In an unexpected reversal of fortunes, Wall Street grappled with increased volatility on Wednesday, as the bubbly start to 2024 quickly gave way to caution. The trading day was punctuated by a pronounced retreat in technology stocks, leading to the Nasdaq Composite’s notable dip for a second consecutive day. This downtrend was further compounded by the Dow Jones Industrial Average’s substantial fall of nearly 300 points. Amidst this landscape of uncertainty, investors’ focus shifted sharply to the Federal Reserve’s steadfast monetary policy, as revealed in the latest meeting minutes. This revelation, coupled with mixed global market responses and fluctuating treasury yields, represented a market in flux, cautiously navigating the early contours of a new financial year.

Key Takeaways:

- Nasdaq Composite’s Decline: The tech-heavy index fell by 1.2%, marking a continuation of its downward trend and its worst performance since October, significantly impacted by major technology stocks like Apple, which declined by 0.8% following a downgrade by Barclays.

- Dow Jones and S&P 500 Slide: The Dow Jones Industrial Average plummeted by 283 points, translating to a 0.8% decline, while the S&P 500 also retreated, slipping by 0.8%. This movement reflects a broader market uncertainty and investor caution.

- Tech Stocks Under Pressure: Technology stalwarts Nvidia, Tesla, and Meta registered declines, contributing to the Nasdaq’s overall drop. Apple’s additional 0.8% dip post-downgrade further exemplifies the tech sector’s challenges.

- Treasury Yield Fluctuations: The U.S. 10-year Treasury yield briefly spiked above 4%, later stabilising around 3.91%, adding to the market’s nervousness and influencing investor decisions.

- Federal Reserve’s Policy Outlook: The Fed’s meeting minutes indicated a cautious approach, with no immediate plans for rate cuts. This stance has led to a tempering of early-year market optimism and a recalibration of expectations.

- Global Market Reactions: European markets mirrored the U.S. trend, with the Stoxx 600 index falling by 1.0%. Asian-Pacific markets also experienced declines, particularly in technology sectors, impacted by global market dynamics and specific downgrades.

- Oil Price Surge: Amidst geopolitical tensions in the Middle East, WTI crude oil prices witnessed a significant increase of over 3%, reaching $72.84 per barrel. This rise in oil prices influenced various market sectors, notably impacting airline stocks.

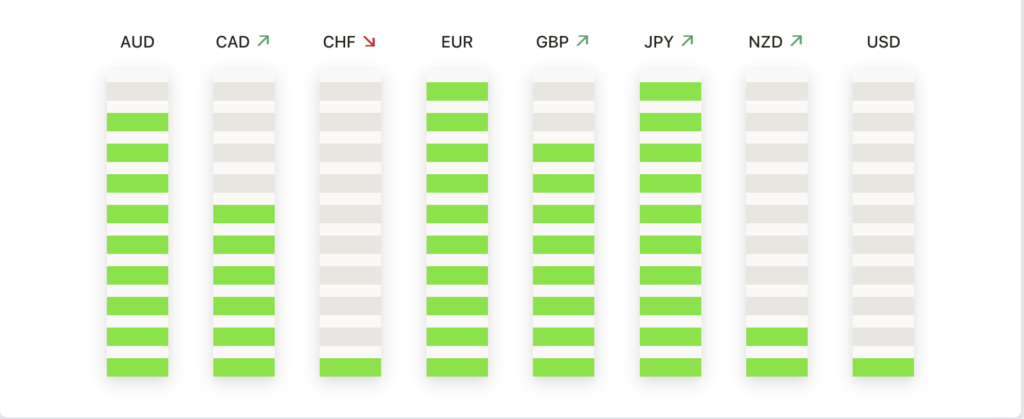

FX Today:

- USD/JPY Hesitates Near 143.75: The USD/JPY pair saw a dynamic session, initially climbing but failing to sustain above 143.75. The yen’s selling pressure eased off after the Federal Reserve’s latest meeting minutes, which seemed to disappoint market expectations for aggressive rate cuts.

- EUR/USD Sinks to Sub-1.0900 Region: The EUR/USD pair experienced a downturn, dipping below the 1.0900 level for the first time since mid-December. This move was influenced by the stronger U.S. Dollar and general weakness in riskier assets.

- GBP/USD Shows Mixed Signals: The GBP/USD pair displayed some resilience, revisiting the upper 1.2600 range. This movement came amid a broader context of three consecutive sessions of losses, highlighting the unique position of the British Pound in the current market environment.

- USD/CAD Advances Amid Canadian Dollar Weakness: The USD/CAD pair climbed to two-week highs, reaching around the 1.3370 zone. This rise was propelled by the weakening Canadian Dollar, which lost ground for the fifth consecutive session, set against a backdrop of broader moves in the commodity sector.

- NZD/JPY Gains Momentum: The NZD/JPY pair showed an uptick, rallying above the 20-day SMA. This movement indicates a shift in momentum, with the pair recovering from recent losses and hinting at potential buying interest despite short-term uncertainties.

- Gold Technical Analysis – Navigating Key Support and Resistance Levels: Gold’s recent trading session saw it dip below pivotal support levels, specifically between $2,050 and $2,045, signalling a bearish outlook in the short term. Should this downward trend persist, the focus shifts to the 50-day simple moving average around $2,010 and further potential supports at $1,990 and $1,975. Conversely, if the market sentiment shifts and buyers regain dominance, gold faces a challenging resistance at $2,045-$2,050. Breaching this could pave the way towards December’s highs, and potentially, with sustained buying momentum, aim for the all-time peak near $2,150.

Market Movers:

- Tech Giants Face Market Challenges: Major technology firms including Nvidia, Tesla, and Meta faced setbacks, with their shares declining on Wednesday. This tech pullback aligns with the broader market trend of moving away from last year’s high-performing tech stocks.

- Charles Schwab (SCHW) and Blackstone (BX) Slip Post-Downgrade: Both Charles Schwab and Blackstone Group experienced declines after Goldman Sachs downgraded these stocks from “buy” to “neutral.” Schwab’s and Blackstone’s slips are reflective of the broader trend in the financial sector, which traded lower overall.

- Airline Stocks Pressured by Rising Fuel Costs: Airline stocks, including Delta Air Lines (DAL) and Southwest Airlines (LUV), faced downward pressure due to the spike in oil prices. The S&P 1500 passenger airlines index notably tumbled in response.

- Eli Lilly (LLY) Emerges as a Top Performer: Eli Lilly saw its shares surge over 4%, leading the gainers in the S&P 500. This uptick came after Bank of America named the stock as its top 2024 pick among large-cap biopharmaceutical companies.

- Notable Declines in Specific Stocks: Aptiv Plc (APTV) and BorgWarner (BWA) both closed down more than 5% after Baird downgraded the stocks to neutral from outperform. Similarly, Walgreens Boots Alliance (WBA) declined over 4%, leading the losers in the Dow Jones Industrial, following Barclays’ initiation of coverage with an underweight rating.

- Tesla (TSLA) Drops Amid Competitive Pressure: Tesla’s shares fell by more than 4% after Q4 sales data showed that China’s BYD Co had overtaken Tesla as the world’s largest seller of electric vehicles.

Conclusion:

As the financial canvas of 2024 begins to unfold, the dynamics observed in Wednesday’s trading session paint a picture of cautious recalibration. The downward trend in major indices, led by significant shifts in the tech sector and influenced by the Federal Reserve’s steadfast monetary stance, reflects an environment of increased vigilance. In addition, the divergent movements in individual stocks and sectors, from energy’s rise against airline stocks’ decline to the pronounced shifts in market heavyweights like Apple and Tesla, underscore the complexity and interdependence of the current market landscape. Investors, now more than ever, are attuned to the intricate back-and-forth of global economic indicators, policy decisions, and corporate performances, navigating a market that remains as unpredictable as it is interconnected.