Financial Market News

- UK Jobs Data Boosts BoE Rate Hike Odds

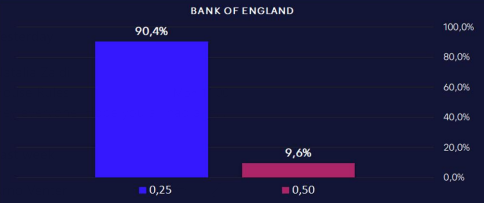

UK jobs data released today showed a surprise increase in wages, which boosted the odds of another 25 basis point rate hike by the Bank of England (BoE) to 90%.

The BoE is concerned about the risk of rising wages creating a second-round effect that keeps price pressures elevated for longer. However, the underlying job market showed notable deterioration, with a -66K job contraction and a bigger than expected pop in the Unemployment Rate.

- Equities Remain on the Backfoot as Benchmark Yields Rise

Equities traded mostly softer in today’s European session as benchmark yields continued to grind higher. Higher risk-free rate of returns (10-year treasury yields) pose a headwind for equities.

- Commodities Stay Pressured on Stronger Dollar and Bad News Out of China

Commodities were broadly pressured this morning following the continued sour risk sentiment but also the strength in the USD and the bleak economic data out of China which showed further pressure on the economy. Gold $1893 Junes low is a a price that needs to hold or we could see a move into the low $1800’s

In FX, CHF Leads the Majors to the Upside

The CHF is leading the major currencies to the upside with the price action looking very indicative of SNB intervention. The AUD is the weakest of the majors given the negative risk flows in equities and commodities, as well as the negative news out of China.

Key Events to Watch

- Canadian CPI (12:30 PM ET)

- US Retail Sales (3:00 PM ET)

Our Take

- We expect the USD to remain the cleanest shirt in the dirty laundry pile, so we would look for upside potential in USDCAD on a beat in US Retail Sales. However, we won’t be necessarily interested to look for shorting opportunities in a miss.

- As always, keep in mind that Retail Sales can be a very noisy data point, which is why it is important to watch out for the monthly revisions that can skew the way markets interpret the actual number.

- As for the Canadian CPI, the markes are quite sure that the BoC won’t be hiking rates in September, and it would arguably take an exceptionally strong beat today to change that view.

Thus, fundamentally speaking, we would prefer to look for shorting opportunities in CAD on a lower-than-expected CPI release (preferably against the USD).

This also means we could use a stronger than expected CPI as a means to look for USDCAD buying opportunities at better levels.

Technically speaking, the chart points that we are at a potential turning points, although more confirmation is required in this case.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.