The financial markets experienced a modest pullback on Monday, signalling a pause in the recent rally as investors took a step back to assess a wide array of economic data and news developments. The major U.S. indexes, including the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, all closed lower on the day, reflecting a cautious stance among market participants. This allowed investors to weigh various factors, ranging from the latest inflation readings to shifting central bank policies, corporate earnings, and geopolitical tensions. As the investment landscape remains dynamic, market participants demonstrated a need to carefully navigate the many forces shaping the financial markets.

Key Takeaways:

- Dow Retreats, Ending Streak of Gains: The Dow Jones Industrial Average reversed its upward trajectory, declining by 0.41%, to settle at 39,313.64. This downturn interrupts the consistent gains that had brought the index closer to the 40,000 mark, showcasing a moment of consolidation in the face of recent market exuberance.

- S&P 500 and Nasdaq Composite Edge Lower: Reflecting a broader market recalibration, the S&P 500 and Nasdaq Composite experienced decreases of 0.31% and 0.27%, closing at 5,218.19 and 16,384.47, respectively. This marks a cautious step back from the record highs achieved last week, amid ongoing evaluations of market fundamentals.

- European Markets Close With Slight Gains: European markets had a hesitant start to the new trading week, showing slight gains amidst a landscape of central bank policy decisions and economic data digestion. The pan-European Stoxx 600 index managed a modest rise, closing up 0.04% after achieving a record high in the previous week. Sector performances varied, with oil and gas stocks leading the gains by rising 0.9%, reflecting a positive sentiment in energy sectors, while media stocks trailed, experiencing a 0.7% decline.

- Asian Markets Experience a Downturn: In contrast to the mixed performances observed in Western markets, Asian markets faced a notable retreat. Japan’s Nikkei 225 closed 1.16% lower at 40,414.12, stepping back from its recent all-time highs, while the Topix index also saw a fall of 1.26% to 2,777.64. Similarly, China’s CSI 300 index ended the day down by 0.54% at 3,525.76, marking its third consecutive day of losses. Hong Kong’s Hang Seng index managed to stay slightly above the flatline, showcasing a resilient but cautious trading atmosphere. South Korea’s Kospi dipped by 0.4% to 2,737.57, albeit coming close to two-year highs earlier in the session.

- EU Probes Tech Giants Under New Regulations: The European Union initiated investigations into Apple, Alphabet, and Meta for potential non-compliance with the Digital Markets Act, signalling tighter regulatory scrutiny on tech giants and their market practices.

- Cryptocurrency Surges; Bitcoin Reclaims $71,000: In a notable shift within digital asset markets, Bitcoin soared by 7%, reaching $71,143.60, with Ether and other cryptocurrencies also posting significant gains climbed to $3,400. This resurgence reflects ongoing investor interest in cryptocurrencies as alternative investment options amid broader market uncertainties.

- New Home Sales Unexpectedly Decline: US new home sales unexpectedly fell 0.3% to a seasonally adjusted annual rate of 662,000 units in February, defying expectations of a rise. This data point suggests potential headwinds in the housing market, a key economic indicator.

- FTX Estate Sells Anthropic Stake for $884 Million: The bankrupt FTX crypto exchange reached a deal to sell the majority of its stake in AI startup Anthropic for $884 million to ATIC Third International Investment Company, a sovereign wealth fund in the United Arab Emirates.

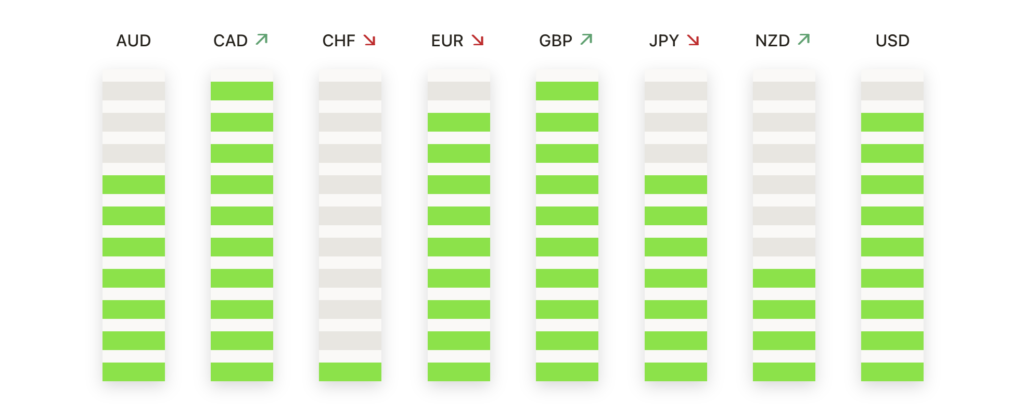

FX Today:

- GBP/USD Eyes Recovery Amid Rate Speculations: The GBP/USD pair is forming a bullish pattern, suggesting potential upside momentum. However, a decisive break above the 50-day moving average of 1.2680 is required to confirm the reversal pattern. Such a move could open the path to 1.2700, with the subsequent target at the March 21 high of 1.2803. Conversely, slipping below the 200-day moving average at 1.2590 could reverse this bullish outlook, potentially extending losses for the pair.

- USD/JPY Hovers Near Key Resistance Levels: The USD/JPY pair has been alternating gains and losses around the 151.50 mark, currently up by 0.06% at 151.40. The pair is eyeing the 2024 peak of 151.86 reached on March 22, with further resistance seen at the 2023 high of 151.90 and the 2022 top at 151.94. A downturn could find initial support at March’s low of 146.47, closely followed by the 200-day SMA at 146.68. Breaking below this level might accelerate declines towards the February low of 145.89 and possibly the December 2023 low of 140.24.

- USD/CAD Seeks Direction in a Quiet Market: The USD/CAD pair shows a neutral bias, trapped within a resistance zone between 1.3610 and 1.3620, which has consistently capped advances. The current market stance is neutral, with indicators hovering around midlines, and price action unfolding above a bullish 20-day moving average. A push through the resistance could signal a move towards 1.3700, while a break below 1.3550 may tilt risks downward, potentially leading to a retest of the 1.3500 threshold.

- Gold Advances on Rate Cut Expectations: Amid a rising yield environment, gold prices gained traction, underpinned by market anticipation of potential interest rate cuts by the U.S. Federal Reserve. Spot gold rose by 0.5% to $2,174.51 per ounce, while U.S. gold futures saw a 0.8% increase to settle at $2,176.4.

Market Movers:

- Boeing Sees Lift Amid Leadership Changes: Boeing shares ticked up by 1.3% as the company announced CEO would step down at the end of 2024. The news of leadership transition brings fresh perspectives on the company’s future direction and potential strategy shifts, resonating positively with investors.

- Intel Faces Downward Pressure: Shares of Intel fell by 1% after reports emerged of China’s new guidelines, which could potentially restrict the use of Intel chips in government servers. The move casts a shadow over Intel’s market positioning in one of its significant markets, stirring concerns among investors about future revenue and market share.

- United Airlines Navigates Turbulence: United Airlines saw a notable decline of 4% following the Federal Aviation Administration’s announcement of increased scrutiny over the airline due to recent safety incidents. This heightened regulatory attention raises questions about operational impacts and potential costs associated with addressing these concerns.

- Masimo Gains on Spinoff News: Shares of Masimo climbed 3.3% after the announcement that its board of directors is exploring a spinoff of its consumer business. The strategic move to possibly separate its consumer segment has been well-received, highlighting the potential for unlocking value and focusing on core business strengths.

- Super Micro Computer Surges on Positive Analyst Coverage: Super Micro Computer experienced a near 8% jump following JPMorgan’s initiation of coverage with an overweight rating and a price target of $1,150. This bullish outlook, based on an approximately 18% potential upside.

- Cleveland-Cliffs Advances on Government Funding News: The steel producer’s stock rose by 1% after securing award negotiations for up to $575 million in funding from the Department of Energy for decarbonization projects.

- Semiconductor Sector Shows Mixed Signals: Despite the broader market’s downward trend, semiconductor stocks like Micron Technology and Nvidia saw gains of 6.2% and 1%, respectively, while the VanEck Semiconductor ETF (SMH) slightly declined by 0.2%.

- Disney Climbs on Analyst Upgrade: Shares of Disney increased by more than 3% following an upgrade to overweight by Barclays, which cited potential for further growth. Additionally, ongoing attention from activist investor Nelson Peltz adds a layer of intrigue regarding the company’s strategic direction and governance.

- Foot Locker Jumps on Upgrade and Turnaround Prospects: Foot Locker’s shares surged 6.1% after an upgrade to outperform by Evercore, driven by optimism surrounding the company’s reinvestment and turnaround efforts.

- Rivian Dips Amid Analyst Downgrade: Rivian’s stock fell by 1.4% following a downgrade to neutral, amidst broader challenges facing the electric vehicle market. This adjustment reflects shifting perceptions of Rivian’s market position and future growth prospects in a highly competitive sector.

- GameStop Rallies Ahead of Earnings: GameStop’s shares soared by 15% in anticipation of its fourth-quarter earnings report, buoyed by expectations of cost discipline and a shift towards higher-margin products. This pre-earnings excitement underscores the ongoing interest in GameStop’s operational strategies and market positioning.

The financial markets paused in this recent rally, with investors taking a step back to assess economic data and news developments. From shifting central bank policies to corporate earnings and geopolitical tensions, the investment landscape remains dynamic. With key players in the tech sector facing regulatory challenges and the commodities market responding to geopolitical tensions, the path forward for investors will likely hinge on adaptability, strategic foresight, and a keen eye on both immediate developments and longer-term economic cues. While the pullback in major indexes signals a cautious sentiment, the resilience of certain sectors and the continued appetite for innovative technologies like AI show the market’s adaptability and ongoing search for growth opportunities.