In a historic week filled with economic revelations and technological successes, the stock market narrative took a dramatic turn as the S&P 500 Index shattered expectations, soaring above the 5,000 mark for the first time ever. This landmark achievement was underpinned by revised inflation data, resilient earnings reports, and escalating economic indicators, painting a picture of a market in robust health. Amidst this bullish backdrop, the Nasdaq Composite rallied impressively, while the Dow Jones Industrial Average navigated a minor setback, showcasing the market’s complex yet optimistic outlook. As investors digested these mixed signals, the charm of technology stocks and the anticipation of forthcoming economic data releases became focal points of a market eagerly charting its course through uncharted waters.

Key Takeaways:

- S&P 500 Breaks Historical Threshold: The S&P 500 Index’s ascent to 5,026.61, marking a 0.57% increase, signifies its first-ever closure above the 5,000 level, highlighting a market buoyed by strong earnings and optimistic economic forecasts.

- Nasdaq Composite Leads with Tech Surge: Experiencing a substantial rally, the Nasdaq Composite surged 1.25% to close at 15,990.66, driven by significant gains in mega-cap technology stocks, including Nvidia’s 3.6% jump and Alphabet’s 2% increase.

- Dow Jones Faces Slight Retreat: In contrast, the Dow Jones Industrial Average encountered a minor decline, dropping 54.64 points or 0.14%, to finish at 38,671.69, reflecting the market’s subtle response to a mix of economic signals.

- Inflation Revisions Fuel Optimism: Revised inflation figures for December, adjusted to a 0.2% increase from the initially reported 0.3%, played a crucial role in uplifting market sentiment, setting a positive tone ahead of January’s CPI data release.

- Global Markets Display Varied Responses: European markets saw a slight decrease, with the Stoxx 600 down 0.08%, while Japan’s Nikkei reached a 34-year high, illustrating the diverse global market reactions to economic data and corporate earnings.

- Amazon Share Sale Draws Attention: Jeff Bezos’s sale of approximately $2 billion in Amazon shares, as part of a pre-arranged trading plan, sparked market interest, reflecting ongoing adjustments among major tech players.

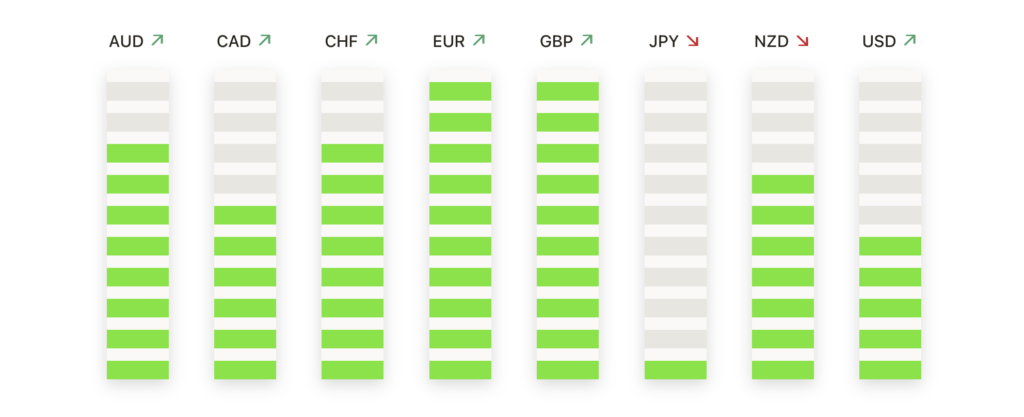

FX Today:

- EUR/USD Edges Higher Amidst Recovery Hopes: The EUR/USD pair saw modest gains, reaching just below the 1.0800 mark as it continued its recovery. The currency pair ended the session beneath the critical 1.0800 threshold, highlighting the ongoing challenges it faces despite a slight recovery from the week’s low near 1.0725. The bearish trend remains intact with the pair still significantly down from its late December peak of 1.1140.

- GBP/USD Gains Traction with Positive Economic Outlook: The GBP/USD pair demonstrated resilience, strengthening to 1.2692, thanks to favourable economic data from the UK. This 0.24% increase suggests an optimistic view of the British economy, despite broader uncertainties, with the pair navigating between the significant retracement levels and the late December highs.

- CAD Experiences Volatility Against the USD: The Canadian Dollar showed volatility, with the USD/CAD pair moving from a low of 1.3413 to a higher range near 1.3480. This movement reflects a half percent rally from bottom to top on Friday, indicating short-term pressure but potential for upward movement towards the 1.3900 mark noted last November.

- Oil Prices React to Geopolitical Tensions: WTI Crude Oil slightly increased by 0.25% to $76.54 per barrel amidst escalating tensions in the Middle East and a contraction in US oil production. The market remains cautious, with oil prices hovering around the 200-day moving average at $77.29, suggesting a balanced yet cautious investor sentiment towards energy commodities.

- Gold’s Decline Amidst Anticipation of CPI Data: XAU/USD (Gold) experienced a dip to $2,025, a decrease of 0.40%, as investors awaited the upcoming Consumer Price Index (CPI) data. Despite this week’s modest fall, the gold market shows signs of consolidation around the 50-day SMA, with potential resistance at $2,065 and support near $2,005, indicating a cautious market sentiment.

- GBP/JPY Navigates Bullish Territory: The GBP/JPY pair maintained its bullish stance, finding support near the 188.50 level after an early-week recovery from 186.20. Despite facing resistance near the 189.00 mark, the pair’s performance indicates a strong inclination towards bullish momentum, supported by a solid base above the 200-day SMA.

Market Movers:

- Semiconductor Sector Leads Gains: Applied Materials (AMAT) set the pace with an impressive surge of more than 6%, highlighting its dominance in the S&P 500 and Nasdaq 100 indices. Following closely, Lam Research (LRCX) and KLA Corp (KLAC) posted gains of more than 5% and 4%, respectively. Nvidia (NVDA) also made a significant impact, advancing by more than 3%, while ASML Holding NV (ASML) and NXP Semiconductors NV (NXPI) each climbed by more than 2%. Intel (INTC) contributed to the rally with a rise of more than 1%, underscoring the semiconductor industry’s robust momentum.

- Software Sector Witnesses Substantial Growth: Cloudflare (NET) led the software sector’s advance with a remarkable 19% jump after reporting Q4 revenues of $362.5 million, surpassing the consensus estimate of $353.8 million. MongoDB (MDB) and Fortinet (FTNT) followed suit with increases of more than 5% and 4%, respectively, while Atlassian Corp (TEAM) and Datadog (DDOG) each secured gains of more than 2%.

- Cybersecurity Firms Rally: The cybersecurity sector saw significant activity, with Crowdstrike Holdings (CRWD), Palo Alto Networks (PANW), SentinelOne (S), Gen Digital (GEN), and Zscaler (ZS) all closing up by more than 2%, reflecting growing investor confidence in cybersecurity solutions.

- FirstEnergy Exceeds Market Expectations: FirstEnergy (FE) outperformed, closing up more than 4% after its Q4 revenue reached $3.20 billion, exceeding the consensus forecast of $2.97 billion, and highlighting its operational success.

- Masonite International’s Acquisition: Masonite International (DOOR) saw a dramatic 35% increase following news of its $3.9 billion acquisition by Owens Corning, marking a significant valuation at approximately $133 per share.

- FleetCor Technologies Enjoys Analyst Confidence: Post-earnings, FleetCor Technologies (FLT) gained more than 3% as analysts raised their price targets by an average of 7.5%, signalling strong future growth prospects.

- Notable Moves in Consumer and Healthcare Sectors: Expedia Group (EXPE) faced a steep decline, dropping more than 17% after its Q4 gross bookings of $21.67 billion fell short of the $22 billion consensus. Similarly, Take-Two Interactive Software (TTWO) and Pinterest (PINS) saw significant decreases of more than 8% and 9%, respectively, due to less favourable earnings outlooks. In contrast, Estee Lauder (EL) and Boyd Gaming (BYD) recorded gains, with Estee Lauder appreciating more than 1% after an upgrade, and Boyd Gaming advancing more than 1% following a strong revenue report of $954.4 million, well above the expected $930.3 million.

The financial landscape reveals a combination of resilience, innovation, and wary hopefulness. The S&P 500’s breakthrough above the 5,000 mark not only symbolises the market’s robust health but also underscores the intricate balance of forces shaping investor sentiment. From the tech sector’s vibrant rally to the dynamics within commodities and currencies, the week’s events reflect a global market at a crossroads, navigating through the complexities of economic indicators, corporate earnings, and geopolitical tensions. As investors and analysts look ahead, the anticipation of forthcoming economic data and policy decisions looms large, promising to further chart the course of a market ever-responsive to change.