Today’s major headlines

- Equity futures were mostly higher as treasury yields pulled back from cycle highs.

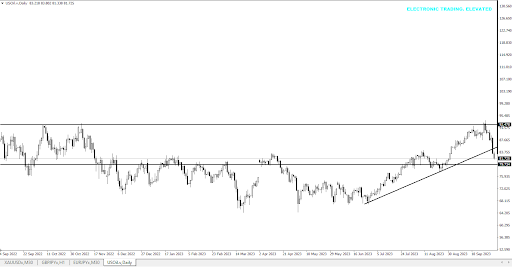

- The US dollar index (DXY) also traded lower as yields pulled back and after yesterday’s mixed ISM Services data.

- WTI crude oil took a tumble and broke below support at $85, but fundamentals remain intact.

Key takeaways

- Equities and risk assets got a lift in Asia-Pacific trading as treasury yields took a breather from recent cycle highs.

- The DXY also traded softer overnight after yesterday’s mixed ISM Services data.

- WTI crude oil has seen a sharp pullback in recent sessions, but the fundamentals remain supportive of upside.

- The main highlight for today will be the US jobless claims data, but markets may ignore the data as attention shifts to tomorrow’s Non-Farm Payrolls (NFP) report.

FX Today

- The AUD is leading the major currencies to the upside as copper attempts a bounce from recent lows.

- The CAD is the weakest of the majors, most likely due to the flush lower in WTI.

Trading strategies

- With yields very close to new cycle highs and the USD having seen 11 weeks of straight gains, the risk-reward of chasing them higher at these levels is not attractive, even if the data comes in better-than-expected.

- The other asset to watch is gold, as a big miss in the data could give gold a decent nudge higher if both the USD and yields pull back a bit.

- The one asset that could be interesting to trade on a really big beat in the claims data is equities, which could see some extension to the downside if the data should surprise meaningfully to the upside.

- If chasing equities on the short side doesn’t look attractive at the time, then we could consider waiting for USDJPY to push into 150 on a very big beat in the US data and then looking for possible signs of more Ministry of Finance (MoF) intervention to try and take advantage of additional downside in JPY pairs.

- Again, since NFP is coming up tomorrow, we are not holding our breath for a big reaction out of the claims data today.

Overall, the market is in a bit of a wait-and-see mode today ahead of tomorrow’s NFP report. If you’re looking to trade today, be careful and keep an eye on the jobless claims data.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.