With a large amount of economic data and robust earnings reports, Wall Street capped off its best week since November, with significant rallies in the S&P 500 and Nasdaq Composite driven by stellar performances in big tech stocks. The S&P 500 ascended by 1.02% to a notable close at 5,099.96, while the Nasdaq surged 2.03%, securing its strongest daily gain since February. Investors rode a wave of optimism caused by impressive earnings from tech giants Alphabet and Microsoft, alongside a keen analysis of the latest US inflation data which suggested persistent yet manageable price pressures. These factors not only boosted market confidence but also hinted at potential strategic shifts as the Federal Reserve eyes its next moves.

Key Takeaways:

- S&P 500 and Nasdaq Composite Score Best Week Since November: The S&P 500 advanced significantly, posting a gain of 2.7% over the week, effectively breaking a three-week losing streak. The Nasdaq Composite outpaced with a robust 4.2% increase, marking its first positive week in the last five. The Dow Jones also saw an uplift, rising 0.7% to close the week.

- European Markets Rally on Corporate Optimism: European stocks made notable gains, with the pan-European Stoxx 600 index rising by 1.2%, showcasing broad-based positivity across sectors. Leading the surge were construction and material stocks, which jumped approximately 2.1%, signalling strong sectoral momentum. The FTSE 100 in the UK ended the week with a significant increase of 3.09%, closing at 8,139.83, driven by robust corporate releases and investor sentiment.

- Asian Markets Experience Mixed Results with Strong Gains in Hong Kong and Japan: Asian markets displayed varied performance, with Japan’s Nikkei 225 advancing 0.81% to close at 37,934.76, and the broader Topix index also up by 0.86%. Hong Kong’s Hang Seng index led the gains, rising by 2.12%, while China’s CSI 300 index also showed strength, climbing 1.53% to close at 3,584.27. Conversely, Australia’s S&P/ASX 200 index moved in the opposite direction, dropping 1.39% to close at 7,575.9, largely affected by declines in industrial and health services stocks.

- Inflation Measures Exceed Expectations: The core personal consumption expenditures (PCE) index, a key inflation gauge monitored by the Federal Reserve, rose 2.8% year-over-year in March, slightly above the anticipated 2.7%. Overall, including food and energy, the PCE index also increased by 2.7%, topping expectations of 2.6%.

- Consumer Spending and Income on the Rise: March saw a notable increase in personal spending, which rose by 0.8%, surpassing the forecasted 0.7%. Personal income also saw an uptick, increasing by 0.5% and outperforming February’s 0.3% growth.

- Oil Prices Rebound Amid Geopolitical Tensions: US West Texas Intermediate crude futures climbed to $83.85 a barrel, up 0.34%, while Brent crude futures rose to $89.50 a barrel, marking a 0.55% increase. This rebound ends a two-week losing streak, fuelled by ongoing tensions in the Middle East.

FX Today:

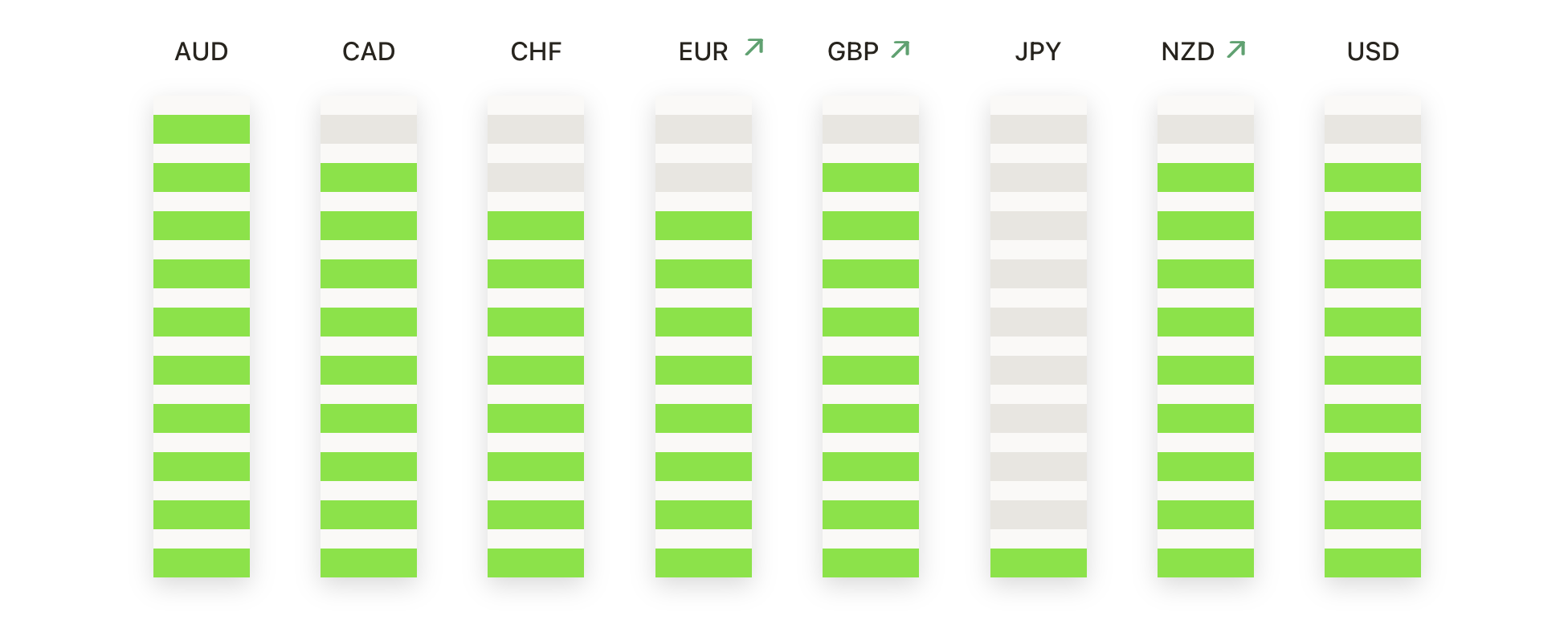

- EUR/USD Sees Volatile Trading: The Euro experienced a rollercoaster day against the US dollar, initially rising to touch a high of 1.0750, only to reverse quickly and dip back down to 1.0710. The pair continues to navigate close to the 1.0700 support level, pulled by shifting expectations surrounding US and EU monetary policies.

- EUR/GBP Adjusts After Hitting Highs: The EUR/GBP pair underwent a sharp decline after reaching a multi-month high of 0.8645 earlier in the week. The subsequent sell-off brought the pair into a neutral stance according to the Commodity Channel Index (CCI), with a potential retest of the 0.8550 support if it breaks below the 50-day simple moving average (SMA).

- GBP/USD Struggles to Maintain Gains: The GBP/USD pair ended the day around 1.2480, showcasing a failure to break past the 200-day moving average at 1.2557 despite closing three consecutive days with gains. This pattern suggests a potential continuation of the downward trend, with the next support level at 1.2400.

- USD/CAD Faces Bearish Pressure: The USD/CAD pair fluctuated between 1.3700 and 1.3660, indicating a possible extension into bearish territory. The pair remains above the 200-day Exponential Moving Average (EMA) at 1.3527, but it continues to face downward pressure from the recent topside miss in US inflation data.

- USD/JPY Breaks Historical High: The USD/JPY pair cleared the June 1990 high of 155.80, pushing further into overbought territory with a Relative Strength Index (RSI) above 70. This move sets the stage for a potential test of higher resistance levels, drawing closer to the 159.20 mark from May 1990.

- EUR/JPY Confronts Overbought Risks: The EUR/JPY pair is hovering around 169.00, facing overbought conditions with an RSI nearing 76.00. Despite this, the strong uptrend could push the pair towards the July 2008 high of 169.97, testing major resistance levels.

- Gold Maintains Strength Amid Inflation Concerns: Despite a challenging week, spot gold held firm, closing at $2,339.70 per ounce, up 0.3%. The precious metal demonstrated resilience as US inflation data confirmed ongoing price pressures, aligning with forecasts. US gold futures also saw an uptick, rising 0.4% to settle at $2,351.60.

Market Movers:

- Microsoft Shows Strength in Cloud: Microsoft’s shares increased by 1.8% after the company reported favourable fiscal third-quarter results. The tech giant’s performance was particularly boosted by significant growth in its Azure cloud services, reflecting the ongoing strength in the tech sector.

- Alphabet Inc. Celebrates Record Day: Alphabet, the parent company of Google, saw its stock soar by 10.2% following first-quarter earnings that surpassed analysts’ expectations. This marked its best day since July 2015, fuelled by robust earnings of $1.89 per share against a forecast of $1.51 per share, with revenue hitting $80.54 billion versus the expected $78.59 billion.

- Intel Faces Challenges: Intel’s shares fell sharply by 9.2% after the chipmaker issued a weaker-than-expected forecast for the current quarter. The company anticipates revenue to be between $12.5 billion and $13.5 billion, below the analyst consensus of $13.6 billion.

- ResMed Surges on Strong Earnings: Shares of ResMed climbed 18.9% after the medical device company exceeded analysts’ expectations for its fiscal third quarter. It reported earnings of $2.13 per share on revenue of $1.20 billion, surpassing the forecasted $1.93 per share on $1.17 billion.

- Snap Inc. Defies Expectations: Snap’s stock price jumped 27.6% after the social media company reported adjusted earnings and revenue that outperformed analyst forecasts. The company’s revenue grew 21% quarter-over-quarter, driven by a resurgence in its digital advertising business.

- Skechers Steps Up: Skechers USA Inc. experienced a rally of approximately 16% following a strong quarterly report that exceeded top and bottom line expectations. The company posted earnings of $1.33 per share and revenue of $2.25 billion, ahead of expectations of $1.10 per share and $2.2 billion in revenue.

- Charter Communications Dips: Shares of Charter Communications slipped by 1.7% due to disappointing first-quarter results. The broadband and cable provider reported earnings of $7.55 per share on revenue of $13.68 billion, missing the anticipated $7.92 per share and $13.74 billion in revenue.

- Exxon Mobil Underperforms Amid Earnings Miss: Exxon Mobil’s stock declined more than 2% after its first-quarter adjusted earnings missed analyst forecasts. The energy giant reported earnings of $2.06 per share, excluding certain items, below the consensus estimate of $2.20 per share, though its revenue of $83.08 billion exceeded expectations.

- Roku Faces Challenges: Roku’s shares declined by 10.3% following its first-quarter earnings report. Although revenue surpassed expectations, the company warned of challenging year-over-year growth comparisons in its streaming service distribution activities, impacted by previous price hikes and a shift toward ad-supported models.

Wall Street wrapped up a momentous week marked by significant stock gains and persistent inflation pressures. The performance of major indices, particularly the S&P 500 and Nasdaq, shows a resilient optimism driven by strong earnings from tech giants and a complex yet stable economic backdrop. Despite the challenges posed by inflation, which remains above the Federal Reserve’s target, corporate America’s robust results and strategic manoeuvres, such as Alphabet’s historic dividend initiation and buyback, offer stability. As investors turn their focus to the upcoming decisions from the Federal Reserve and earnings from other tech giants, the market’s mood hints at the potential for continued growth despite economic uncertainties.