The S&P 500 is edging closer to its record highs in a remarkable display of market resilience, signalling an upbeat end to the year as it notches its eighth consecutive winning week – a feat not seen since 2017. This Friday, the S&P 500 rose modestly, underscoring a robust undercurrent of investor optimism fuelled by cooler inflation data and growing anticipation of a more accommodative monetary policy from the Federal Reserve. The Nasdaq Composite also witnessed gains, while the Dow Jones Industrial Average saw a slight retraction. These movements reflect a nuanced backdrop of economic and corporate dynamics, including impactful earnings reports and geopolitical developments, shaping investor sentiment as the market moves towards the cusp of a new year. With the backdrop of cooling inflation and renewed rate cut expectations, this period marks a significant chapter in the financial narrative of 2023, highlighting a complex interplay of factors driving the markets forward.

Key Takeaways:

- Inflation Data Signals Economic Stability: The November core personal consumption expenditures price index rose by a modest 0.1% last month and showed a year-over-year increase of 3.2%, aligning closely with economist forecasts and reinforcing the narrative of stabilizing inflation.

- Russell 2000 Indicates Broadening Rally: The small-cap Russell 2000 index gained 0.8%, marking its sixth straight positive week, which reflects the depth of the current market rally.

- Asian Markets Respond Positively: Asian stocks, including Japan’s Nikkei, showed upward movement in response to the global market trends. The Nikkei posted a gain of 0.16%, continuing its strong performance with a 27% rise in 2023.

- Commodities and Currencies Show Mixed Responses: Oil prices exhibited mixed trends, with U.S. WTI crude futures rising by 0.33% to $73.80 per barrel. The dollar index hovered near a five-month low, while the yen remained steady against the dollar.

- Sector-Specific Movements Influence Market: The tech sector, despite Oracle’s shares plummeting by over 12%, showed flexibility, while energy stocks lagged behind, influenced by fluctuations in crude oil prices.

- Federal Reserve Policy Anticipation: The market’s response to the Federal Reserve’s signals of a potential easing in monetary policy in 2024 has been a critical factor in recent stock movements, with investors keenly awaiting the next policy announcements.

- Global Economic Indicators Impacting Market Dynamics: From the U.S. PCE data to the Bank of Japan’s policy outlook, various global economic indicators are playing a significant role in shaping market trends, as investors weigh these factors in their decision-making processes.

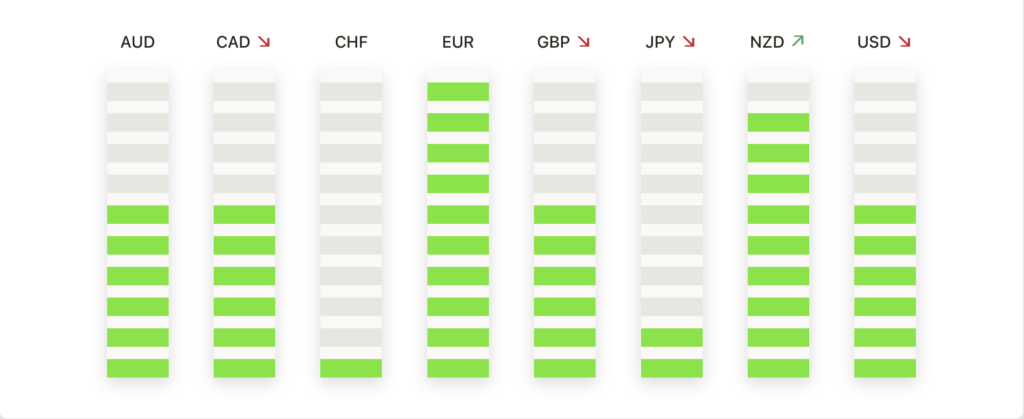

FX Today:

- US Dollar Shows Mixed Performance Amid Rate Cut Speculations: The US Dollar experienced mixed fortunes, hovering near a five-month low with the Dollar Index (DXY) at 101.61, a slight retreat from a recent low of 101.42. This movement reflects a 1.8% decrease for the year, indicating a potential end to its two-year winning streak. Market expectations of Federal Reserve rate cuts in early 2024 are influencing the dollar’s trajectory.

- EUR/USD Tests Higher Thresholds: The Euro saw a momentary uplift against the US Dollar, with the EUR/USD pair reaching levels above 1.0800 before facing resistance. Short-term forecasts suggest potential upside, but the market remains cautious ahead of the European Central Bank (ECB) decision on monetary policy.

- GBP/USD Maintains Stability Amid Economic Projections: The British Pound demonstrated resilience against the US Dollar, with the GBP/USD pair hovering around the 1.2550 mark. This steady performance aligns with the 20-day Simple Moving Average (SMA), with upcoming UK economic reports expected to influence its movement.

- USD/JPY Encounters Minor Shifts: The USD/JPY pair experienced a decrease, but managed to stabilise above 145.50 following the US CPI data release. Market focus now shifts to Japan’s Tankan survey, with mixed outcomes anticipated.

- Antipodean Currencies React to Broader Sentiments: The NZD/USD and AUD/USD pairs displayed reactions to global market sentiments. The NZD/USD stayed around the 0.6100 zone, while the AUD/USD showed modest declines, retracting below 0.6550 despite earlier gains.

- Swaps Indicate ECB Rate Cut Expectations: Market swaps are pricing in a 25 basis point rate cut possibility by the ECB at 4% for its next meeting in January and 51% for the subsequent meeting in March.

- Japanese Yen Gains Amid BOJ Policy Outlook:The yen has been steadily appreciating, up 4% this month against the dollar and on track for its second consecutive month of gains. However, it remains down 7.8% for the year against the US Dollar. The Bank of Japan’s potential policy shift is a significant factor in this trend.

- Oil Prices Impact Currency Dynamics:The recent dynamics in oil prices, with WTI crude futures seeing a rise, have implications for currency markets, particularly for oil-sensitive currencies like the Canadian Dollar and Russian Ruble.

- Gold Prices Affect Currency Valuations:The surge in gold prices to $2,064.02 an ounce has ripple effects across currency markets, as gold is often seen as a hedge against currency devaluation.

Market Movers:

- Nike’s Sharp Decline Amid Sales Forecast Revision: Nike (NKE) witnessed a significant drop of 11%, following its announcement of a weaker sales outlook and a major cost-cutting initiative aimed at saving approximately $2 billion over the next three years. The sportswear giant’s downward revision notably impacted investor sentiment in its sector.

- Bristol Myers Squibb and Karuna Therapeutics Make Headlines: Bristol Myers Squibb (BMY) saw its shares rise by 2%, while Karuna Therapeutics (KRTX) soared by an impressive 47%, following the news of Bristol Myers agreeing to acquire Karuna for a staggering $14 billion.

- Rocket Lab’s Contract Win Boosts Shares: Rocket Lab (RKLB) experienced a remarkable surge, climbing 28% after securing a $15 million U.S. government contract, significantly bolstering its space business backlog.

- Cummins Faces a Downturn: Cummins (CMI) reported a downturn of 3% in its stock value. This decline came in the wake of the company’s announcement regarding a $2.04 billion charge in the fourth quarter, linked to its emissions certification and compliance process for pickup truck engines.

- Coinbase Gains on Raised Target: Shares of Coinbase (COIN) increased by 3.7% after Mizuho Securities uplifted its price target on the stock from $35 to $54, indicating renewed investor confidence in the cryptocurrency exchange platform.

- Mixed Reactions in U.S. Home Builders: In the wake of a disappointing new home sales report, U.S. home builders showed mixed responses. DR Horton (DHI) and Lennar (LEN) saw minor declines of 0.1% and 0.2%, respectively, while Pulte Group (PHM) and KB Home (KBH) each nudged upwards by 0.1%.

- Chinese Tech Stocks Under Pressure: Tencent Holdings (700 Hong Kong) closed down 12.7% in Hong Kong, while NetEase’s U.S. ADR (NTES) fell 18% in U.S. trading. Prosus NV (PRX Amsterdam), with its significant stake in Tencent, also saw a 14% decline in European trading, following China’s new gaming restrictions.

- Positive Movement in U.S. Tech Sector: Despite broader concerns, some U.S. tech companies like Unity Software (U) and Roblox (RBLX) saw mixed movements, with Unity down 3.0% but Roblox up 2.3%, and Electronic Arts (EA) slightly gaining by 0.1%.

- Sector-Specific Trends Influencing Stock Movements: The market’s reaction to individual company news, such as Nike’s cost-cutting plans and China’s gaming regulations, underscores the influence of sector-specific trends and regulatory changes on stock prices, reflecting the interconnected nature of modern financial markets.

Conclusion:

As we approach the end of a tumultuous year, the financial markets are painting a picture of optimism and resilience. The S&P 500’s approach to record highs, alongside other major indices’ extended winning streaks, underscores a market that is gradually steadying in the face of geopolitical tensions and economic uncertainties. The mixed performance of individual stocks, such as Nike’s downturn and Bristol Myers Squibb’s acquisition-driven surge, highlights the nuanced and sector-specific nature of current market dynamics. Furthermore, global economic indicators, including inflation data and central bank policies, continue to play a pivotal role in shaping investor sentiment. As the market gears up for 2024, investors remain watchful, balancing their strategies between caution and vigilance, in a financial landscape that remains ever dynamic and interconnected.