The Dow Jones Industrial Average modestly climbed, while the S&P 500 and Nasdaq Composite posted notable gains, breaking a losing streak and igniting optimism across Wall Street. This rally was underpinned by significant developments in the tech sector, including Nvidia’s anticipated AI advancements and Alphabet’s potential collaboration with Apple, setting a hopeful tone for technology’s influence on market dynamics. The market’s anticipation of the Federal Reserve’s forthcoming policy decisions suggests a complex relationship between expectations and strategies among investors, navigating through a landscape of economic uncertainties and opportunities.

Key Takeaways:

- Dow Jones and S&P 500 Make Gains Amid Tech Rally: The Dow Jones Industrial Average increased by 75.66 points, marking a 0.2% rise to close at 38,790.43. The S&P 500 saw a more significant lift, gaining 32.33 points or 0.63% to finish at 5,149.42.

- Nasdaq Leads with Tech Surge, Closing Up 0.82%: Boosted by major tech developments and investor enthusiasm, the Nasdaq Composite advanced by 0.82%, ending the session at 16,103.45.

- Nvidia and Alphabet Stocks Surge on AI Innovations and Potential Partnerships: Nvidia shares saw a 0.7% increase, lifted by the announcement of their new AI chips named Blackwell, set to ship later this year. Alphabet shares soared by 4.6% following reports of talks with Apple to incorporate its Gemini AI into iPhones, spotlighting the pivotal role of AI developments in stock performance.

- European Markets Show Resilience Ahead of Fed Meeting: The pan-European Stoxx 600 slightly down by 0.1%, featuring a 1.4% decline in telecoms stocks but a 0.9% rise in auto shares, underscores the region’s diverse economic landscape. Notably, Germany’s DAX remained flat, while the UK’s FTSE 100 and France’s CAC 40 experienced minor setbacks by 0.06% and 0.2%, respectively..

- Asian Markets Show Strength with Japan and China Leading Gains: The Nikkei 225 index in Japan led the advances in the Asian markets, closing 2.67% higher at 39,740.44, while the Topix gained 1.92%, ending at 2,721.99. China’s CSI 300 index rose 0.94% to 3,603.53, marking its sixth consecutive session of gains, driven by better-than-expected retail sales and industrial production figures for the start of the year. South Korea’s Kospi ended 0.72% higher at 2,685.84.

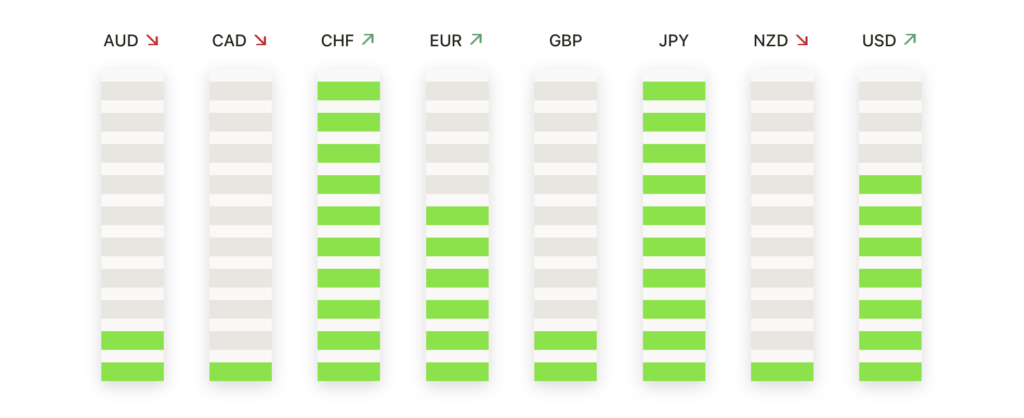

FX Today:

- EUR/USD Experiences Downward Pressure Amid High US Yields: The EUR/USD pair faced downward momentum, breaking below the 1.0872 mark and extending losses below the 1.0870 figure. The pair is now testing support around the 100-day Moving Average (DMA) at 1.0860, hinting at a potential further downside with key support levels at the 50-DMA at 1.0850 and the 200-DMA at 1.0838. Resistance is pegged at the 1.0900 level.

- USD/JPY Surges Past 149.00, Eyes Further Gains: The USD/JPY pair saw a significant upward move, breaking above the 149.00 barrier as market participants anticipate the Bank of Japan’s policy meeting. The pair’s bullish momentum is underscored by a climb above the descending 200-hour Simple Moving Average (SMA), now looking to test key resistance near the 151.00 level.

- GBP/USD Holds Steady Amid US Dollar Advance: The GBP/USD pair traded within a tight range in the low-1.2700s, reacting to the strength of the US dollar. The pair’s movements remain constrained as market watchers anticipate potential shifts in sentiment that could emerge from economic data releases and central bank decisions.

- Canadian Dollar Remains Steady in Anticipation of Central Bank Decisions: The USD/CAD pair was particularly stable, hovering just below the 1.3550 level, with technical support around the 1.3500 mark. This subdued activity highlights the market’s cautious approach in the lead-up to pivotal policy updates.

- AUD/USD Tests Key Support Amid Market Uncertainty: The AUD/USD pair edged lower, challenging the 200-day SMA at around 0.6550 amid marginal losses. This movement reflects the market’s cautious sentiment, especially with the Reserve Bank of Australia expected to maintain its cash rate, and ahead of significant economic data releases that could influence currency dynamics.

- Crude Oil Futures Reach Four-Month High Amid Supply Concerns: Crude oil futures surged to their highest level since late October, with WTI for April delivery climbing 2.1% to settle at $82.72 a barrel. This uptrend was fuelled by a mix of geopolitical tensions and optimistic economic data from China, alongside news of Iraqi export cuts and robust demand in the gasoline market. May Brent also advanced, rising 1.8% to $86.89 a barrel.

- Gold Prices Edge Higher, Awaiting Fed’s Decision: The price of gold maintained its uptrend, oscillating within the $2,160-$2,180 range as investors and traders await the Federal Reserve’s policy decision. The stability near the bottom of this range suggests that buyers remain in control, potentially aiming for the year-to-date high of $2,195.15, just ahead of the $2,200 mark. However, a pullback below $2,160 could lead to tests of significant support levels

Market Movers:

- Alphabet Gains on Potential Apple Partnership: Alphabet (GOOGL) experienced a significant uptick, closing more than 4% higher following reports that Apple is considering integrating Google’s Gemini artificial intelligence search engine into the iPhone.

- Tesla Surges on Price Increase Announcement: Tesla’s shares soared, closing up more than 6% after the electric vehicle giant announced a forthcoming $1,000 price hike for all US Model Y vehicles starting April 1st.

- Nuvei Corp Skyrockets on Acquisition Talks: Shares of Nuvei Corp (NVEI) closed up more than 30% after news broke that Advent International is in discussions to acquire the payment processing company.

- HashiCorp Considers Strategic Options, Shares Climb: HashiCorp (HCP) saw its shares jump more than 8% amid reports the cloud software company is exploring strategic alternatives, including a possible sale.

- PepsiCo Upgraded, Shares Increase: PepsiCo (PEP) shares rose more than 3% after Morgan Stanley upgraded the stock to overweight from equal weight, citing strong growth prospects. The upgrade reflects confidence in PepsiCo’s market positioning and its ability to navigate the consumer goods landscape effectively.

- Science Applications International Drops on Earnings Miss: Science Applications International (SAIC) faced a sharp decline, closing down more than 10% following a Q4 earnings report that fell short of expectations and a less-than-optimistic earnings forecast for 2025.

- Shift4 Payments Dips Amid Sale Discussions: Shares of Shift4 Payments (FOUR) closed down more than 6% as the CEO expressed dissatisfaction with valuations from potential buyers, highlighting challenges in achieving a fair market value for the payment processing company.

- Boeing Leads Dow Losers on Legal Inquiry: Boeing (BA) shares dropped more than 1%, leading the losers in the Dow Jones Industrials after reports of a grand jury investigation into suspected federal criminal law violations, casting a shadow over the aerospace giant’s market perception.

As the markets wrapped up a day marked by a notable rebound in tech stocks and anticipation ahead of central bank meetings, investors demonstrated a renewed appetite for risk, boosted by developments in artificial intelligence and strategic corporate manoeuvres. With the global economy at a critical stage, the day’s movements reflect the broader market sentiment; a blend of hope for technological advancements and vigilance in the face of economic uncertainties. As investors navigate this difficult landscape, the outcomes of the upcoming policy meetings and their implications for inflation, interest rates, and global growth will be critical in shaping the market’s direction in the weeks to come.