The S&P 500 and Nasdaq Composite session closed in the red, primarily dragged down by a significant drop in Nvidia’s stock ahead of its highly anticipated earnings report. The Dow Jones Industrial Average slightly dipped, reflecting a cautious stance among investors across the board. Nvidia’s nearly 4.4% fall underscored concerns over its valuation, casting a shadow on the tech sector and influencing declines in other major tech stocks like Amazon and Microsoft. The day also featured major movements in the financial sector, with Capital One’s announcement to acquire Discover Financial Services in a landmark deal capturing investor attention. Additionally, Walmart’s acquisition of Vizio and its earnings beat added some positive notes to the market’s overall performance.

Key Takeaways:

- Broad Market Indicators Show Divergence: The Dow Jones Industrial Average marginally decreased by 0.17%, closing at 38,563.80. In contrast, the S&P 500 and Nasdaq Composite experienced more marked declines, with the S&P 500 dropping 0.60% to 4,975.51, and the Nasdaq falling 0.92% to end the day at 15,630.78, illustrating the tech sector’s significant impact on market sentiment.

- European and Asian Markets Reflect Global Cautiousness: European stocks ended slightly lower, with the Stoxx 600 index down by 0.1%, and Asia-Pacific markets closed mixed. This global cautiousness came amidst ongoing adjustments in investor expectations around the Federal Reserve’s interest rate trajectory, influenced by recent economic data.

- Capital One and Discover Financial Services’ Mega Merger: The financial sector was abuzz with the news of Capital One Financials’ agreement to acquire Discover Financial Services in a massive all-stock deal valued at $35.3 billion. Following the announcement, Capital One’s stock saw a modest increase of 0.1%, while Discover’s shares surged by 12.6%.

- Walmart Surges on Earnings Beat and Acquisition News: Walmart stood out as a notable performer, climbing over 3% after surpassing quarterly earnings and revenue forecasts, driven by robust global e-commerce growth. The retailer’s move to acquire Vizio for $2.3 billion further increased investor sentiment, propelling its shares to a record high.

- Sector-Specific Movements Indicate Varied Investor Sentiment: Mining and tech stocks in Europe faced declines, while chemicals saw an uptick, signalling a diverse investor response to sector-specific dynamics. Meanwhile, significant corporate announcements and economic indicators continue to shape market movements, highlighting the interconnectedness of global financial markets and the influence of macroeconomic factors on investor strategies.

FX Today:

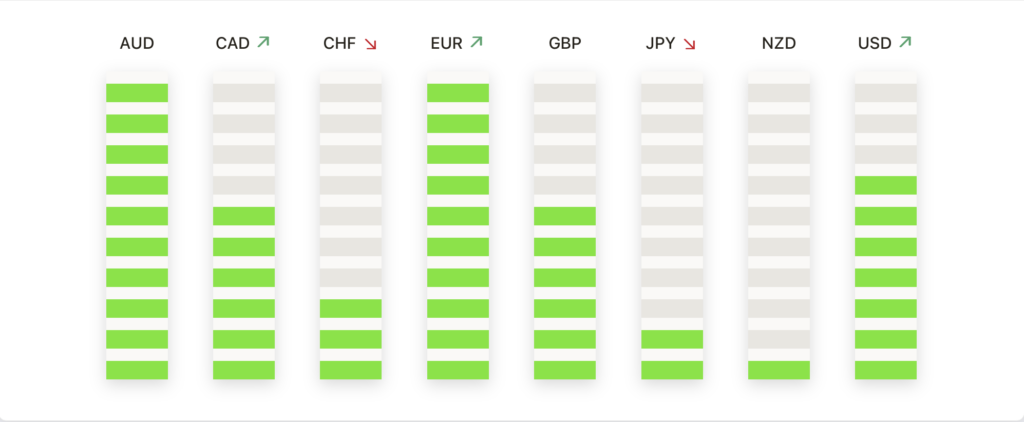

- EUR/USD Sees Notable Recovery: The EUR/USD pair made a significant climb, touching a two-week high just under 1.0840 as the US Dollar weakened, showcasing a dynamic shift in currency strength. This movement, reclaiming the 1.0800 level for the first time in a week, reflects the market’s anticipation of the Federal Reserve’s meeting minutes. The currency pair, which hovered near 1.0760 supported by the 200-hour SMA, remains on the bearish side of the 200-day SMA at 1.0830, indicating a cautious but optimistic outlook.

- GBP/USD Gains on UK Economic Positivity: The GBP/USD pair ascended to 1.2643, marking a 0.40% increase, fuelled by the Bank of England Governor’s optimistic remarks on the UK’s economy. Despite being range-bound, the pair has edged closer to the 50-day DMA at 1.2671, suggesting potential for further gains if it surpasses the February 19 high of 1.2629.

- USD/CAD Volatility Following CPI Report: After Canada’s CPI inflation report came in below expectations, the USD/CAD pair experienced fluctuations, dropping to a low of 1.3472 before rebounding to 1.3530. This price action filled the Fair Value Gap (FVG) between 1.3530 and 1.3470, indicating market adjustments to the unexpected inflation data and positioning the pair within a pivotal range around the 1.3500 mark.

- NZD/USD Rises Amid US Dollar Dip: The NZD/USD pair recorded a 0.28% gain, reaching 0.6168, as the US Dollar showed signs of weakness ahead of the FOMC minutes. With market predictions leaning towards multiple rate cuts in 2024, the pair’s movement reflects growing optimism and a shift towards a more bullish sentiment supported by technical indicators such as the RSI and MACD.

- Gold Continues Its Upward March: Gold prices surged to $2,028.44, up 0.52%, extending its rally for the fourth consecutive day. This rise, amid speculation of interest rate cuts and persistent inflation concerns, highlights gold’s appeal as a safe haven. The metal’s trajectory towards the 50-day SMA at $2,033.69 suggests a bullish market sentiment, with potential resistance at the recent cycle high of $2,065.60.

- Silver Maintains Gains Despite Resistance: Silver edged up slightly, trading at $22.99 per troy ounce, as it faced resistance below the $23.00 mark. The precious metal, navigating through technical barriers and bolstered by falling US Treasury yields, remains a critical asset for investors looking for stability amidst economic uncertainties. The near-term focus is on surpassing key resistance levels, including the 200-DMA at $23.28, to unlock further upside potential.

Market Movers:

- Expeditors International Leads S&P 500 Declines: Expeditors International of Washington (EXPD) experienced a significant drop, closing down more than 6%, leading the losers in the S&P 500. The logistics firm reported a Q4 EPS of $1.09, falling short of the consensus estimate of $1.22, triggering a negative reaction from investors concerned about the company’s performance and future growth prospects.

- Chip Sector Faces Broad Retreat: The semiconductor sector saw widespread losses, with Nvidia (NVDA) leading the decline by more than 4% as investors awaited its earnings report with bated breath. Other chipmakers, including Advanced Micro Devices (AMD) and Applied Materials (AMAT), saw their stocks tumble more than 5%, while Lam Research (LRCX), Marvell Technology (MRVL), and ASML Holding NV (ASML) also faced significant downturns. This sector-wide sell-off reflects mounting concerns over valuation and future earnings amid a challenging economic landscape.

- Tesla and Airbnb Downgraded: Tesla (TSLA) and Airbnb (ABNB) both closed down more than 3% following downgrades by Phillip Securities, which shifted its stance to neutral from accumulate and buy, respectively. These downgrades underscore investor recalibration of expectations in light of the companies’ current valuations and growth trajectories.

- Barclays Surges on Strategic Overhaul Announcement: Shares of Barclays jumped 8.6% after the bank unveiled a major operational overhaul, including cost cuts and asset sales, in its fourth-quarter results. The strategic initiatives aim at revitalising the bank’s performance and were well-received by investors, driving up its stock significantly.

- Conagra Brands Capitalises on Health Trends: Shares of Conagra Brands (CAG) climbed more than 4% as the company highlighted its positioning to benefit from the growing consumer trend towards healthy frozen meals, especially as GLP-1 drugs for weight loss gain popularity. This rise reflects the market’s positive reception to companies that align with emerging health and wellness trends.

- Air Liquide and SolarEdge Navigate Market Reactions: Air Liquide’s shares jumped 7.5% after the company beat full-year profit expectations, while SolarEdge’s stock tumbled 18% on weak first-quarter guidance. These contrasting movements underscore the diverse challenges and opportunities faced by companies across different sectors.

- Palo Alto Networks Adjusts Full-Year Guidance: Shares of Palo Alto Networks saw a 13% drop in extended trading after the cybersecurity firm adjusted its full-year revenue and billings guidance downwards, despite beating top and bottom-line estimates for the quarter. This revision signals potential challenges ahead, impacting investor sentiment.

- Intel and GlobalFoundries Boosted by Government Support: Intel (INTC) and GlobalFoundries (GFS) both saw their stocks rise, by more than 2%, on news related to U.S. government subsidies under the Chips and Science Act, highlighting the importance of government-industry collaboration in advancing the semiconductor sector’s growth.

- Coca-Cola Exudes Confidence in Growth Targets: Coca-Cola (KO) experienced a share price increase of more than 2% after its President and CFO expressed confidence in achieving the higher end of its long-term growth targets, reassuring investors about the beverage giant’s future prospects.

The movements across the stock market, from the decline in tech giants led by Nvidia to the strategic acquisitions by Capital One and Walmart, show the complexity of global financial markets. Investor sentiment has been tested by a mix of earnings reports, corporate strategies, and economic indicators, leading to notable shifts in stock valuations. Despite these fluctuations, the resilience of certain sectors and companies has shone through, offering a glimpse into potential areas of growth and stability. Investors are reminded of the importance of staying informed and agile, ready to navigate the ever-changing landscape of the stock market. As we look forward, the anticipation of future economic data and corporate earnings will continue to guide market trajectories, emphasising the need for strategic decision-making in the pursuit of investment success.