Wall Street’s main indexes concluded an impressive session with considerable gains, inspired by investor confidence that the U.S. Federal Reserve might be concluding its rate-hiking cycle. The markets were further lifted by a succession of strong quarterly earnings reports that reinforced a bullish sentiment.

Key Takeaways

- Market Performance: The S&P 500 escalated by 1.90%, signalling a robust rebound. Similarly, the Dow Jones Industrial Average soared by 550 points, its most substantial leap since June. The Nasdaq Composite wasn’t left behind, climbing 1.79%.

- Federal Reserve’s Impact: The Fed’s decision to hold interest rates steady, along with Chair Jerome Powell’s comments, was perceived as a softening in their tightening policy, which in turn spurred the equity markets as bond yields dipped.

- Corporate Earnings: Wall Street has adjusted its fourth-quarter earnings growth forecast to 7.2%, down from 11% but the outlook remains optimistic as 80.9% of reporting companies have exceeded analysts’ expectations.

- Global Indexes Echo Gains: European indexes resonated with Wall Street’s optimism, with Spain’s IBEX35 up by 2.04% and Portugal’s PSI INDEX increasing by 1.19%.

- Apple’s Resilience: Apple Inc. beat earnings estimates with an EPS of $1.46, surpassing the $1.39 consensus. Their iPhone revenue matched expectations at $43.81 billion, anchoring the company’s financial performance despite a general downturn in hardware sales.

Bank of England Holds Rates

Adding to the global economic narrative, the Bank of England’s decision to maintain interest rates at a 15-year high of 5.25% has captured market attention. Despite inflation rates easing, the Monetary Policy Committee’s commitment to vigilance suggests a cautious approach to rate adjustments in the near term. The decision reflects a broader hesitation among central banks to navigate away from the inflation battle too swiftly.

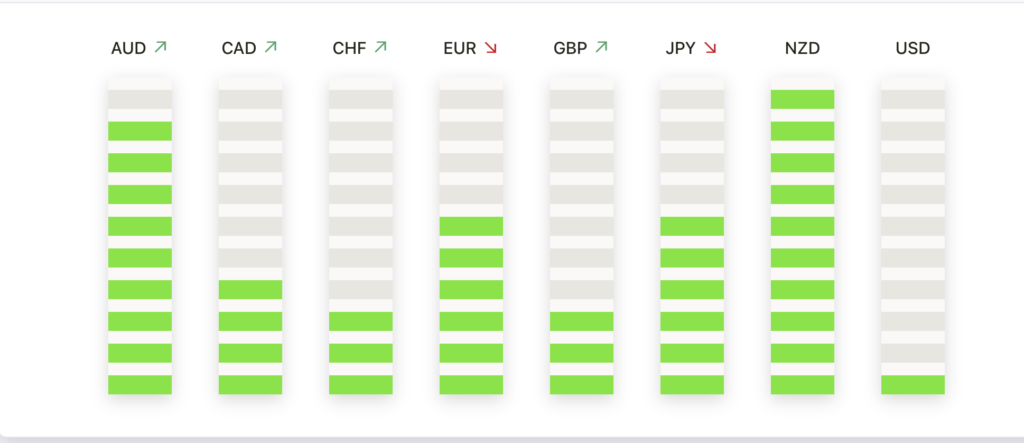

FX Today

- Dollar Retreats: In the forex market, the dollar index retreated to 105.81, before stabilizing at 106.17, which represented a 0.67% decrease. This downturn was mirrored across several pairs, with GBP/USD rising by 0.48% in the wake of the Bank of England’s rate decision.

- USD/CAD Technical Analysis: The USD/CAD pair showcased a downtrend, influenced by a weakening dollar and speculative bets on the Fed’s rate cut plans. Notably, the 20-day MA around 1.3720 offered immediate support, with a further safety net near the 1.3650 threshold.

Trading Strategies

- Index Watch: Traders should employ a nuanced approach when observing index movements. Given the S&P 500’s surge, setting targets and stops around its resistance at 4,317.77 and support levels could be advantageous. The Dow’s 550-point jump to 33,840.62 underscores the need for dynamic positioning as markets may quickly adjust to new economic data.

- Forex Fluctuations: Forex traders may find opportunities in the volatility spurred by central bank decisions. Following the Bank of England’s rate hold, trading pairs like GBP/USD, which saw a 0.48% increase, could be ripe for strategic entries and exits, especially around key psychological levels and economic announcements.

- Commodity and Currency Correlations: With the USD/CAD pair trending downwards and resting near the 20-day MA of 1.3720, traders could capitalize on breaks or bounces from this moving average, considering the Canadian dollar’s sensitivity to oil price movements. Observing these correlations can lead to informed trades that align with broader market trends.

- Earnings-Driven Trades: In light of Apple’s earnings, traders might look to engage in trades that capitalize on the subsequent market reactions. Considering Apple’s iPhone revenue hit the expected $43.81 billion mark, assessing the company’s stock performance post-earnings release could reveal patterns for short-term trades or longer-term investment decisions.

- Sentiment Analysis: The EUR/USD sentiment data showing a majority long position could indicate a tempting opportunity. Should market sentiment persist, watching for the resistance levels of 1.0694, 1.0810 and 1.1275 might offer a strategic entry point for those looking to capitalise on such changes.

In summary, Wall Street’s surge on the back of rate peak bets and earnings enthusiasm is being mirrored in global financial markets. With central banks like the Federal Reserve and the Bank of England making pivotal decisions, the interconnection of market reactions highlights the importance of a multi-faceted, informed trading strategy. Investors must remain vigilant and adaptive to the nuanced shifts in the economic landscape as policy shifts, corporate performance, and commodity prices continue to drive market sentiment.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.