- Benchmark yields continue to rise, putting more pressure on risk assets.

The 10-year Treasury yield broke back above 4.2% yesterday and is now approaching its October 2022 high of 4.33%. This is putting pressure on stocks, commodities, and other risk assets.

- The Dollar strengthens as Treasury yields rise.

The Dollar index (DXY) closed above its 200-day moving average for the first time since November 2022. This is due to the rising dollar’s safe-haven appeal as investors become more risk-averse.

- Bitcoin falls to lowest levels since June.

Bitcoin fell below $29,000 yesterday, its lowest level since June. This is due to the broader sell-off in risk assets and the rising dollar.

Analysis

The continued rise in Treasury yields is being driven by a number of factors, including strong economic growth and rising inflation expectations.

The continued upside risks to growth (Atlanta Fed GDPNow is currently sitting above 5.0% for Q3), and the impact that will have on inflation, alongside foreign players like China and Saudi dumping some treasury positions is the biggest driver among these moves in yields, not the FOMC minutes which was stale.

The rising dollar is also being supported by the strong economic data and the rising Treasury yields. The dollar is seen as a safe haven during times of uncertainty, and the current market volatility is likely to continue to support the dollar.

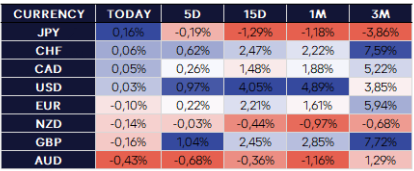

A quick look at the FX Strength Matrix

In FX, the JPY is leading the major currencies to the upside following this morning’s continued risk off tone, with yields putting pressure on risk assets broadly. The AUD is the weakest of the majors following a miss in Aussie jobs data, with the economy shedding 14K jobs with the Unemployment rate jumping to 3.7%.

What to Watch

The economic calendar is light today, with only US jobless claims and the Philadelphia Fed business index data scheduled for realase. However, even these minor data releases could have a big impact on the markets, given the current volatility.

Investors will be closely watching the data to see if it provides any clues about the future path of interest rates. If the data is strong, it could lead to further gains for the dollar and Treasury yields. However, if the data is weak, it could lead to a sell-off in risk assets, and a decline in the dollar.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.