The Dow Jones Industrial Average and the S&P 500 reached new heights, lifted by a confluence of favourable inflation data and robust performances from technology giants such as Nvidia and Meta Platforms. Tuesday’s trading session closed on an upbeat note, with the Dow climbing 0.61% while the S&P 500 rose 1.12%, reaching a new peak. This rally underscores a growing optimism in the face of the Federal Reserve’s upcoming policy decisions. With Nvidia’s shares leaping over 7% and Oracle’s surprise earnings beat propelling it upwards by more than 11%, the market’s momentum appears extremely strong, catalysed by strategic earnings and a steady economic outlook.

Key Takeaways:

- Dow and S&P 500 Achieve Remarkable Gains Amid Positive Inflation Data: The Dow Jones Industrial Average soared, adding 235.83 points to close at 39,005.49, marking an increase of 0.61%. The S&P 500 followed suit, jumping 1.12% to a new record closing high of 5,175.27, driven by favourable US inflation figures and renewed investor interest in tech.

- Nasdaq Composite Rises, Led by Tech: With a significant boost of 1.54%, the Nasdaq Composite closed at 16,265.64. Leading the charge, Nvidia’s shares surged over 7%, while Microsoft and Meta Platforms saw gains of 2.6% and 3.3%, respectively. Oracle outperformed expectations with an 11% jump following impressive earnings reports.

- Inflation Rates Align With Expectations, Fuelling Market Optimism: February’s consumer price index (CPI) increased by 0.4% month-over-month and 3.2% year-over-year, closely matching forecasts. This alignment has eased concerns over the Federal Reserve’s rate decisions, potentially setting a positive trajectory for market movements.

- Global Markets Respond Positively to US Economic Indicators: European markets ended higher, with the Stoxx 600 index climbing 1% and the FTSE 100 reaching a 10-month peak after the US inflation report. Similarly, in Asia, the Hang Seng index led with a 3% rise, while Japan’s Nikkei 225 experienced a slight decline amid corporate inflation data.

- US Dollar Strengthens and Commodities Markets Show Volatility: The U.S. Dollar Index (DXY) experienced a slight increase to 103.05, amidst hot CPI figures boosting Treasury yields. Meanwhile, crude oil prices encountered resistance, with WTI crude oscillating around the $78 mark, demonstrating the commodities market’s sensitivity to economic forecasts and energy supply concerns.

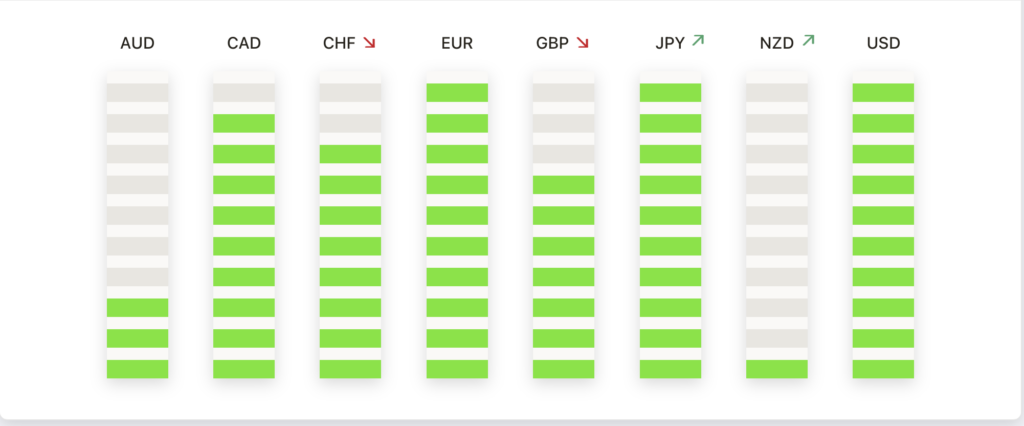

FX Today:

- Euro Shows Resilience Despite Dollar’s Strength: The Euro (EUR/USD) demonstrated slight fluctuations, settling down 0.06% at $1.0919. This movement reflects the market’s assessment of the CPI data’s impact on global exchange rates, with the Euro showing resilience in the face of the Dollar’s strength.

- Yen Weakens Against a Strengthening Dollar: The Japanese Yen (USD/JPY) saw a decline, weakening by 0.5% to 147.67 against the Dollar. This depreciation followed comments from the Bank of Japan’s Governor, which dampened hopes for a departure from its negative rate policy, further influencing the Yen’s performance against the Dollar.

- Sterling Adjusts After UK Wage Growth Data: The British Pound (GBP/USD) fell by 0.16% to $1.279, influenced by data indicating a slight cooling in UK wage growth. This economic indicator has increased speculation regarding the Bank of England’s potential rate cuts, affecting Sterling’s valuation.

- Canadian Dollar Faces Volatility After CPI Report: The Canadian Dollar (USD/CAD) oscillated within the 1.3500 handle, reflecting market reactions to the U.S. CPI data. The currency pair showed resilience, bouncing from 1.3470 and facing resistance at 1.3520, highlighting the ongoing adjustments in currency valuations based on economic forecasts and inflation expectations.

Market Movers:

- Tech Companies Push Nasdaq Higher: Leading the charge in the Nasdaq’s impressive advance, Nvidia (NVDA) saw a significant jump of over 7%, demonstrating the tech sector’s robust strength. Other notable tech movers included Microsoft and Meta Platforms, with gains of 2.6% and 3.3% respectively, bolstering investor confidence in technology stocks amidst favourable market conditions.

- Oracle Outshines with Earnings Beat: Oracle (ORCL) stood out with an 11.88% rally, surpassing Wall Street’s earnings expectations. The surge was attributed to a pronounced increase in demand for its Gen2 AI infrastructure, signalling strong growth prospects for cloud and AI-related services.

- Archer-Daniels-Midland Climbs on Earnings Success: Agricultural giant Archer-Daniels-Midland (ADM) advanced by 4.06%, following the release of its quarterly earnings report. The company not only surpassed earnings expectations but also announced a revision of three years of inter-segment sales, indicating solid operational performance.

- Boeing Faces Headwinds Amid Quality Concerns: Boeing (BA) encountered a downturn, dropping by 4.17%, as investigations into a recent flight incident and ongoing certification delays impacted its stock. The aerospace leader’s challenges highlight the intricate dynamics affecting companies with extensive regulatory and quality control issues.

- Southwest Airlines Takes a Hit from Boeing’s Delays: The ripple effect of Boeing’s difficulties was felt strongly by Southwest Airlines (LUV), which saw its shares plummet by 14.76%. The airline’s decision to adjust its flight schedules and pause new hiring in response to delayed Boeing 737 Max deliveries underscores the interconnected nature of the aerospace and airline industries.

- Cryptocurrency Sector Sees Mixed Movements: Bitcoin briefly touched a new record high before settling down by about 1.6%, breaking a six-day streak of gains. Meanwhile, Coinbase (COIN) managed a slight recovery of 0.89%, and Marathon Digital (MARA) continued its downward trend with a 2.06% decline, illustrating the volatile landscape of the cryptocurrency market.

- 3M Rises on New CEO Announcement: 3M shares saw an increase of 4.97% as the company announced William Brown, former CEO of L3Harris Technologies, as its new CEO effective May 1. This leadership change has sparked positive sentiment among investors, reflecting optimism for strategic growth and innovation under new guidance.

- Asana Declines on Weak Revenue Forecast: Asana’s stock fell by 12.72% following its announcement of lower-than-expected full-year revenue guidance, projecting revenues between $716 million and $722 million, which falls short of the $725 million forecast by analysts. This adjustment has raised concerns over the company’s growth trajectory in the competitive work management platform sector.

- MicroStrategy Climbs Amid Positive Analyst Commentary: Shares of MicroStrategy increased by 7.35% after bullish remarks from Wall Street, with Canaccord Genuity upgrading its price target to $1,810 and highlighting the company’s proactive strategies amidst the bitcoin rally. Similarly, TD Cowen raised its price target to $1,560, maintaining an outperform rating and underscoring investor confidence in MicroStrategy’s market positioning.

- American Airlines Dips on Q1 Guidance Concerns: American Airlines’ stock decreased by 4.71% after issuing first-quarter earnings guidance at the lower end of its expected range, anticipating an adjusted loss of 15 cents to 35 cents per share. Factors such as rising fuel costs have pressured the airline, contributing to investor apprehension regarding its near-term financial health.

- New York Community Bancorp Surges on Equity Investment News: Shares of New York Community Bancorp increased by 5.85% following the closure of a significant equity investment exceeding $1 billion, aimed at bolstering its balance sheet. This financial infusion is viewed positively by the market, reflecting strengthened financial foundations and growth prospects for the regional bank.

As March progresses, the remarkable surge in US stocks, pushed by cooling inflation and revived enthusiasm for AI and technology, has reshaped the market landscape. The Nasdaq’s impressive performance and the S&P 500’s new record high underscore investors’ confidence in the potential of disruptive technologies and their ability to drive economic growth. However, lingering concerns over the federal budget deficit and ongoing challenges faced by Boeing are clear reminders of the complex dynamics at play. As the market navigates these events, the coming days will reveal whether this rally has the momentum to sustain itself, or if a more cautious approach will occur amid the ever-evolving economic landscape.