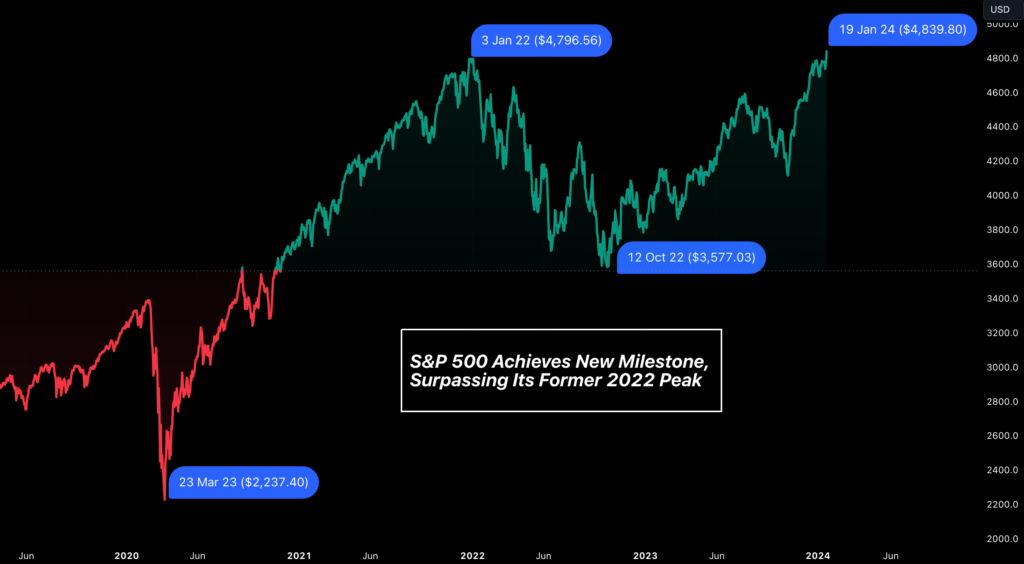

In a remarkable demonstration of resilience, global stock markets soared to new heights, defying geopolitical uncertainties and mixed economic signals. The S&P 500 surged to a record-breaking close, leaping 1.23% to reach an unprecedented 4,839.81, eclipsing its previous peak set in early 2022. Concurrently, the tech-heavy Nasdaq Composite amplified this sentiment, advancing 1.70% to solidify its position above previous records. This bullish momentum is a clear testament to the burgeoning investor confidence, catalysed by a blend of favourable corporate earnings and optimistic consumer data, signalling a robust commencement to the trading year of 2024.

Key Takeaways:

- Nasdaq Composite and Nasdaq-100 Soar: Demonstrating a strong tech sector performance, the Nasdaq Composite advanced to 15,310.97. Similarly, the Nasdaq-100, focused more on technology stocks, gained 1.95%, also reaching a record high, underscoring the tech sector’s significant recovery and investor confidence.

- European Markets Show Mixed Responses: The Stoxx 600 index closed slightly higher, reflecting mixed performances across different sectors. Banking stocks in Europe remained stable, while auto stocks experienced a slight dip.

- Crude Oil Prices Rebound: After a period of decline, crude oil prices witnessed an uptick with West Texas Intermediate (WTI) crude rising to $75 per barrel. This increase is attributed to a decrease in U.S. oil inventories and sustained demand expectations.

- U.S. Job Market Remains Robust: Recent data indicating a lower-than-expected rise in jobless claims at 190,000 and strong private payroll numbers added to investor confidence, hinting at a resilient U.S. labour market.

- Strong Investor Interest in New Bitcoin ETFs: The newly launched U.S. bitcoin exchange-traded funds (ETFs) have drawn extraordinary investor interest, evidenced by an inflow of $1.9 billion into nine new funds in just three days of trading. Leading this surge are BlackRock’s Bitcoin ETF, which has surpassed the $1 billion threshold in investor inflows, and Fidelity’s Bitcoin ETF, closely following with about $880 million in assets.

FX Today:

- EUR/USD Sees Fluctuations Amidst Policy Speculations: The EUR/USD pair experienced volatility this week, with notable movements around the 1.0850 support level, influenced by the European Central Bank’s monetary policy decisions and market reactions to inflation data. The pair remains closely watched, with resistance seen around 1.0950 and support at 1.0787.

- GBP/USD Stuck in a Range Amid Mixed Economic Signals: The British Pound, trading against the US Dollar, remained largely range-bound. Current market dynamics suggest that the pair might continue to oscillate between the 1.26007 low and the 1.28288 high, with key support at 1.2600 and resistance near 1.27600. The Bank of England’s upcoming policy decisions and economic releases from the US are likely to influence its trajectory.

- AUD/USD Gains on Positive Sentiment: The Australian Dollar saw a bullish movement against the US Dollar, registering a gain of 0.34%, notably breaching the 200-day moving average at 0.6579. This upturn suggests a positive market mood, countering the impacts of a weak housing market report. The next resistance is eyed at 0.6600, with the pair maintaining a neutral to bullish outlook.

- USD/JPY Reacts to Japanese Inflation Data: The USD/JPY pair remained mostly unchanged, with the Yen weakening against the Dollar. This movement is partly attributed to Japan’s latest inflation data, which showed a slowdown to 2.6% in December, the lowest since June 2022. The 10-year JGB bond yield’s rise to a 1-month high of 0.673% also played a role in the currency’s performance.

- USD/CAD Faces Resistance: The USD/CAD pair has seen a sharp rally since late 2023, but faced resistance near the 1.3540 mark. The pair’s short-term outlook remains positive as long as it stays above the 200-day SMA at 1.3475. A breach of this level might signal a pullback, while a successful move above 1.3540 could pave the way for further gains.

- Precious Metals Influence Forex Market: The forex market also reacted to movements in precious metals, with gold closing higher by 0.38% and silver settling lower. These fluctuations, influenced by a weaker dollar and geopolitical risks in the Middle East, have ripple effects on currency valuations, particularly in commodity-linked economies.

Market Movers:

- Nvidia’s Remarkable Surge: Nvidia (NVDA) witnessed an extraordinary rise of nearly 20% in the first 13 trading days of 2024, with a week’s gain of almost 8%. The stock hit a record high of $591.99, up 19.5% from its 2023 close. This performance is aligned with strong investor interest in AI technology and semiconductor sectors.

- Semiconductor Stocks Lead Gains: Semiconductor stocks showed remarkable growth, with Advanced Micro Devices (AMD) leading the pack, closing up more than 7%. Broadcom (AVGO) and Lam Research (LRCX) also saw significant gains, each closing up more than 5%. The rally in chip stocks comes after Taiwan Semiconductor Manufacturing Co (TSMC) predicted a return to solid growth this quarter.

- Travelers Companies’ Earnings Beat: Travelers (TRV) closed up over 6% following a robust earnings report, with Q4 net premiums written reaching $9.99 billion, surpassing the $9.93 billion consensus. This surge reflects the positive market reaction to the company’s financial health.

- Texas Instruments Upgraded: Texas Instruments (TXN) closed up more than 4% after an upgrade from UBS, which raised the stock to buy from neutral with a price target of $195. The upgrade is a testament to the company’s strong market position and potential for growth.

- Truist Financial Sees Target Price Increase: Truist Financial (TFC) closed up more than 4% as analysts raised their price targets on the stock by an average of 17% following its quarterly earnings results. This increase indicates growing confidence in the financial institution’s future performance.

- Health Insurance Stocks Under Pressure: Health insurance stocks faced a downturn, with Molina Healthcare (MOH) leading the decline in the S&P 500, closing down more than 4%. Humana (HUM) and Centene (CNC) also saw declines of more than 2%. This trend reflects concerns over the sector’s future earnings outlook.

- Airlines React to Geopolitical Tensions: Delta Air Lines (DAL) closed down more than 2% following the announcement of flight cancellations to Tel Aviv through April. United Airlines Holdings (UAL) and American Airlines Group (AAL) also saw declines, influenced by these geopolitical developments.

- PPG Industries’ Weak Forecast: PPG Industries (PPG) closed down more than 2% after forecasting weaker-than-expected Q1 adjusted EPS, highlighting challenges in the manufacturing sector.

- iRobot Plummets on Acquisition Block: iRobot (IRBT) experienced a sharp decline, closing down more than 25% following reports that the European Union’s antitrust watchdog plans to block Amazon’s planned acquisition, underscoring the impact of regulatory decisions on corporate strategies.

As the curtains close on another eventful trading day, the stock market narrative is one of resilient optimism tempered by cautious pragmatism. The record-breaking rally of the S&P 500 and Nasdaq, alongside the Dow’s steadfast performance, signals a renewed confidence in the economic landscape, driven by technological innovation and robust corporate earnings. Yet, beneath the surface of these gains lies some complexity, with individual stock movements and sector-specific trends painting a picture of a market in constant flux, responsive to the slightest shifts in economic data, policy decisions, and global events. Investors, armed with a blend of hope and vigilance, proceed with strategies reflective of a market that remains ever sensitive to the undercurrents of an evolving global economy.