In a volatile trading session, US stocks staged a comeback on Friday, with the major indices recovering from steep losses in the previous session. However, the gains were not enough to offset weekly declines as investors grappled with the implications of an unexpectedly strong job market report. The Dow Jones Industrial Average surged, while the S&P 500 and the tech-heavy Nasdaq Composite also advanced. Despite the rebound, all three indices posted losses for the week, with the Dow marking its worst weekly performance of 2024 so far, underscoring the market’s concerns about the potential for higher interest rates to linger.

Key Takeaways:

- Dow’s Resilient Rebound: The Dow Jones Industrial Average bounced back significantly, climbing 307.06 points, or 0.8%, to close at 38,904.04, following its largest daily decline since March 2023.

- S&P 500 and Nasdaq Gain Ground: The S&P 500 rose by 1.11%, ending the week at 5,204.34, while the Nasdaq Composite increased by 1.24%, closing at 16,248.52, as investors reacted positively to the latest job data.

- US Job Market Surpasses Expectations: The Labor Department reported a March nonfarm payroll increase of 303,000 jobs, significantly above the anticipated 200,000, with unemployment steady at 3.8%.

- European Markets End Lower Amid Sectoral Declines: The European stocks struggled and declined for the Stoxx 600, which fell by 0.84%. Specific sectors faced notable setbacks, with retail and utilities sectors dropping over 2%, and household goods decreasing by 1.6%. Among the major bourses, Germany’s DAX retreated by 1.3%, France’s CAC 40 lost 1.1%, and the U.K.’s FTSE 100 decreased by 0.8%. The UK house prices also fell by 1% for first time in six months in March.

- Asian Markets Show Varied Performance with Focus on Japan: The Asian markets presented a mixed picture, heavily influenced by Japan’s Nikkei 225, which experienced a significant drop of 1.96%, closing at 38,992.08. This marked a notable decline, bringing the index below the 39,000 threshold. The broader Topix index also saw a decrease, falling 1.08% to finish at 2,702.62. In contrast, Hong Kong’s Hang Seng index managed a slight increase of 0.18%, and South Korea’s Kospi dropped 1.01%.

- Oil Prices Climb Amid Geopolitical Strain: Oil markets experienced heightened activity, with West Texas Intermediate (WTI) crude advancing to $86.91 a barrel, marking a 0.37% increase. The Brent crude followed suit, reaching $91.17 a barrel, a rise of 0.57%. These movements propelled oil prices to six-month highs. Over the week, US crude oil demonstrated a robust performance, ascending 4.5%, while the global benchmark, Brent crude, accrued a 4.2% gain. The “golden cross” pattern, identified as the 50-day moving average surpassing the 200-day moving average.

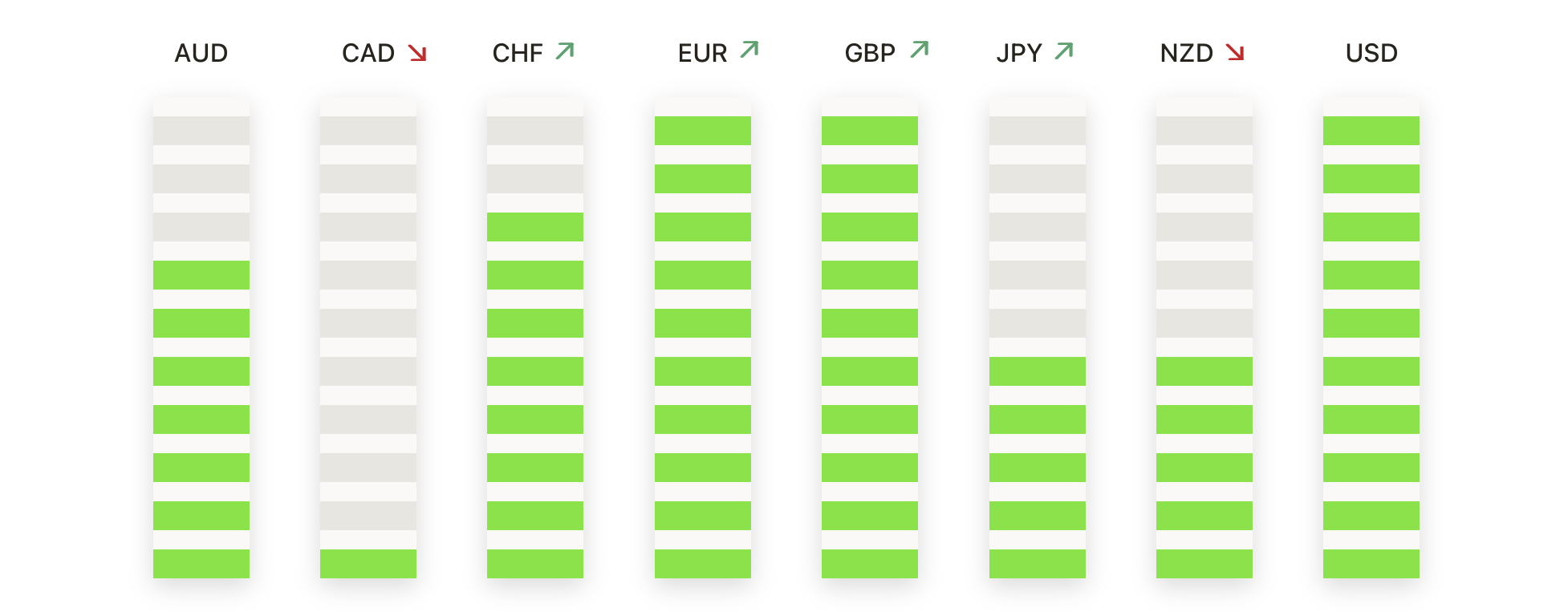

FX Today:

- GBP/USD Faces Downward Pressure: The British Pound retraced towards its 200-day moving average, with potential for a further slide below the significant retracement support at 1.2500. The currency pair has been in a broad trading range for nearly five months, with a current downward trend hinting at possible deeper declines towards the 1.24 level.

- EUR/USD Hovers Around Key Technical Level: The Euro found temporary respite, stabilising around the 200-day Simple Moving Average (SMA) after a slight recovery. The EUR/USD pair faced a low of 1.0792 on Friday but managed to remain steady despite negative yield spread movements, closing near the 1.0830 level, indicative of market uncertainty and cautious investor sentiment.

- USD/JPY Approaches Potential Breakout: The USD/JPY currency pair remained on the edge of a bullish breakout, with trading confined between 150.90 and 152.00. Market dynamics suggest a possible upward swing, potentially targeting the 155.25 level, dependent on the broader economic outlook and policy directions from Japan.

- NZD/USD Signals Bearish Trends with Bullish Undertones: The New Zealand Dollar ended the week at 0.6013, reflecting a slight decline but managing to close the week on a positive note. Despite a predominant bearish trend, emerging bullish signals suggest a near-term sideways trading pattern, with significant resistance at the 20, 100, and 200-day SMA levels.

- US Dollar Index Fluctuates Amid Jobs Data: The US Dollar Index edged up by 0.19% following robust nonfarm payroll figures, closing at an unspecified level but signalling mixed market reactions. The strong job growth figures and subsequent increase in Treasury yields lent some support to the dollar, balancing the equity market’s strength and investor sentiment towards currency valuation.

- Gold’s Bullish Trajectory as Safe Haven Appeal Strengthens: Gold’s market dynamics have been equally compelling, with the metal surging past the critical $2,300 threshold, showcasing a robust demand for safe-haven assets amidst the prevailing market uncertainty. This surge led to gold touching a peak, drawing closer to the $2,350 level, pushed by a strong momentum with the Relative Strength Index (RSI) stretching beyond the overbought condition at 70.00, hinting at a sustained buyer interest.

Market Movers:

- Uber Technologies Gains on Price Target Hike: Uber Technologies (UBER) rose over 3% after Jefferies raised its price target to $100 from $95, citing optimistic projections for the company’s growth trajectory.

- Newmont Rides Gold’s Rally: Newmont Corporation (NEM) saw a significant uptick, closing up more than 5%, as gold prices soared to new heights, with the precious metal breaking through the $2,300 level and demonstrating a strong market sentiment towards safe-haven assets.

- Western Digital Enjoys Analyst Upgrade: Western Digital (WDC) ended the day up more than 3% after an upgrade from Rosenblatt Securities, which set a new price target of $115, reflecting positive expectations for the company’s financial performance.

- Arch Capital Group Expands Its Portfolio: Shares of Arch Capital Group Ltd (ACGL) increased more than 3% following the announcement of its $450 million acquisition of Allianz Global’s US MidCorp and Entertainment Insurance businesses, signalling strategic growth and market consolidation.

- Eaton Corp Leaps on Upgraded Rating: Eaton Corporation Plc (ETN) closed up more than 3% as RBC Capital Markets upgraded the stock to outperform from sector perform, with a revised price target of $371, highlighting strong market confidence.

- Tech Sector Witnesses Broad Gains: Notable technology stocks like Nvidia (NVDA), Advanced Micro Devices (AMD), and ASML Holding NV (ASML) saw their shares increase by more than 2%, driven by bullish sentiment across the sector. This positive movement was mirrored by gains in other tech companies, including Broadcom (AVGO) and Microchip Technology (MCHP), each closing up more than 1%.

- Krispy Kreme Sweetens on Upgrade: Krispy Kreme (DNUT) surged more than 7% following an upgrade to overweight from neutral which set a target price of $20, reflecting a positive reassessment of the company’s market position.

- Vertiv Holdings Receives Bullish Coverage Initiation: Shares of Vertiv Holdings (VRT) climbed more than 5% after Oppenheimer initiated coverage with an outperform rating and a target price of $96, indicating strong future growth potential.

- Shockwave Medical Acquired by Johnson & Johnson: Shockwave Medical (SWAV) experienced a more than 1% increase in its stock price after Johnson & Johnson announced an acquisition deal valued at $13.1 billion, or $335 per share, showcasing the company’s significant market value and industry impact.

- Tesla Leads Losses on Cancelled Car Plans: Tesla (TSLA) faced a setback, dropping more than 3%, following reports of cancelled plans for a low-cost entry-level car, highlighting challenges and strategic shifts within the company.

- Paramount Global Dips on Public Market News: Paramount Global (PARA) saw its shares fall more than 3% amid news that Skydance Media might maintain a substantial stake, affecting the company’s market perception and future strategy.

- Lamb Weston Holdings Adjusts to Price Target Cut: Lamb Weston Holdings (LW) declined more than 2% as Citigroup reduced its price target, indicating market correction and the potential impact on investor sentiment.

- Intel Faces Decline on Negative Outlook: Intel (INTC) led the losses in the Dow Jones Industrials and Nasdaq 100, dropping more than 2% due to unfavourable market reactions to its recent business forecasts.

The week’s market activity concluded with resilience and caution, where the Dow Jones Industrial Average’s rebound casted a hopeful glow against the backdrop of its worst week in 2024, where the Dow, S&P 500, and Nasdaq recorded weekly declines of 2.27%, 0.95%, and 0.8% respectively. Investors, while lifted by the unexpectedly strong job numbers, remained vigilant. The surge in oil prices, alongside notable fluctuations in precious metals and forex markets, highlighted the global landscape’s relationship of supply, demand, and sentiment. As tech stocks rallied and key companies made significant moves, the narrative of market movers showed the ongoing adaptation and strategic positioning within various sectors. Last week’s dynamics underscore a market at the crossroads of recovery and uncertainty, where optimism for economic strength is balanced by the rationality of financial caution.