The global financial markets navigated through a complex maze of economic signals against the backdrop of closed U.S. markets in observance of Martin Luther King, Jr. Day. European stocks retreated modestly, reflecting investor unease as bond yields edged higher. Meanwhile, in a surprising move, China’s central bank refrained from an anticipated rate cut, adding to the cautious tone set against a backdrop of forthcoming GDP data. The German economy notably dodged a recession despite reporting a contraction of 0.3% in 2023, a testament to its resilience in a challenging global environment. The annual gathering in Davos commenced, shifting the focus to geopolitical dynamics. This mixed financial environment underscores the complexity of current economic challenges. Investors braced for a critical week ahead, with key data releases from China, the UK, and the US poised to offer fresh insights into the global economic pulse amidst ongoing challenges.

Key Takeaways:

- European Markets Retreat Amid Rising Yields: The STOXX 600 index in Europe closed down 0.5%, as bond yields increased. This downturn brought the index’s year-to-date decline to approximately 1%, a contrast to the 13% rise it experienced in 2023. Key markets like Britain’s FTSE 100 and Germany’s DAX also saw declines of 0.4% and 0.5%, respectively.

- China’s Central Bank Defies Expectations, Holds Rates: In a move that caught investors off-guard, the People’s Bank of China kept its medium-term policy rate unchanged, avoiding the anticipated rate cut. This decision contributed to the Chinese CSI 300 index dipping to its lowest since 2019, though it later recovered slightly to close 0.1% lower.

- Japanese Stocks Reach 34-Year High: Contrasting with the broader market trend, Japan’s Nikkei 225 index soared to a 34-year peak, crossing 36,000 points. The rally in Japanese stocks is attributed to the weakening yen and a drop in U.S. bond yields.

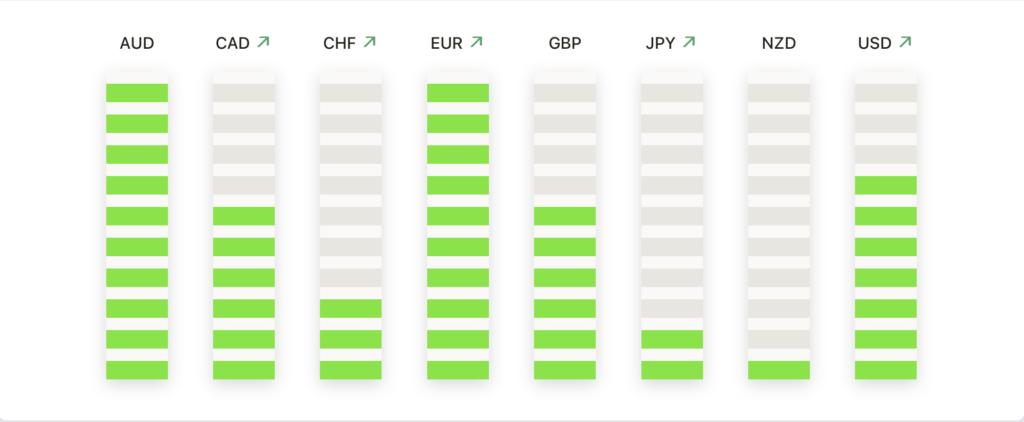

- Currency Movements Remain Mixed: The Euro and the U.S. Dollar saw modest movements, with the Euro trading around $1.095 and the Dollar index rising by 0.14% to 102.65. These shifts in major currencies play a crucial role in influencing investor sentiment and international trade dynamics.

- Bank Valuations Poised for Significant Growth: According to a report, global banks have the potential to enhance their valuations by $7 trillion over the next five years, contingent on growth promotion and productivity enhancements.

FX Today:

- Dollar Index Sees Modest Uptick: The U.S. Dollar Index edged up slightly by 0.14%, hovering around the 102.65 mark. This incremental rise is indicative of the nuanced shifts in investor confidence and the comparative performance of the dollar in the global FX landscape.

- AUD/USD Responds to PBoC Decision and Market Sentiment: The Australian Dollar faced a downtrend against the U.S. Dollar. The AUD/USD pair was seen trading at 0.6655, marking a decrease from its high of 0.6705, reflecting the complex dynamics between domestic economic indicators and global market movements.

- GBP/USD Adjusts Ahead of Key Data Releases: The GBP/USD pair trading at around 1.2717, a subtle decline from its previous position. Analysts predict a slight uptick in the year-over-year figures, which could significantly impact the pair’s trajectory. Traders are monitoring the 1.2650 – 1.2685 support range closely, as a break below could lead to further declines.

- USD/JPY Capitalises on Currency Dynamics: The USD/JPY pair experienced upward momentum, trading near the 146.00 level, driven by the Japanese Yen’s relative weakness and shifting U.S. economic indicators. The potential resistance looming around the 147.00 – 147.50 zone. Market participants remain attentive to the Bank of Japan’s ultra-dovish monetary policy and its impact on currency dynamics.

- Canadian Dollar’s Mixed Performance: The USD/CAD pair hovered around 1.3440, indicating a potential test of the 1.3500 psychological barrier, marked by the 200-day Simple Moving Average. This movement comes in light of the upcoming Canadian Consumer Price Index (CPI) inflation data.

- EUR/GBP Navigates Through Market Pressures: The EUR/GBP pair showed resilience, trading around 0.8600 with modest gains. The immediate support is seen at the 0.8600 level, with a break below potentially exposing the pair to further declines. Conversely, resistance lies around 0.8615, followed by the January highs near 0.8650.

- Oil Prices Dip Amid Demand Concerns: Brent crude oil saw a decrease of 0.8%, settling at $77.66 a barrel. This decline was influenced by mixed signals regarding global demand and disruptions in Red Sea shipping routes.

Market Movers:

- Atos SE experienced a significant drop, with shares falling by 15.1%, marking the largest decline among the Stoxx Europe 600 constituents.

- Sinch AB and Samhaellsbyggnadsbolaget i Norden AB Series B also faced downturns, with their shares dropping 10.4% and 9.3% respectively.

- MorphoSys AG stood out with a positive performance, as its shares climbed 9.7%, leading the gainers in the Stoxx Europe 600.

- Viaplay Group and Flutter Entertainment PLC also saw gains of 4.5% and 3.0%, contributing to the varied performance across different sectors.

Conclusion:

As global markets conclude a day of mixed signals and strategic recalibrations. The divergent paths of major economies – from Europe’s cautious trading to China’s rate decision, and Germany’s economic resilience – highlight the multifaceted nature of the current financial landscape. The temporary pause in U.S. market activities served as a reminder of the interconnectedness and interdependency of global markets. As the world’s financial leaders converge in Davos, their discussions and decisions are set to resonate across markets, potentially charting the course for future economic policies and investor strategies. With significant data releases on the horizon, the investment community is poised on the cusp of new insights that could recalibrate market sentiments and strategies. In this intricate dance of economies and policies, the ability to navigate through uncertainty and anticipate shifts remains a key determinant of market direction in the days ahead.