Monday saw a retreat in the S&P 500 as investors shifted focus to key inflation data, with the index stepping back from its recent record highs. The Dow Jones Industrial Average edged lower by 0.1%, while the S&P 500 experienced a 0.3% decline, and the Nasdaq Composite slipped 0.1%. Notably, Amazon made its debut in the 30-stock Dow, replacing Walgreens Boots Alliance, a move expected to reshape the index’s composition and amplify its exposure to the tech and consumer retail sectors. The market’s attention remained fixed on inflationary pressures and the Federal Reserve’s response, with Treasury yields ticking higher and adding pressure to equities. Despite the pullback, optimism surrounding AI-powered companies, helped by robust earnings from Nvidia, continues to hold market sentiment, suggesting a sustained rally in the face of economic uncertainties. As investors brace for a flurry of economic releases and earnings reports, including the Fed’s preferred inflation gauge, the stage is set for a dynamic week driven by evolving market dynamics and macroeconomic indicators.

Key Takeaways:

- Market Indices Retreat: The S&P 500 retreated by 0.3%, closing at 5,069.53, while the Dow Jones Industrial Average decreased by 0.1%, ending the day at 39,069.23. The Nasdaq Composite saw a decline of 0.1%, finishing at 15,976.25.

- European and Asian Market Overview: European markets had a mixed session, with the Stoxx 600 index rebounding by 0.4%. The Zealand Pharma soared by 35% after reporting strong trial results for a weight-loss drug. Japan’s Nikkei 225 continued its rally to new all-time highs (0.4% higher at 39,233.71), while China’s markets experienced a setback (1.04% to close at 3,453.36). South Korea’s Kospi index ended 0.8% lower despite regulatory measures aimed at enhancing corporate governance.

- Innovative Partnerships and Expansion: Microsoft’s partnership with Mistral, aimed at extending its reach beyond OpenAI, underscores the strategic moves by tech companies to diversify and strengthen their market position through innovative collaborations. Similarly, Goldman Sachs and Abu Dhabi’s Mubadala Development Company launching a $1 billion partnership to invest in the Asia Pacific region reflect a significant focus on tapping into emerging market potentials and fostering global investment strategies.

- US Housing Market Struggles to Meet Expectations: January’s new home sales figures disappointed as sales of single-family homes reached 661,000, only a modest 1.5% increase, falling short of the Dow Jones estimate by 2.4%. The median sale price stood at $420,700, with an average price of $534,300, while inventory levels remained at 456,000, representing an 8.3-month supply. These underwhelming numbers underscore the challenges faced by the housing sector amidst elevated mortgage interest rates, highlighting ongoing concerns about the strength of the US economy.

- Dow Jones Welcomes Amazon: The Dow Jones Industrial Average underwent a significant shakeup this week, with Amazon stepping in to replace Walgreens Boots Alliance. The addition of the e-commerce giant marks a notable shift for the index, which has struggled to keep pace with the broader market. Amazon’s inclusion highlights the evolving landscape of the US economy, where technology plays an increasingly pivotal role. Meanwhile, Amazon shares decline 0.3% on Monday.

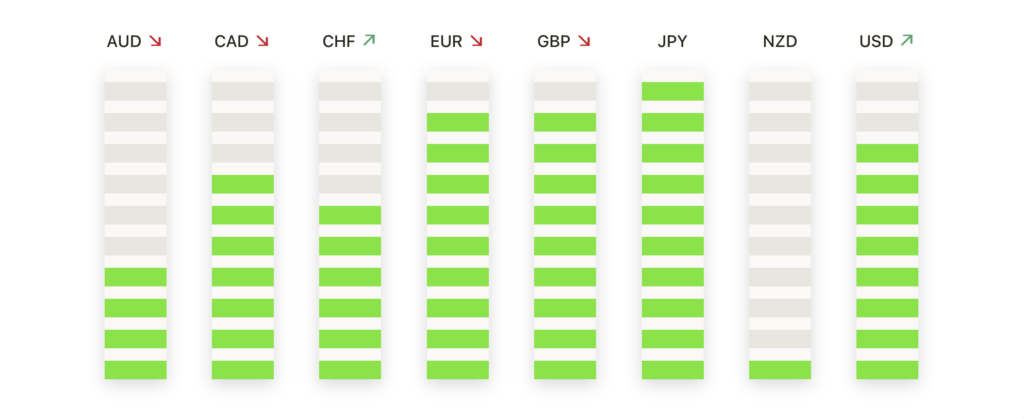

FX Today:

- EUR/USD Battles Resistance: EUR/USD saw marginal gains on Monday, rising approximately a quarter of a percent as it approached the key resistance level of 1.0860. The pair remains capped below this level, with near-term technical indicators showing resistance in the range of 1.0800 to 1.0820. Despite the bullish buildout, EUR/USD faces significant pressure around the 200-day Simple Moving Average (SMA) near 1.0830, reflecting ongoing market uncertainty.

- USD/CAD Stagnates Near 1.3500: USD/CAD continues its sideways drift near the psychological level of 1.3500, with intraday bids gravitating towards this major price handle. The pair has maintained this rough sideways channel since early February, with daily candlesticks indicating consolidation around the 200-day SMA at 1.3478. With economic data remaining thin on Monday, traders are eyeing upcoming releases, including US Durable Goods Orders and GDP growth figures, for potential directional cues.

- British Pound Shows Resilience: The British Pound extends its upward trajectory against the US Dollar for the eighth consecutive session, carried by positive domestic economic news and delayed interest rate hike expectations in the US. Sterling tests resistance near $1.2706, aiming towards February’s peak of 1.2750. Despite these gains, GBP/USD faces challenges from broader market volatility, with technical support seen around 1.2672 and 1.2518.

- Bitcoin Surges Above $54,000: Bitcoin resumes its rally, surging above the $54,000 level on Monday following a week of subdued trading. The flagship cryptocurrency gains 5%, reaching its highest level since December 2021 at $54,965.26. Ether also sees upward movement, climbing over 2% to trade at $3,173.87. Crypto-related equities experience notable gains, with Coinbase and MicroStrategy jumping 16%, and Riot Platforms and Marathon Digital soaring 15% and 20%, respectively.

- EUR/JPY Hits New YTD Highs: EUR/JPY advances sharply, surpassing the 163.00 figure as traders capitalize on Japanese Yen weakness. The pair hits a new year-to-date (YTD) high at 163.72, indicating sustained bullish momentum. Technical analysis suggests potential challenges around the 164.00 figure, with support levels at 162.56 and 161.61 in case of a pullback. Amid global economic uncertainties, EUR/JPY remains a focus for forex traders seeking trading opportunities amidst ongoing market fluctuations.

Market Movers:

- Berkshire Hathaway Takes a Dive: Berkshire’s Class B (BRK.B)shares dipped 1.9% in intraday trading, despite reaching all-time highs earlier in the session. This decline follows strong operating earnings in its fourth quarter, showcasing the market’s reaction to recent developments.

- R1 RCM Rockets (RCM) Upward: Shares of the health-care payment tech company surged an impressive 25.1% after major holders indicated potential strategic alternatives, including a possible privatisation. This substantial increase underscores the market’s response to potential corporate restructuring.

- Freshpet’s Strong Performance: Freshpet (FRPT)witnessed a remarkable 19.7% surge in its shares following its fourth-quarter financial report, which revealed adjusted earnings and revenue exceeding analyst expectations. The company’s robust performance highlights its resilience and growth potential in the pet food industry.

- HashiCorp Rises on Upgrade: HashiCorp’s (HCP) shares jumped 14% after receiving an upgrade from Morgan Stanley to overweight from equal weight. This upgrade reflects the bank’s positive outlook on HashiCorp’s prospects amidst a resurgence in cloud initiatives, resonating well with investors.

- Pilgrim’s Pride Beats Expectations: Shares of Pilgrim’s Pride (PPC)climbed 8% as the meat processing company exceeded Wall Street’s expectations for its fourth-quarter earnings. Pilgrim’s Pride’s better-than-expected performance underscores its ability to navigate market challenges and deliver solid results.

- Domino’s Pizza Increases Dividend: Domino’s Pizza (DPZ)saw a 5.9% increase in its shares after announcing a 25% raise in its dividend, to be paid on March 29. Additionally, the authorization of an additional share repurchase program of up to $1 billion signals confidence in the company’s financial strength and growth prospects.

- Moderna Faces Downgrade: Shares of Moderna (MRNA) experienced a 2.5% decline following a downgrade to reduce from hold by HSBC. Concerns over the effectiveness of Moderna’s RSV vaccine compared to competitors contributed to this downgrade, impacting investor sentiment.

- Alcoa Announces Acquisition: Alcoa’s (AA) shares slid 4.5% after the announcement of its agreement to acquire its Australian joint venture partner Alumina Limited for about $2.2 billion in an all-stock transaction. This strategic move led to a re-evaluation of Alcoa’s position in the market.

- Fluence Energy Receives Upgrade: Shares of Fluence Energy (FLNC)surged 7.9% after Susquehanna Financial upgraded the energy storage stock to positive from neutral. The upgrade, coupled with recent stock weakness, presents an attractive entry point for investors, driving up demand for the company’s shares.

- Alphabet Tumbles: Alphabet (GOOGL) closed down more than 4% to lead the losers in the Nasdaq 100 after growing criticism of its image-generation AI tool on Gemini. Over the past week, users discovered historical inaccuracies from the image generator, which have circulated widely on social media, fuelling the perception that the company is an unreliable source for AI, posing a risk to its search business.

It is evident how closely the stock market’s fluctuations are linked with economic news and investor sentiment. The S&P 500 retreated from its recent record high, reflecting a pause in the market rally as investors awaited key inflation data. The Dow Jones Industrial Average slipped slightly, while the Nasdaq Composite also saw a modest decline. With investors closely monitoring economic and inflation risks, particularly ahead of the release of the monthly personal consumption expenditures price index later this week, market sentiment remains optimistic yet wary. The recent strong earnings season has strengthened investor confidence, despite lingering concerns about inflation and potential Fed actions. It is clear that investors need to remain vigilant, keeping a close eye on economic indicators and market trends. The stock market remains full of risks and opportunities, requiring careful navigation to seize chances for success while mitigating potential downsides.