The sector’s response to fluctuating interest rates and varying economic conditions will be key to maintaining global financial stability.

- Emerging Markets’ Role: Emerging markets could play a more significant role in the global economy, especially with potential shifts in monetary policies and the ongoing effects of the pandemic. Their performance could influence global trade, investment flows, and economic recovery.

- Cybersecurity Concerns in a Digital World: As businesses and governments become increasingly digital, cybersecurity threats pose a more significant risk. Companies and nations must invest in robust cybersecurity measures to protect sensitive data and infrastructure from growing cyber threats.

- Sustainability and ESG Investing: The focus on sustainability and Environmental, Social, and Governance (ESG) criteria in investment decisions will continue to grow. Companies that prioritize sustainable practices and ESG compliance are likely to attract more investment and consumer support.

Conclusion:

As we step into 2024, the landscape of global finance and economics presents a multifaceted narrative of transformation and adaptation. The meeting of evolving technological paradigms (particularly in artificial intelligence), the reshaping of luxury and defence sectors, and the shifting sands of monetary policies sets the stage for a year of significant developments. Amidst this backdrop, the persistent themes of sustainability, cybersecurity, and the growing influence of emerging markets signal a pivotal shift in global economic dynamics. Investors and businesses alike must navigate this landscape with agility and foresight, ready to embrace the opportunities and challenges that this new year will present. The year ahead promises not just change, but a redefinition of market norms and strategies, demanding a nuanced understanding of a rapidly evolving global economic ecosystem.

As 2023 is finally over, here is to a prosperous New Year for all the investors!