The joy surrounding the recent stock market rally was put to the test on Thursday as hotter-than-expected US inflation data reduced expectations of an imminent interest rate cut by the Federal Reserve. The Dow Jones Industrial Average snapped a three-day winning streak while the Nasdaq Composite and S&P 500 also retreated, declining 0.3% and 0.29%, respectively. The reason behind the market’s setback was a higher-than-anticipated 0.6% increase in February’s producer price index (PPI) which reignited concerns about persistent inflationary pressures and the potential need for the Fed to maintain its hawkish monetary policy stance.

Key Takeaways:

- Dow Jones Industrial Average Faces Downward Pressure: The Dow closed the trading day at 38,905.66, marking a decline of 137.66 points, or 0.35%. This movement snapped a three-day winning streak, indicating investor caution in response to fresh economic data.

- Nasdaq Composite and S&P 500 Retreat: The Nasdaq Composite fell to 16,128.53, while the S&P 500 decreased ending the session at 5,150.48. Both indices mirrored concerns over inflation and its potential impact on market dynamics.

- Inflation Data Surpasses Expectations: February’s Producer Price Index (PPI) reported a 0.6% increase, with core PPI (excluding food and energy) rising by 0.3%. These figures outpaced economist predictions of 0.3% and 0.2%, respectively, sparking concerns over inflationary pressures.

- European Markets Close Lower After US Inflation Data: European stocks reacted negatively to the hotter-than-expected US inflation figures, with the pan-European Stoxx 600 index closing down 0.2%. This retreat reflects growing concerns about the global implications of persistent inflation and its potential to prompt tighter monetary policy by central banks, including the European Central Bank.

- Asian Markets Show Mixed Response to Wall Street’s Rally Falter: In Asia, markets exhibited a mixed response, with Japan’s Nikkei 225 marginally rising by 0.29% and China’s CSI 300 index declining by 0.28%. The varied performance in Asian markets indicates regional differences in investor sentiment and economic outlook, influenced by local factors such as wage negotiations in Japan and anticipation of wholesale inflation data in India. Meanwhile, South Korea’s Kospi climbed 0.94%.

- Oil Prices Advance While Supply Deficit Is Forecast: US crude futures rose to $81.26 a barrel, a 1.93% increase, lifted by the IEA’s supply deficit forecast for 2024. This price movement signals market anticipations of tightening supply conditions.

FX Today:

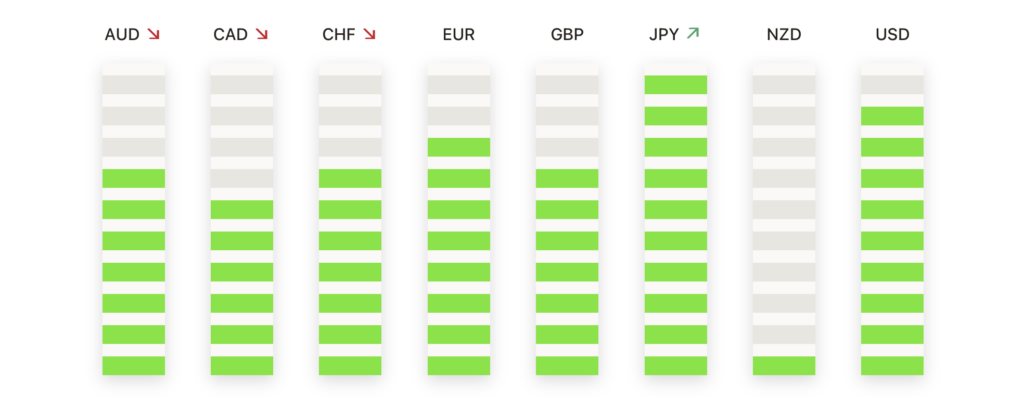

- Dollar Strengthens on Hawkish PPI and Yield Rise: The dollar index witnessed an uplift of 0.57% in response to the hawkish PPI report, slightly adjusting market expectations for an imminent Fed rate cut. This upward movement was further boosted by a sharp 10 basis point rise in the 10-year T-note yield, enhancing the dollar’s appeal through improved interest rate differentials.

- USD/CAD Sees Notable Rally: Following the hot US PPI inflation report, the USD/CAD pair experienced a significant surge, crossing the 1.3500 threshold to reach a weekly high above 1.3530. The pair found support at the 200-hour Simple Moving Average (SMA) near 1.3508, with intraday support set at 1.3460. Despite fluctuations, the USD/CAD continues to hover around the 200-day SMA at 1.3480.

- GBP/USD Adjusts to Inflation Data: The release of strong US producer inflation figures led to a downturn in GBP/USD, breaking below the previous weekly low of 1.2744. A daily close below this level could signal further weakness, with subsequent supports at 1.2700 and the 50-day moving average (DMA) at 1.2685. However, a rebound above 1.2800 could challenge the weekly highs at 1.2823, indicating potential shifts in market sentiment.

- GBP/JPY Navigates Rate Hike Expectations: Amid anticipation for Bank of Japan (BoJ) rate hikes, GBP/JPY experienced a narrow range of movement, settling around the 189.00 mark. Despite facing a technical rejection at the 200-hour SMA at 189.43, the pair managed to maintain stability near its opening levels. The GBP/JPY’s technical posture suggests a balance between support at the bullish 200-day SMA above 184.20 and resistance near the 191.00 level.

- Euro and Yen React to Global Central Bank Signals: The EUR/USD pair fell 0.64%, primarily influenced by the strengthening dollar and commentary from ECB officials favouring rate cuts. Meanwhile, USD/JPY increased by 0.35%, with market attention focused on potential rate adjustments by the BoJ, despite speculative reports suggesting a hike in the upcoming meeting.

Market Movers:

- Under Armour Drops as Founder Returns as CEO: Sportswear manufacturer Under Armour saw its shares fall 10.7% amid news that founder Kevin Plank is returning as CEO. The leadership change suggests strategic shifts that have yet to convince investors of a turnaround.

- Robinhood Markets Climbs on Trading Volume Increase: Fintech firm Robinhood Markets enjoyed a 5.2% uptick in its shares following a report of a 41% year-over-year increase in equity trading volumes for February, indicating robust user engagement and platform growth.

- US Steel Dips Amid Acquisition Concerns: Shares of US Steel fell by 6.4%, continuing losses from the previous session. Reports of President Biden’s concerns over the company’s proposed acquisition by Nippon Steel may have contributed to investor unease.

- Fisker Plummets on Bankruptcy Speculation: Electric vehicle maker Fisker’s stock halved to 15 cents per share following reports that the company is considering bankruptcy filing, underscoring severe financial and operational challenges.

- RTX Gains on Positive Analyst Upgrade: Aerospace and defence company RTX saw its shares rise 1.3% after receiving an upgrade to an overweight rating from Wells Fargo. The upgrade reflects fading concerns over a jet engine recall and confidence in the company’s recovery trajectory.

- Lennar Faces Setback with Revenue Miss: Homebuilder Lennar saw its shares decline by 7.6% following a revenue report of $7.31 billion for its first quarter, falling short of the expected $7.39 billion. The miss highlights challenges in the housing market.

- Dick’s Sporting Goods Soars on Earnings Beat: Shares of Dick’s Sporting Goods leaped 15.5% after the company reported fourth-quarter earnings of $3.85 per share on $3.88 billion in revenue, surpassing the anticipated earnings of $3.35 per share on $3.80 billion in revenue.

- Dollar General Ends Lower Despite Positive Earnings: Despite reporting higher-than-expected fourth-quarter results, with earnings of $1.83 per share on $9.86 billion in revenue, Dollar General’s shares dropped 5.1%.

- SentinelOne Dips on Mixed Outlook: SentinelOne’s shares plummeted 16.6%, even though the cybersecurity firm reported a smaller-than-expected fourth-quarter adjusted loss of 2 cents per share on $174 million in revenue.

- UiPath Faces Decline on Revenue Guidance Concerns: Shares of UiPath tumbled 6.9% after the company forecasted first-quarter revenue of $330 million to $335 million, below the expected $346.8 million. The cautious outlook likely raised doubts about the company’s short-term growth prospects.

- MicroStrategy Pulls Back Despite Bitcoin Buy Announcement: Despite announcing plans to raise $500 million for additional bitcoin purchases, MicroStrategy’s shares declined 5.1%, reflecting investor scepticism or broader market trends affecting crypto-related stocks.

- WW International Suffers on Debt Talk Reports: Shares of weight management company WW International plunged 21% on news that lenders are preparing for debt negotiations. The drop highlights concerns about the company’s financial stability and future direction.

The day’s market movements were heavily influenced by the latest inflation data, causing investors to proceed with caution. A significant increase in the US Producer Price Index impacted various market aspects, from stock indices to currency pairs, and altered what many expect from the Federal Reserve moving forward. This situation highlighted how economic trends can affect individual stocks and sectors differently, as seen in Nvidia’s pullback and Fisker’s notable decline. Moving ahead, investors’ ability to adapt and stay resilient will be crucial as they navigate through ongoing changes and uncertainties, always on the lookout for signs of market stability or potential volatility.