In a noteworthy shift, global stock markets edged lower, marking a departure from the recent tech-driven highs that had pushed major indices to record levels. The S&P 500 and Nasdaq Composite experienced downturns, as the successful rally in technology stocks began to lose steam. Meanwhile Cryptocurrencies continue to rally on the SEC’s recent move to allow spot bitcoin ETFs. This cooling off comes while investor anticipation grows for the upcoming US consumer price index report, set to provide fresh insights into inflation trends. Notably, the Dow Jones Industrial Average managed a modest gain, signalling a mixed sentiment among investors. As markets brace for pivotal inflation data and Federal Reserve decisions, the landscape is ripe with caution, underscoring the complex relationship between economic indicators and investor expectations.

Key Takeaways:

- S&P 500 and Nasdaq Composite Retreat Amid Cooling Tech Rally: The S&P 500 dipped by 0.11%, and the Nasdaq Composite slid by 0.41%, reflecting a cooling off from the recent tech-fuelled rally. Despite these losses, the Dow Jones Industrial Average opposed the trend with a slight increase of 46.97 points, or 0.12%.

- Technology Sector Witnesses Notable Pullback: Leading tech stocks experienced significant downturns, with Super Micro Computer plummeting over 5% and Nvidia dropping 2%. Meta Platforms also faced a sharp decline, tumbling 4.4%, as investors began to question the sustainability of the AI-driven rally in tech shares.

- European Markets Close Lower Amid Sectoral Losses: The Stoxx 600 index closed down 0.4%, dragged down primarily by a 2.1% loss in technology stocks. However, food and beverage stocks managed a modest gain of 0.3%. Raiffeisen Bank’s shares plummeted by 7.4% amid fears of U.S. sanctions, while Telecom Italia dropped 4.4% following concerns over its post-sale debt levels.

- Asian Markets Led Lower by Japan’s Nikkei Amid Rate Hike Speculations: The Nikkei 225 saw a sharp decline of 2.19% to close at 38,820.49, influenced by Japan’s averted technical recession and consequent rate hike speculations. China’s CPI moved out of deflation territory, recording a 0.7% year-on-year increase, beating expectations and signalling economic shifts in the region.

- Cryptocurrency Market Hits New Heights as Bitcoin and Ether Surge: Bitcoin reached a new record high of $72,750.16, with a 3% increase, while Ether broke through the $4,000 mark for the first time since December 2021. The inflow into US spot bitcoin ETFs and anticipation for Ethereum’s “Dencun” upgrade are pivotal drivers behind the crypto market’s robust performance. Additionally, the Financial Conduct Authority in the UK announced on Monday that it will, for the first time, permit exchanges to list cryptocurrency-linked exchange-traded products.

- Long-Term Inflation Expectations Rise: The New York Fed’s Survey of Consumer Expectations showed an increase in longer-term inflation expectations, with the three-year outlook rising 0.3 percentage points to 2.7%, and the five-year outlook jumping 0.4 percentage points to 2.9%, well above the Fed’s 2% target.

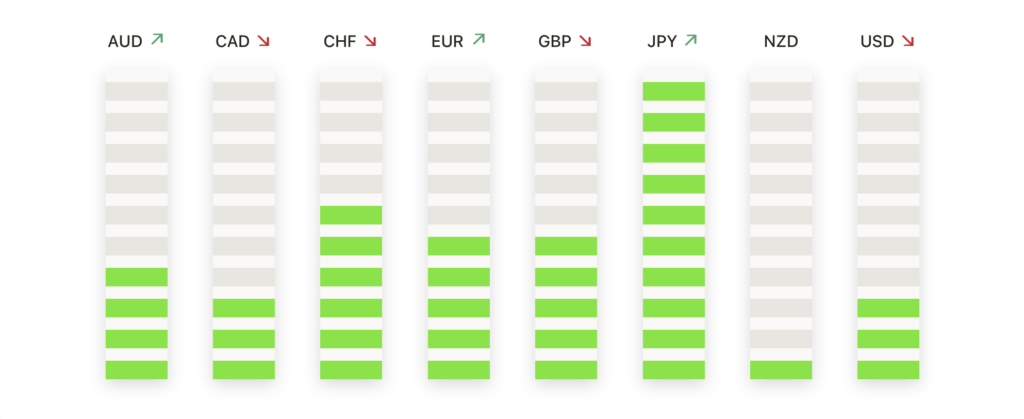

FX Today:

- GBP/USD Finds Near-term Support Amid Pullback: The GBP/USD pair faced a reversal, ending its streak of gains to trade lower on Monday. After failing to sustain levels above the 1.2900 handle, GBP/USD retraced below this resistance, finding a temporary floor at 1.2800. Despite the pullback, the currency pair remains notably above the 200-day Simple Moving Average (SMA) positioned at 1.2586, reflecting a bottom-to-top climb of 3% from the significant low at 1.2518.

- EUR/USD Tests Support After Retracement: The Euro against the US Dollar experienced a mild setback, edging closer to the 1.0900 mark. If the downward momentum persists, support at 1.0890 becomes crucial, with a significant point at 1.0850 where various moving averages converge alongside an upward trendline. A bullish resurgence could lift EUR/USD towards the resistance at 1.0980, potentially unlocking a pathway to 1.1020 and heightening the focus on 1.1075.

- USD/CAD Oscillates Around the 200-day SMA: The USD/CAD pair witnessed fluctuations, finding a late uplift from the 1.3440 zone but encountering resistance near 1.3500, which curtailed its recovery towards the week’s higher vicinity around 1.3600. Amidst this volatility, the pair closely hovers around the 200-day SMA at 1.3477, with a breach below 1.3400 potentially paving the decline towards the lows of late 2023 around 1.3200, whereas a push above the immediate ceiling at 1.3600 looms.

- USD/JPY Retreats to Key Support Amid Broad Dollar Weakness: The USD/JPY pair continued its downward trajectory, gravitating towards a support band between 146.50 and 146.00, shown by the 200-day SMA and the swing low of February. A further downtrend may target the 145.00 benchmark, while any resurgence could face resistance at 147.50, with a breakthrough potentially steering focus towards the 148.90 and 149.70 levels, up to 150.90.

- Gold Holds Steady as Traders Await US CPI Data: Gold’s recent rally towards the $2,180.00 mark has paused, with the precious metal’s momentum appearing stretched despite the Relative Strength Index (RSI) indicating overbought conditions above 80. Nevertheless, the upward slope of the RSI suggests sustained buying interest. A push above the all-time high at $2,195.15 could lead to gold challenging the $2,200.00 threshold. Conversely, a retreat below the early March low of $2,154.17 may initiate a decline towards the $2,150.00 level, with further supports at $2,100.00, the late December high of $2,088.48, and the early February peak at $2,065.60.

Market Movers:

- Nvidia and Chip Stocks Among Nasdaq’s Largest Losers: Nvidia (NVDA) experienced a further decline of 1.98%, adding to the previous session’s sell-off of 5.47%, despite an initial surge of more than 17% over six sessions. The broader chip sector also faced downturns, with Advanced Micro Devices (AMD) dropping 4.34%, Marvell Technology (MRVL) by 4.06%, Micron Technology (MU) by 3.19%, and Lam Research (LRCX) by 2.66%, highlighting a challenging day for semiconductor stocks.

- Oracle Outperforms Amid Earnings Surprise: Oracle’s shares saw an uptick of over 14% in extended trading following a quarterly earnings report that surpassed Wall Street’s expectations. The company’s strong performance, particularly in its cloud services and license support segment, stands out as a positive note in an otherwise cautious market environment.

- Consumer Goods and Retail Sectors Face Headwinds: British retailer Currys experienced a significant drop of 5.43% after Elliott Investment Management withdrew from the takeover race, highlighting the challenges within the consumer goods and retail sectors, as companies navigate changing market dynamics and investor expectations.

- Boeing Suffers from Legal Concerns: Boeing’s (BA) shares fell 3% following news that the US Justice Department has initiated a criminal investigation into a recent incident involving a midair door blowout on an Alaskan Airlines flight, raising concerns over the company’s immediate future.

- Pharmaceutical Sector Experiences Setback: Eli Lilly’s shares decreased by more than 3%, reflecting broader concerns within the pharmaceutical sector and contributing to the day’s overall market downturn.

- Moderna Leads Nasdaq 100 Following Positive Study News: Moderna (MRNA) emerged as the best-performing stock in the Nasdaq 100, with a significant rise of 8.69%. This surge came on the heels of an announcement about a mid-stage study in collaboration with Merck to test an experimental cancer vaccine, highlighting the potential for significant advancements in medical treatment.

- Tesla Secures a Rebound: Tesla (TSLA) enjoyed a rebound, climbing 1.41% after a period of losses. This movement suggests a sentiment of recovery among investors towards the electric vehicle giant, despite the broader market’s fluctuations.

As the technology-fuelled rally took a breather, investors remained focused on the upcoming inflation data releases, which could provide crucial insights into the Federal Reserve’s monetary policy path. Despite the pullback in major indices, pockets of strength emerged, with cryptocurrencies and select technology stocks defying the broader market trend. However, concerns over persistent inflationary pressures and the potential impact on economic growth continued to linger, underscoring the cautious sentiment prevailing in the markets. As the week unfolds, traders will closely scrutinise the CPI report and other economic indicators for clues on the direction of interest rates and the overall health of the economy.