On Tuesday, markets were hit by worry and uncertainty as inflation for January went higher than what experts had predicted. This surprise increase in the consumer price index caused a big drop on Wall Street, leading to the Dow Jones Industrial Average’s biggest fall since March 2023. The continuing high inflation is making people doubt whether the Federal Reserve will cut interest rates as hoped. This shift in expectations has turned investor optimism into caution. At the same time, rising Treasury yields show how closely stock and bond markets are linked to economic signals and the Fed’s decisions.

Key Takeaways:

- Dow’s Steep Decline Marks Market Jitters: The Dow Jones Industrial Average faced a significant setback, plunging 524.63 points or 1.35%, closing at 38,272.75. This downturn represented the index’s worst day since March 2023 on a percentage basis, highlighting investor fear amidst inflation concerns.

- S&P 500 and Nasdaq Composite Follow Suit: The broader market wasn’t spared either, with the S&P 500 sliding 1.37% to settle at 4,953.17, and the Nasdaq Composite falling 1.8% to finish at 15,655.60, indicating widespread bearish sentiment among investors.

- Russell 2000 Witnesses Marked Volatility: The Russell 2000 index tumbled nearly 4%, marking its worst session since June 2022 and underscoring the heightened volatility affecting smaller companies.

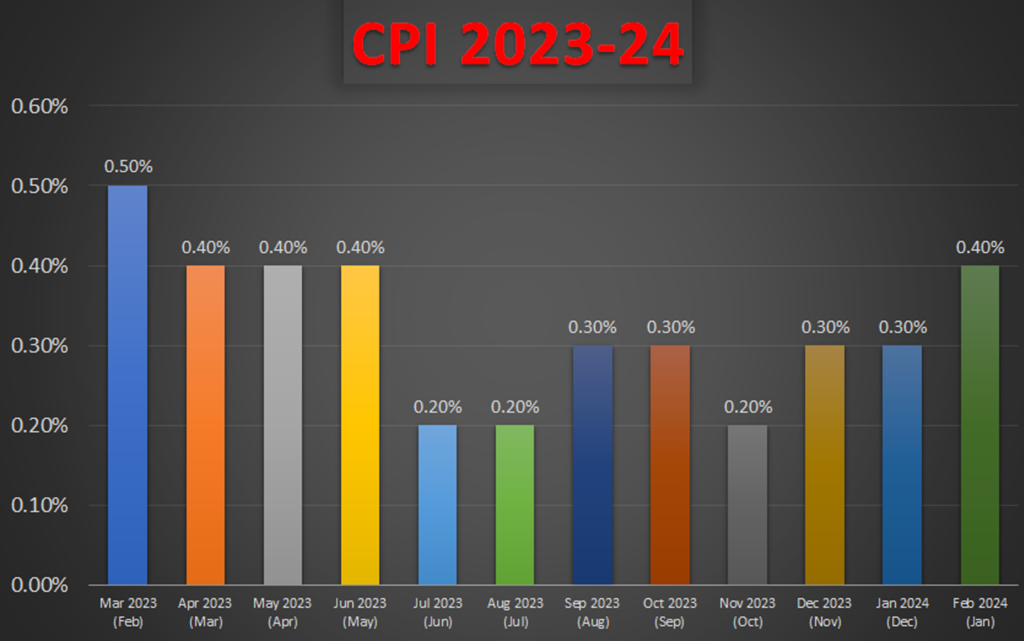

- Inflation Data Exceeds Expectations: January’s consumer price index rose 0.3% from December, with an annual increase of 3.1%, surpassing Dow Jones’ anticipated figures of 0.2% monthly and 2.9% yearly increases, respectively. Core CPI, excluding food and energy, rose 0.4% month over month and 3.9% year over year, further fuelling inflationary concerns.

- Treasury Yields Surge on CPI Report: The 2-year Treasury yield ascended above 4.66%, and the 10-year yield eclipsed 4.32% following the CPI data release, affecting sectors sensitive to interest rates, notably tech, with giants like Microsoft and Amazon each losing more than 2%.

- European Markets React to US Inflation: European stock markets closed down 1%, with the Stoxx 600 index leading the downturn, propelled by the tech sector’s 2.7% decline and financial services stocks losing 1.7%, as the US’s inflation data prompted a re-evaluation of the rate cut timeline by the Federal Reserve.

FX Today:

- EUR/USD Slips Amid Rate Cut Hopes Dashed by US CPI: The EUR/USD pair took a hit, tumbling 0.9% after the release of the US Consumer Price Index (CPI) data, which came in hotter than expected. This inflation data has dampened hopes for imminent rate cuts from the Federal Reserve, leading to a stronger dollar and putting pressure on the Euro.

- Canadian Dollar Weakens Amid US Inflation Surge: The Canadian Dollar experienced a notable decline against the US Dollar on Tuesday, with the USD/CAD pair soaring to an eight-week peak, hitting a session high of 1.3578. This upward movement, marking an increase of over 1% within the day. The Canadian Dollar fell approximately 0.75% against the US Dollar, also shedding about 0.5% against the Pound Sterling. The USD/CAD’s ascent above the 200-day SMA near 1.3477 emphasises the bullish momentum, challenging traders to maintain levels above the critical 1.3550 threshold to avoid regression into previous consolidation ranges.

- GBP/JPY Hits Nine-Year Peak on Strong UK Economic Indicators: The GBP/JPY currency pair achieved a notable milestone, touching the 190.00 mark, a level not seen in nine years. This significant appreciation, culminating in a 0.6% rise for the day and marking a nearly 6% increase from recent lows, was fuelled by unexpectedly positive UK economic indicators. Notably, the UK’s Unemployment Rate came in better than forecasts, and a deceleration in wage growth falling to 5.8% from the previous period’s 6.7%.

- Mexican Peso and Other Emerging Market Currencies Adjust: The Mexican Peso, along with other emerging market currencies, showed volatility following the US inflation report. The unexpected uptick in inflation led to a reassessment of the Federal Reserve’s easing timeline, affecting currencies worldwide as the Dollar strengthened.

- Oil Prices and Currency Movements: In the face of US inflation concerns that pressured the stock market, oil futures experienced a rise on Tuesday. The March West Texas Intermediate (WTI) contract climbed by 95 cents, reaching a settlement of $77.87 a barrel, marking a 1.24% increase. Meanwhile, the April Brent contract saw a rise of 77 cents, or 0.94%, to close at $82.77 a barrel. Despite the volatility, with WTI fluctuating within a $68 to $78 range, both WTI and Brent have registered gains of approximately 8.68% and 7.44% for the year, showcasing resilience in the oil market.

Market Movers:

- JetBlue Airways Takes Flight: JetBlue Airways soared, closing nearly 22% higher after news broke of activist investor Carl Icahn taking a nearly 10% stake in the airline. This significant increase underscores the market’s positive reaction to strategic investments from influential financial figures.

- Hasbro Faces Headwinds: Toymaker Hasbro experienced a downturn, closing 1.4% lower after its fourth-quarter earnings fell short of analyst expectations. The market’s response highlights the challenges facing consumer goods and entertainment sectors in navigating economic uncertainties.

- Restaurant Brands International Exceeds Financial Forecasts: Restaurant Brands International reported quarterly earnings and revenue that surpassed analysts’ expectations on Tuesday, propelled by notably strong sales at Tim Hortons. The company achieved adjusted earnings of 75 cents per share, edging out the expected 73 cents, and posted revenue of $1.82 billion. This robust growth underscores the impact of Tim Hortons’ sales in driving the company’s success.

- Avis Budget Group Hits a Bump: Shares of Avis Budget Group tumbled about 23%, following a disappointing revenue report for the fourth quarter. The sharp decline reflects investor concerns over the travel and leisure sector’s recovery trajectory amidst fluctuating demand.

- Moody’s Corp (MCO) Leads S&P 500 Declines: Moody’s Corp shares dropped more than 7% after the company reported a Q4 adjusted EPS of $2.19, missing the consensus estimate of $2.33. This led to Moody’s leading the day’s losers in the S&P 500, reflecting investors’ reactions to the earnings miss.

- Lyft Rides Higher on Earnings Beat: Lyft’s shares jumped near 19% after-hours trading following an earnings report that outperformed analyst predictions. The ride-hailing company’s guidance for gross bookings also topped estimates, signalling a strong start to the year despite ongoing competition and market challenges.

- Biogen (BIIB) Takes a Hit in Nasdaq 100: Biogen’s stock fell over 7%, making it one of the Nasdaq 100’s biggest losers, after announcing Q4 revenue of $2.39 billion, which was below the expected $2.46 billion. The market’s response was swift, indicating concerns over the company’s revenue performance.

- Marriott International (MAR) Dips on EPS Forecast: Marriott International saw its shares decline more than 5% after forecasting a 2024 adjusted EPS range of $9.18 to $9.52, which was weaker than the expected $9.68. The forecast adjustment led to a re-evaluation of the company’s growth prospects among investors.

- Waste Management (WM) Climbs: Waste Management’s stock rose more than 5% after reporting a Q4 adjusted operating Ebitda that surpassed expectations and provided an optimistic full-year forecast. The financial performance underscored the company’s operational efficiency, appealing to investors.

As the trading day ends, it’s clear how closely the stock market’s ups and downs are tied to economic news and investor sentiment. The strong response to January’s inflation report and big moves by major companies show how balanced yet fragile the market can be. Some industries are doing well despite the challenges, while others are struggling, showing how different factors can affect companies in varied ways. Investors need to be very careful, paying attention to changes in government policies and economic trends, as they look for chances to succeed in a market full of risks and opportunities.