The stock market retreated on Thursday, with the Dow Jones Industrial Average closing lower by 98 points, or 0.3%, effectively ending its four-day winning streak. This pause in the November rally was primarily led by notable declines in the energy sector, as investors opted for a more cautious stance after a robust start to the month. The S&P 500 and the Nasdaq Composite exhibited minimal changes, indicating a broader market hesitation.

The US labour market is showing signs of gradual cooling. The number of Americans filing new claims for unemployment benefits increased to a three-month high last week. Initial claims for state unemployment benefits rose 13,000 to a seasonally adjusted 231,000 for the week ended November 11, pointing towards a potential easing in the labour market’s tightness. This development is consistent with the broader economic impact of higher interest rates and a moderating pace of economic activity. Continuing jobless claims also increased, reaching levels last seen two years ago, suggesting a growing number of unemployed individuals are experiencing longer spells of joblessness. Despite these trends, the labour market remains fairly tight, with job openings continuing to outnumber the unemployed.

The energy sector faced significant pressure, with Chevron’s shares dropping 2%, indicative of broader challenges within the sector. This downturn was further compounded by a substantial 5% plunge in West Texas Intermediate crude oil prices. In the tech and retail sectors, notable movements were observed. Cisco Systems’ shares tumbled nearly 12% following the company’s announcement of lowered revenue and profit forecasts, signalling a slowdown in demand for its networking equipment. Conversely, Walmart’s stock experienced a 7% decline after the retail giant adjusted its earnings forecast downwards, despite having recently achieved a record high. In contrast, Macy’s provided a bright spot in the retail sector, with its shares jumping 5% after surpassing fiscal third-quarter earnings expectations.

Key Takeaways

- Dow Slips, Ending Winning Streak: The 0.3% drop in the Dow reflects broader market caution, snapping its recent upward trend.

- Energy Sector Leads Decline: Chevron’s 2% drop exemplifies the energy sector’s struggles, coinciding with a significant decrease in crude oil prices.

- Mixed Fortunes in Tech and Retail: Cisco’s 12% fall and Walmart’s 7% decline contrast with Macy’s 5% gain, highlighting varied sectoral impacts.

- European Markets Also Retract: The Stoxx 600’s 0.7% decline mirrors a similar sentiment in European markets, despite individual stock successes like Siemens.

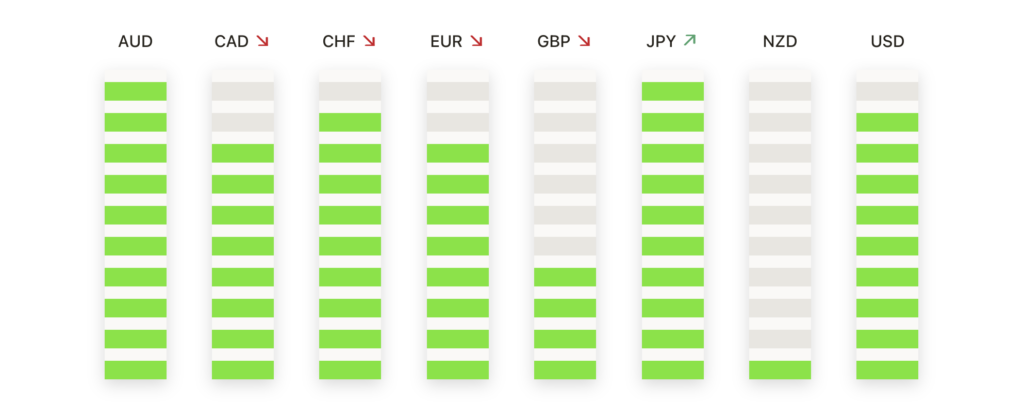

FX Today

- EUR/USD Retreats from 1.0900: The pair reached a high of 1.0896 but fell back, now trading around 1.0850. Key resistance is at 1.0890, with support levels at 1.0840 and 1.0800.

- GBP/USD Maintains Position Above 1.2400: Despite losing some ground, the pound stayed above the 1.2400 mark, facing resistance at the 100-day SMA at 1.2500.

- Commodity Currencies Under Pressure: The Canadian Dollar weakened due to falling oil prices, while the Australian and New Zealand Dollars also saw declines.

Trading Strategies

- Equities: Investors may consider a cautious approach, focusing on sectors less impacted by current market volatility. Technology and consumer staples could offer safer bets.

- Forex: The EUR/USD pair presents an interesting opportunity, with potential resistance near 1.0890. GBP/USD traders should look for buying opportunities above the 1.2400 level.

- Commodities: Gold’s upward trajectory might continue, with significant support at $1,956 and resistance at $1,971. Oil prices, currently under pressure, could offer short-selling opportunities.

This market pause underscores the delicate balance investors are navigating between profit-taking after a strong rally and the ongoing assessment of ecoconomic indicators and corporate earnings. The varied performance across different sectors, from energy to technology and retail, reflects the complex interplay of factors influencing market sentiment. As the month progresses, close attention to these dynamics will be crucial for investors looking to adapt their strategies to the evolving economic landscape.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.