In a dynamic twist of economic narratives, the global financial stage witnessed a day steeped in contrasts and complexities. The United Kingdom’s inflation rate, in a startling but welcome descent, tumbled to 3.9% from 4.6%, stirring the cauldron of market speculation and heightening anticipation of Bank of England rate adjustments. This significant deceleration in price growth casts a new light on the UK’s economic panorama, simultaneously aligning it more closely with international trends while underscoring its unique challenges. Amidst this backdrop, stock markets across the globe oscillated, reflecting a combination of investor sentiment, economic data interpretations, and corporate developments. From Wall Street’s retreat ending a winning streak, where the Dow Jones Industrial Average closed more than 470 points lower to snap a 9-day win streak, to Alphabet’s surge to new heights, the day encapsulated the ever-evolving and intricate dance of the financial markets.

Key Takeaways:

- Dramatic UK Inflation Reduction: UK’s inflation experienced a sharp decline to 3.9% in November, down from October’s 4.6%. This significant drop, the lowest since September 2021, beat all forecasts, including a Reuters poll anticipating a 4.4% inflation rate.

- Market Response to BoE Rate Cut Predictions: The market rapidly adjusted to the inflation data, fully pricing in a Bank of England rate cut by May 2024. The probability of a cut by March is now nearly 50%, indicating a major shift in investor expectations.

- GBP and Bond Yield Fluctuations: Following the inflation report, the British Pound fell notably against the U.S. dollar, from $1.271 to $1.266. Concurrently, yields on British government bonds plummeted, signalling a recalibration of market sentiment.

- Stock Market Volatility: The Dow Jones Industrial Average concluded a nine-day rally, dropping 312 points (0.8%). The S&P 500 and Nasdaq Composite also retracted, declining by 1.1% and 1.2% respectively, reflecting a broader market correction.

- Corporate Movements Influencing Indices: FedEx, facing a more than 10% drop after a disappointing revenue outlook, largely influenced the S&P 500’s downturn. In contrast, Alphabet (Google’s parent company) excelled, achieving a new 52-week high with over a 2% gain.

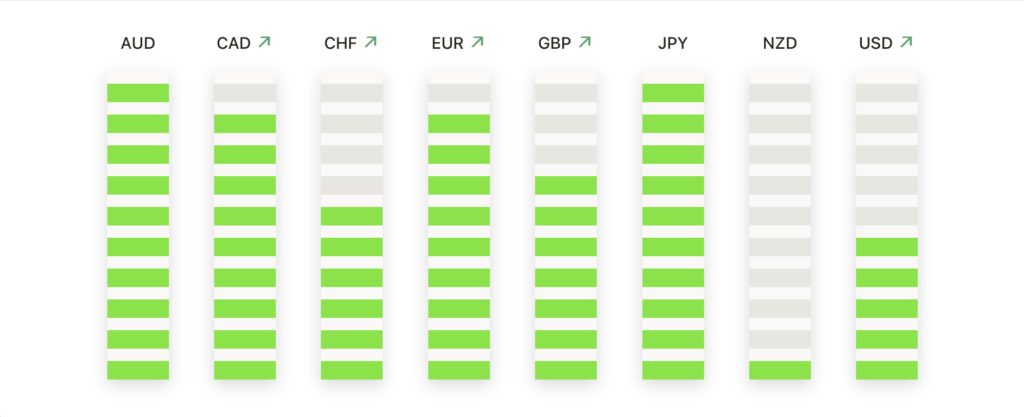

FX Today:

- British Pound Reacts to Inflation News: The pound experienced a notable drop against the U.S. dollar, falling from $1.271 to $1.266, in response to the UK’s inflation rate falling to 3.9% in November from 4.6% in October. This decrease in inflation rate is the lowest since September 2021.

- Euro Under Pressure: The Euro (EUR/USD) declined by 0.37%, influenced by signs of easing price pressures in Europe. This was primarily due to the German November Producer Price Index (PPI) falling more than expected, and the UK November Consumer Price Index (CPI) rising less than anticipated. Despite these pressures, the Euro found some support as the Eurozone December consumer confidence index climbed to a 5-month high.

- Japanese Yen Shows Resilience: The USD/JPY pair saw a minor decrease, closing around 143.70. The Yen gained strength, bolstered by a decrease in T-note yields and a drop in the 10-year Japan Government Bond (JGB) yield to a 4.5 month low of 0.555%, despite signs of strong dollar selling in the market.

- Canadian Dollar Strengthens: The USD/CAD pair hit four-month lows, reaching 1.3310 before rebounding slightly to 1.3350. This movement comes ahead of Canada’s Retail Sales report, which is expected to show a 0.8% increase in October.

- New Zealand Dollar Fluctuations: The New Zealand Dollar (NZD/USD) initially peaked near 0.6300, a five-month high, but later retraced to around 0.6250. Investors are now looking forward to the upcoming Credit Card Spending report from New Zealand for further market direction.

- Dollar Index Sees Uplift: The dollar index increased by 0.3%, finding support from weaker-than-expected inflation reports from Germany and the UK, which impacted European bond yields and weakened the Euro against the Dollar. The dollar’s gains were further amplified by stronger-than-expected U.S. existing home sales and consumer confidence reports.

- Metal Markets’ Divergent Trends: Silver prices initially rose, reaching weekly highs at $24.45, but later lost momentum, falling back to $24.10. Conversely, Gold prices declined, falling below the $2,030 support area. This reflects the diverse responses of metal markets to the current economic environment.

Market Movers:

- Alphabet Inc. (GOOGL) Surges: Leading the S&P 500 and Nasdaq 100, Alphabet soared with a more than 3% gain. This rally was fuelled by a report from the Information news service about Google’s plans to restructure its 30,000-person ad-sales unit due to the rise of automation.

- Transportation Sector Rallies: Trucking stocks witnessed a significant uptick following Bloomberg Intelligence’s positive assessment of freight demand. SAIA Inc (SAIA) jumped more than 4%, Old Dominion Freight Line (ODFL) increased over 3%, JB Hunt Transport Services (JBHT) rose more than 2%, and both Marten Transport (MRTN) and Landstar System (LSTR) saw gains exceeding 1%.

- Energy Sector on the Rise: With WTI crude oil reaching a 2-week high, energy stocks and service providers moved upwards. Notables include Baker Hughes (BKR), Devon Energy (DVN), Diamondback Energy (FANG), Phillips 66 (PSX), Haliburton (HAL), ConocoPhillips (COP), Marathon Petroleum (MPC), and Valero Energy (VLO), each climbing more than 1%.

- Toro Co (TTC) Outperforms: Toro Co reported a remarkable quarter, with its adjusted EPS of 71 cents surpassing the consensus of 56 cents, leading to an over 8% increase in its stock price.

- WW International (WW) Gains on Analyst Optimism: WW International’s stock surged over 6% after Guggenheim Securities initiated coverage with a buy rating and a price target of $14.

- FedEx (FDX) Leads Losses: FedEx led the losers in the S&P 500, plummeting more than 10% after reporting Q2 adjusted EPS of $3.99, falling short of the consensus of $4.19.

- AON Plc (AON) Drops on Acquisition News: AON Plc’s stock declined more than 5% after announcing its agreement to acquire NFP Corp for approximately $13.4 billion in cash and stock.

- General Mills (GIS) and Other Food Makers Fall: General Mills saw a decline of more than 3% after revising its full-year organic net sales forecast. This news also dragged down other food makers, with Campbell Soup (CPB) and Conagra Brands (CAG) falling more than 2%, and both JM Smucker (SJM) and Kraft Heinz (KHC) dropping more than 1%.

- Tech Stocks Zoom Video Communications (ZM) and DocuSign (DOCU) Underperform: Both Zoom Video Communications and DocuSign experienced a downturn, each falling more than 2% following downgrades by Wells Fargo Securities.

Conclusion:

As the financial curtains draw to a close on a day of mixed fortunes and shifting paradigms, the markets leave behind a mosaic of pivotal movements and strategic recalibrations. The significant drop in UK inflation, contrasted with the unexpected twists in stock market performances and corporate developments, underscore the relationship economic indicators and investor sentiment. While Alphabet’s rally and the energy sector’s ascent symbolise resilience and adaptability, the retreats of FedEx and other key players remind us of the ever-present volatility and uncertainty inherent in financial markets. As investors navigate this complex landscape, today’s events serve as a vivid reminder of the relentless dynamism that characterizes the global financial ecosystem.