In a vibrant display of market resilience, Wall Street soared to new heights on Tuesday, marking a significant shift in investor sentiment. The trading day was characterised by a keen focus on fresh inflation data and anticipatory moves ahead of the Federal Reserve’s policy announcement. The S&P 500 reached a peak not seen since January 2022, while the Dow Jones Industrial Average and the Nasdaq Composite rallied to intraday highs, reflecting a year’s worth of investor confidence and market recalibration. This surge in major indices, set against a backdrop of aligning inflation rates and economic forecasts, paints a picture of a market balancing on the brink of optimism and cautious expectation, eagerly awaiting the Fed’s next move in the intricate dance of monetary policy.

Key Takeaways:

- S&P 500 Achieves Milestone: The S&P 500 index ascended by 0.3%, reaching its highest level since January 2022, underscoring robust recovery and growing investor confidence.

- Dow Jones and Nasdaq Follow Suit: The Dow Jones increased by 158 points (0.4%), and the Nasdaq gained 0.6%, both reaching their highest intraday levels in over a year.

- Inflation Data Fuels Market Optimism: November’s CPI rose 3.1% year-over-year, meeting economist forecasts and suggesting a stable economic environment.

- Tech and Energy Sectors Show Divergent Trends: Oracle’s shares plummeted by over 12%, whereas the broader tech sector demonstrated resilience. Energy stocks lagged behind, influenced by a drop in crude oil prices.

- Global Markets Respond to U.S. Trends: European markets closed slightly lower, reflecting a cautious response to U.S. inflation data and the upcoming Federal Reserve meeting.

- U.S. Crude Oil Prices Decline: WTI crude oil prices fell by nearly 4%, underlining concerns over inflation and its impact on future demand.

- Stock Market on a Winning Streak: The major indices are on consecutive gains, with the S&P 500 surging more than 12% in a six-week period.

- Nasdaq 100 Changes: DoorDash (DASH), MongoDB (MDB), and Splunk (SPLK) are set to join the Nasdaq 100 index, while Zoom Video Communications (ZM), Enphase Energy (ENPH), and eBay (EBAY) are among those exiting. These changes, part of an annual rebalancing, indicate significant shifts in market valuation and sector representation.

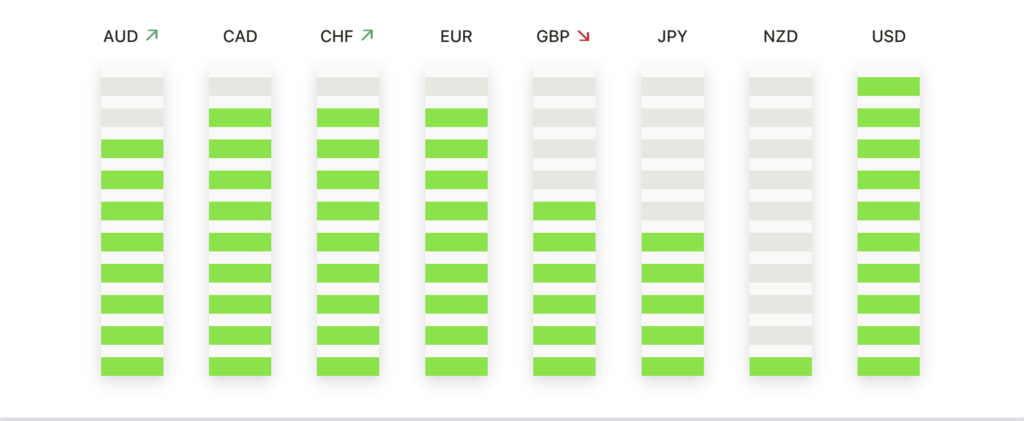

FX Today:

- USD Stabilizes Amid Inflation Data: The U.S. Dollar experienced mixed responses following the release of the consumer price index data. The Dollar Index (DXY) showed modest fluctuations, facing resistance around the 104.30 zone. Despite the slight movements, the overall performance of the USD remained steady, supported by the 10-year Treasury yields which shifted slightly from 4.23% to 4.20%.

- EUR/USD Sees Momentary Upswing: The EUR/USD pair witnessed a brief rise, testing levels above 1.0800. However, the pair failed to maintain its strength above this threshold. The short-term outlook suggests a potential upside, but the sentiment remains cautious ahead of the upcoming European Central Bank (ECB) decision on monetary policy.

- GBP/USD Steady Amidst Economic Projections: The GBP/USD pair hovered around the 1.2550 mark, aligning closely with the 20-day Simple Moving Average (SMA). Upcoming UK economic reports, including gross domestic product growth and industrial production data, along with the Bank of England’s monetary policy announcement, are expected to influence the pair’s movement.

- USD/JPY Experiences Slight Fluctuations: The USD/JPY pair showed a decrease but managed to cut losses after the U.S. CPI data release, stabilising above 145.50. The market’s focus is now on Japan’s Tankan survey, with expectations of mixed outcomes that could impact the pair’s future direction.

- Antipodean Currencies Respond to Global Sentiments: Both the NZD/USD and AUD/USD pairs reflected reactions to broader market sentiments. The NZD/USD maintained its position above key moving averages, staying around the 0.6100 zone, while the AUD/USD showed modest declines, retracting to levels below 0.6550 despite earlier gains.

- Oil’s Recent Price Dynamics: WTI crude oil prices saw a significant drop, falling more than 3.50% and posting the lowest close since June, dropping below $69.00 per barrel. This decline is a reflection of concerns over inflation and its potential impact on future demand. Resistance for WTI could be around the $72.00 to $73.00 range, while key support might be found near the $68.00 level. A break below this support could indicate further bearish momentum.

- Gold (XAU/USD): Gold prices experienced a spike to $1,996 following the U.S. inflation data but faced selling pressure, pulling back to around the $1,980 zone. This indicates a volatile response to the market’s readjustment to economic data. Immediate resistance for Gold lies around the $2,000 mark. Further resistance might be seen at $2,007 and $2,025. On the downside, support could be found at $1,968 (near the 50-day MA), followed by the psychologically significant $1,950 level and then $1,941. These levels are crucial for determining Gold’s short-term direction.

Market Movers:

- Johnson Controls (JCI): Fell 5.97% following weaker-than-expected 2024 EPS forecast.

- Moderna (MRNA): Dropped 4.60% after CEO Bancel’s announcement.

- Lucid Group (LCID): Tumbled 8.24% after CFO House’s resignation.

- Macy’s (M): Declined 8.06% following a downgrade by Citigroup.

- Seagen (SGEN): Rallied 3.55% on news of Pfizer’s acquisition approval.

- Take-Two Interactive (TTWO): Climbed 3.29% after an outperform rating by Wolfe Research.

- A O Smith (AOS): Rose 2.09% after an upgrade from Northcoast Research.

- Icosavax (ICVX): Surged 50% following AstraZeneca’s acquisition announcement.

- Zillow Group (ZG): Increased 3.90% after an upgrade by JMP Securities.

Conclusion:

As the financial year nears its close, Tuesday’s market performance, marked by the S&P 500’s notable rise to its highest level since early 2022, encapsulates excitement among investors. It should be kept in mind that the market is recalibrating amidst global economic uncertainties, particularly in light of the inflation data aligning with expectations. With the investment community’s focus now shifting to the upcoming Federal Reserve policy announcement, the market stands at a pivotal juncture. This moment is critical in determining the course for the remainder of the year, as it balances the robust stock market performance against the shifting dynamics in the FX and commodity sectors, underlining the complex, multifaceted nature of global financial markets.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.