Despite March typically being a tough month for stocks, the Nasdaq Composite and the S&P 500 have hit new highs, thanks to strong interest in big technology companies and excitement about artificial intelligence (AI). This surge in the markets happens as inflation in the US is slowing down, raising hopes for a possible interest rate cut by the Federal Reserve. However, in Europe, inflation is sticking around longer than expected, showing that prices aren’t dropping as fast as hoped. Even with these concerns, investors are feeling positive, especially about tech stocks, pushing the Nasdaq to its highest ever close and the S&P 500 over the 5,100 mark for the first time. This shows a strong market rally even with the usual challenges stocks face in March.

Key Takeaways:

- Nasdaq Hits Record High Amid AI Boom and Slowing Inflation: The Nasdaq Composite surged 1.14% to close at 16,274.94, reaching a session peak of 16,302.24 and surpassing its 2021 record. This represents the Nasdaq’s highest close since November 2021, driven by investor enthusiasm for megacap technology stocks in light of slowing inflation and the artificial intelligence sector’s growth.

- S&P 500 Breaks Through 5,100 Threshold: The S&P 500 achieved a milestone by closing above $5,100 for the first time, with a gain of 0.80% to 5,137.08. This record close emphasises the broad market’s strength and the positive investor sentiment prevailing in the economic environment.

- Dow Jones Posts Modest Gains: The Dow Jones Industrial Average saw a gain of 0.23%, or 90.99 points, to close at 39,087.38, demonstrating restrained optimism among investors and resilience despite being the relative straggler among major indexes.

- Sector Performance Highlights Tech and Consumer Discretionary Strength: The technology sector led the weekly gains in the S&P 500, increasing by approximately 2.4%, with consumer discretionary following closely with a 2.1% rise. Health care, however, lagged, dropping by 1.1%, indicating sectoral shifts amid current economic conditions.

- European Markets Close Higher Amid Inflation Data: European stocks ended the session higher, with the Stoxx 600 up 0.6%. February’s flash euro zone inflation fell to 2.6%, slightly above expectations, stirring investor anticipation for potential European Central Bank rate cuts. Notable gains were seen in tech stocks, up 1.6%, while insurance stocks fell by 0.7%.

- Asian Markets Mixed as Japan Nears Record Level: Japan’s Nikkei 225 approached the 40,000 mark, closing 1.9% higher at 39,910.82, nearly setting a new record. China’s markets responded positively to manufacturing data, with the CSI 300 index rising 0.6% to 3,537.8, reflecting some optimism in the region.

- Investment Shifts Amid Debt Concerns: The U.S. national debt is rapidly growing, now exceeding $34 trillion, prompting concerns over the country’s fiscal health. This surge in debt has led investors to seek stability in assets like gold and bitcoin, highlighting worries about traditional currency values. Additionally, Moody’s Investors Service has downgraded its outlook on the US credit rating to negative due to the rising debt and its impact on economic stability, signalling serious challenges ahead for fiscal management.

- Oil Prices Surge Ahead of OPEC+ Decision: US crude oil futures reached $80 a barrel for the first time since November, indicating a tightening market in anticipation of an OPEC+ decision on production cuts. The West Texas Intermediate for April settled at $79.97 a barrel, its highest close since Nov. 6, with a 2.19% increase. Similarly, May Brent futures rose 2.09% to $83.94 a barrel.

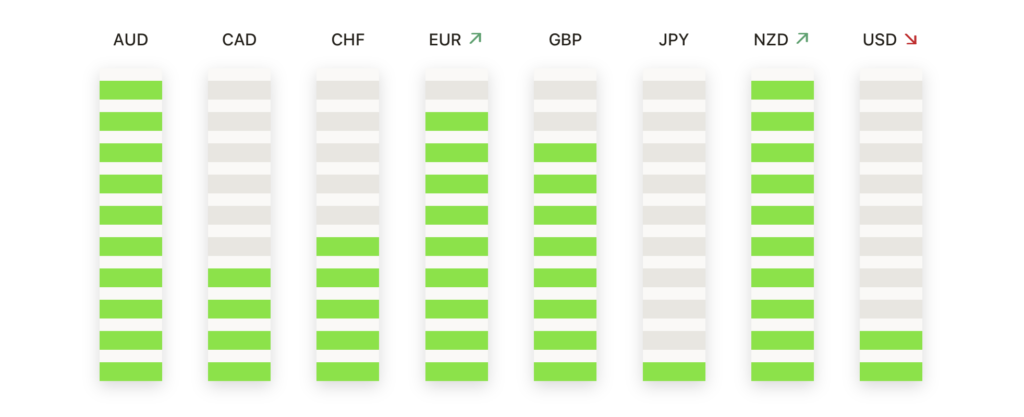

FX Today:

- EUR/USD Rebounds Amid US Data Miss: The pair climbing from the 1.0800 level to reach 1.0840 following a disappointing US ISM PMI report that fuelled a risk-on sentiment among investors. Throughout the week, the currency pair fluctuated between 1.0860 and 1.0800, ultimately concluding the week near its opening level. Currently, EUR/USD is navigating around the 200-day Simple Moving Average (SMA) at 1.0830, indicating little directional momentum. Since its last swing low of 1.0695 in early February, the pair has seen an approximate 1.3% increase.

- EUR/GBP Finds Support Above Key Moving Averages: The EUR/GBP pair edged higher throughout the week, trading around 0.8564 and regaining ground above the 20-day simple moving average (SMA). The move brings into focus a cluster of recent highs up to 0.8578 and the 50-day SMA at 0.8588, with further resistance at the 200-day SMA at 0.8610, showcasing the pair’s attempt to establish a new range amidst shifting market dynamics.

- GBP/USD Remains in a Narrow Range as Budget Approaches: GBP/USD continued to navigate between the intraday low of 1.25174 on February 7 and the high of 1.27133 on February 23. With the Spring Budget looming, the pair’s movements are closely watched for potential shifts in market sentiment that could break the current trading boundaries.

- USD/CAD Struggles to Break Past 1.3600: USD/CAD faced resistance at the 1.3600 level, retreating to test support around 1.3550. The pair remains caught in a consolidation phase, wrestling with the 200-day SMA at 1.3477. The ongoing struggle to break through the 1.3600 mark highlights the delicate balance of forces acting on the pair, with potential for reversion to previous ranges if momentum wanes.

- USD/JPY Aims for Higher Ground Following BoJ Comments: The USD/JPY pair resumed its upward trajectory, breaching the 150.00 mark in light of dovish remarks from Bank of Japan Governor Kazuo Ueda. With eyes set on surpassing the next resistance at 150.85, the pair’s movements reflect heightened investor scrutiny of Japan’s economic outlook and its implications for currency valuations.

- Gold Rallies Toward All-Time Highs Amid Market Uncertainty: Gold experienced a significant rally, pushing towards the $2,100.00 level and breaking through several key resistance points, including the $2,050 psychological barrier and the February 1 high of $2,065.60. The precious metal’s ascent into the $2,065-$2,090 range, just shy of the all-time high of $2,146.79, highlights its status as a safe haven.

Market Movers:

- Dell Technologies Surges After Strong Q4 Results: Dell Technologies saw its shares jump more than 30% following a Q4 adjusted EPS report of $2.20, well above the consensus of $1.72. The significant earnings beat by Dell underscored the company’s robust financial health and operational efficiency.

- NetApp Soars on Earnings Beat: NetApp led the gains in the S&P 500, closing up more than 18% after outperforming expectations with a Q3 adjusted EPS of $1.94, surpassing the consensus estimate of $1.68.

- Cooper Companies Posts Impressive Sales: Shares of Cooper Companies climbed more than 9% after the firm reported Q1 net sales of $931.6 million, exceeding analyst expectations of $915.9 million. The strong sales figures highlighted Cooper’s solid market position and growth trajectory.

- Eli Lilly Gains on Raised Price Target: Eli Lilly’s shares rose more than 3% after Bank of America elevated its price target for the stock to $1,000 from $800, citing potential upsides from its diabetes and obesity programs.

- Everbridge Jumps on Increased Acquisition Offer: Everbridge saw a surge of more than 25% after Thoma Bravo raised its acquisition offer to $35 per share, indicating strong interest in the company and the high value seen in its technology solutions.

- Caret Holdings Upgraded, Shares Skyrocket: Caret Holdings experienced a significant boost, with shares up more than 21% following an upgrade from “hold” to “buy” and setting a new price target of $40.

- Dominion Energy Leads Declines on Weak EPS Forecast: Dominion Energy’s shares fell more than 6%, making it one of the S&P 500’s biggest losers after projecting a 2024 adjusted EPS of $2.62-$2.87, below the consensus estimate of $3.03.

- Zscaler Falls on Weak Billings Growth: Zscaler led the Nasdaq 100’s losers, with a decline of more than 9% after reporting that Q2 calculated billings grew 27% year-over-year, missing the 30% growth expectation. The slower-than-anticipated growth rate raised concerns about the company’s market expansion and future revenue prospects.

- New York City Community Bancorp Plummets Amid Leadership and Control Issues: New York City Community Bancorp’s shares tumbled over 26% after the bank announced a significant leadership change and revealed issues with its internal controls. Already down more than 65% in 2024, this latest drop worsened investor concerns over the bank’s stability and the potential implications for a broader real estate market shakeout.

As March unfolds, the record highs of the Nasdaq Composite and S&P 500 highlight a growing excitement around tech and AI, despite the usual challenges this month brings to stocks. These achievements show investors are really into tech right now, even as they keep an eye on changing economic signs like slowing inflation in the US and sticky prices in Europe. The rise in the U.S. national debt and the decisions about oil production by OPEC+ add more for investors to think about. But overall, the mood in the market is one of caution and hope, with people looking forward to what tech advancements might bring next, all while navigating the ups and downs of the economy.