Markets exhibited a complex range of highs and lows, navigating through a mix of record-setting achievements and underlying economic uncertainties. The S&P 500 and Dow Jones Industrial Average both notched fresh records, underscoring the robust appetite for risk among investors, lifted by a combination of corporate earnings beats and positive economic indicators. Yet, the landscape was not without its challenges, as the Nasdaq Composite’s slight retreat and mixed economic data painted a picture of the intricate balance markets are currently managing. Amidst this backdrop, Wall Street analysts and investors alike are judging the sustainability of recent momentum, particularly in the tech sector, which has been at the heart of the market’s rally. Last week’s market movements serve as a reminder of the delicate relation between investor optimism and the reality of ongoing economic challenges.

Key Takeaways:

- Record Highs Amid Mixed Market Sentiments: The S&P 500 marginally advanced by 0.03% to close the week at a historic high of 5,088.80, briefly surpassing the 5,100 threshold for the first time. The Dow Jones Industrial Average also set a new record, climbing 62.42 points, or 0.16%, to close at an all-time high of 39,131.53. Conversely, the Nasdaq Composite experienced a modest decline of 0.28%, closing at 15,996.82 despite achieving a 52-week high earlier in the session.

- European Markets Achieve New Records: European stocks ended the week on a high note, with the Stoxx 600 index climbing 0.4% on Friday to close at a fresh record, helped by positive earnings and mixed data. The French CAC 40 and the German DAX both edged higher by 0.7% and 0.3%, respectively, contributing to the upbeat mood in European equities.

- German Economic Contraction Adds to Eurozone Concerns: Germany’s GDP contracted by 0.3% in the fourth quarter of 2023, confirming fears of a deepening economic downturn in Europe’s largest economy. This followed a 0.1% contraction in the third quarter, marking a challenging period for the German economy.

- Asia-Pacific Markets Show Resilience: In Asia, the CSI 300 index of major Chinese stocks edged up by 0.09%, marking nine consecutive days of gains. However, the Hang Seng index in Hong Kong dipped slightly by 0.13% in volatile trading. South Korea’s Kospi and Australia’s S&P/ASX 200 both closed higher, by 0.13% and 0.43%, respectively, indicating a generally positive outlook in the region.

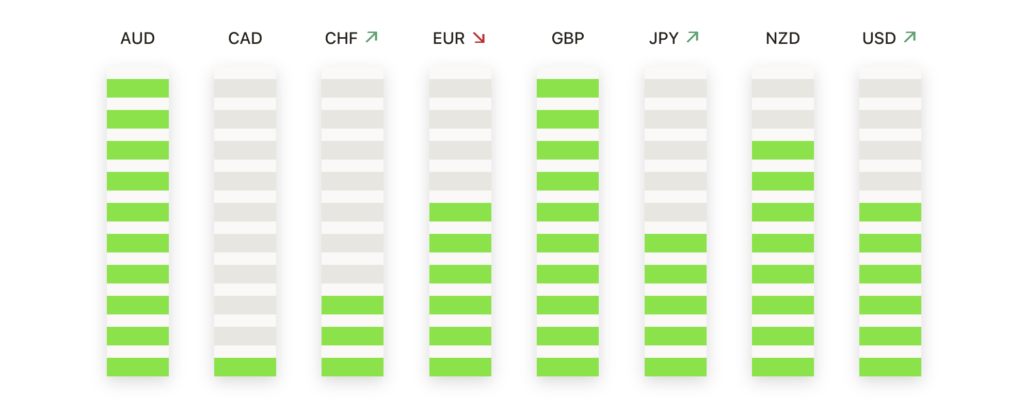

FX Today:

- EUR/USD Holds Steady in a Narrow Band: The EUR/USD pair adjusted slightly, trading within a close range between 1.0840 and 1.0810, reflecting market caution ahead of upcoming significant data releases. Despite a brief ascent to a near-term high of 1.0888 earlier in the week, the pair settled just above the 1.0800 level, constrained by the 200-day SMA at 1.0827. The pair’s movements suggest a cautious outlook from traders, with a net decline of about 2.8% from its late December peak.

- GBP/USD Faces Uncertain Terrain: The GBP/USD traded within a narrow band, moving between 1.2459 and 1.2862, with recent activity pinpointing 1.2694 as a critical resistance level. Amid UK’s entry into a technical recession in Q4 2023, signals of a mild downturn and optimistic remarks from Bank of England Governor hint at potential recovery. The focus remains on external factors, including US economic data. This week, the pair’s direction may hinge on how the external factors play against the internal economic narrative, challenging the notion of stability amongst underlying uncertainties.

- Gold Climbs on Yield Retreat: Gold prices found support from falling US Treasury yields, with XAU/USD rising to $2,038, a 0.70% increase. The metal broke past the 50-day SMA at $2,033.75, eyeing the resistance at $2,050, and potentially targeting the early February high of $2,065.60. Investors’ shift towards the safe-haven asset amid subdued bond yields underscores the cautious market sentiment.

- USD/JPY Awaits Breakout: USD/JPY was largely unchanged, lingering just below the resistance at 150.85. A breakthrough could ignite bullish momentum towards the 152.00 level, last year’s highs. Conversely, failure to surpass this resistance might see the pair retreating towards support levels at 149.70 and 148.90.

- EUR/JPY Contends with Resistance: EUR/JPY experienced marginal fluctuations, trading just beneath the 164.00 resistance. A decisive move above this level could challenge the trendline resistance at 165.20. On the downside, support lies at 161.50 and 160.75, with further weakness possibly exposing the pair to the 100-day SMA near 159.60.

- GBP/JPY Surpasses Multi-Year Highs: GBP/JPY advanced, breaking above the significant 191.00 mark, signalling bullish control. The next resistance is envisioned at 192.50, with the potential to approach the 2015 peak of 196.00 on continued strength. Initial support is found at 190.00, followed by 188.50, with the 50-day SMA providing additional support near 185.50.

Market Movers:

- Nvidia’s Stellar Earnings Propel Tech Sector: Nvidia shares surged, closing up nearly 1% at $788.17 after an exceptional earnings report. The company announced a staggering 265% increase in revenue year-over-year to $22.10 billion for its fiscal fourth quarter, significantly above the expected $20.62 billion. This performance briefly elevated Nvidia’s market cap to over $2 trillion during intraday trading, underscoring the tech sector’s robust demand for artificial intelligence capabilities.

- Block Inc Surges on Earnings Beat: Shares of Block Inc (SQ) soared by 16.1% after the financial services company reported fourth-quarter revenue that exceeded Wall Street estimates. The company’s robust performance is a testament to the growing fintech sector’s resilience and innovation.

- Carvana Co Jumps on Positive Outlook: Carvana’s (CVNA) stock climbed 32.1%, helped by the used car retailer’s optimistic growth forecast for 2024. This significant uptick reflects investor confidence in Carvana’s business model and the broader recovery in the used vehicle market.

- Booking Holdings Faces Headwinds on Outlook Concerns: Shares of Booking Holdings (BKNG) tumbled over 10%, leading losses in the S&P 500, after the travel and booking company provided a gross bookings growth forecast that fell short of market expectations. This decline reflects growing concerns over the travel sector’s recovery pace amidst fluctuating demand.

- MercadoLibre Dips on Earnings Miss: MercadoLibre’s (MELI) shares dropped more than 10%, marking a significant pullback after the e-commerce giant reported quarterly earnings that missed analyst expectations. The downturn underscores the challenges facing online retailers as they navigate shifting consumer spending patterns.

- Volvo Cars Adjusts Stake in Electric Vehicle Market: Volvo Cars announced a decision to dilute its stake in electric vehicle maker Polestar by distributing 62.7% of its holdings to its shareholders, resulting in a 3.8% decline in its stock price. This strategic move reflects the evolving dynamics within the electric vehicle sector and Volvo’s adjustment to market conditions.

- Warner Bros. Discovery (WBD) Faces Setback: Warner Bros. Discovery’s shares declined by more than 9% following a Q4 revenue report of $10.28 billion, missing the consensus expectations of $10.46 billion. This downturn reflects market concerns regarding the company’s growth prospects and competitive positioning in the dynamic media and entertainment landscape.

The notable uptick across all major US indices shows prevailing positivity among investors. The S&P 500 led the charge with an impressive 1.66% increase, closely followed by the Nasdaq’s 1.4% gain, and the Dow’s rise of 1.3%. This collective upward movement, from Nvidia’s record-breaking earnings to the more measured pace of Booking Holdings, illustrates a dynamic financial environment. The gains across the board highlight the resilience and adaptability of markets in the face of technological innovation and economic challenges alike. As investors look back on a period of substantial progress, they are reminded of the importance of strategic agility and informed decision-making in capitalising on growth, while remaining prepared for the unpredictability of global economic trends.