The stock market made a strong comeback this week, with the S&P 500 and Nasdaq Composite hitting new highs. This uplift was driven by enthusiasm about slowing inflation and strong performances in the technology sector. Both indices managed to recover from earlier losses, setting new benchmarks for future trading. Technology stocks, with Intel leading the charge in the Dow, played a significant role in this resurgence. The market positivity was further boosted by the European Central Bank’s updated inflation predictions and signals from the Federal Reserve Chair about potential rate cuts, adding to the momentum and bringing Wall Street back to a position of strength.

Key Takeaways:

- S&P 500 and Nasdaq Composite Achieve New Records: The S&P 500 advanced by 1% to secure a fresh closing record, while the Nasdaq Composite saw a 1.5% climb, touching an all-time high. This performance marks a significant recovery, erasing earlier losses and showcasing investor confidence, especially in the tech sector.

- Dow Jones Industrial Average Posts Gains: Despite being the slower mover among its counterparts, the Dow Jones Industrial Average managed to secure a 0.3% increase, adding 117 points to close at 39,598.71, signalling steady investor optimism across broader market indices.

- European Markets React Positively to ECB’s Forecasts: European stocks responded favourably to the European Central Bank’s updated economic forecasts, with the Stoxx 600 index climbing 1.05% to breach the 500-point level for the first time, following the ECB’s announcement and interest rate decisions.

- Asian Markets Show Mixed Responses Amid Global Trends: Japan’s Nikkei 225 retreated from record highs, closing 1.2% lower, while the Taiwan weighted index and Australia’s S&P/ASX 200 reached new peaks, indicating diverse reactions across Asian markets to global economic signals and central bank policies.

- Tech Leads Market Surge: Information technology and communication services were the primary drivers of the S&P 500’s record performance. Intel, in particular, led the Dow’s advance with a notable gain of over 3%, highlighting the tech sector’s pivotal role in the market’s upward trajectory.

- Central Banks’ Policies Fuel Optimism: The European Central Bank’s announcement of lowered annual inflation forecasts and the Federal Reserve Chair Jerome Powell’s indication of forthcoming rate cuts have injected a wave of hope, contributing to the market’s rally. Powell’s assertion that rate cuts are on the horizon, pending inflation confidence, has been a key factor in boosting market sentiment.

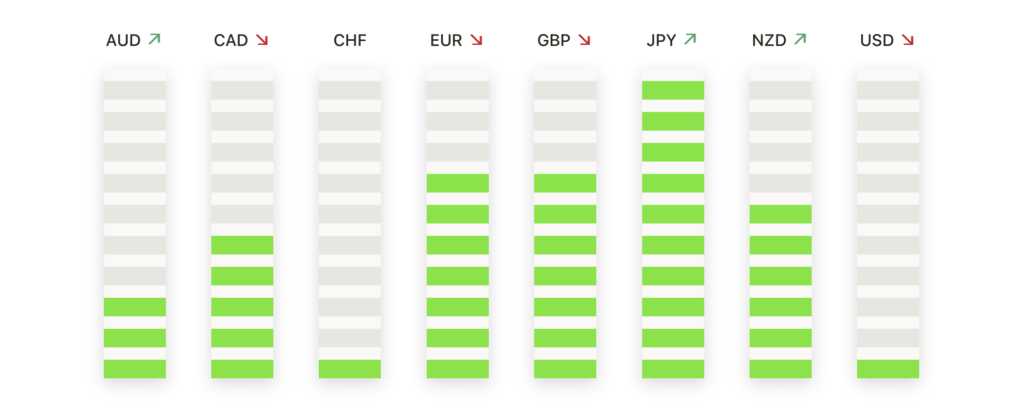

FX Today:

- EUR/USD Witnesses Modest Uplift Amidst Rate Cut Speculations: The EUR/USD pair experienced a slight increase, trading above the 1.0830 mark, as market participants anticipate potential rate cuts following the European Central Bank’s updated forecasts. The pair showed resilience, bouncing off a low of 1.0870 to reach a high of 1.0942, reflecting optimism in currency markets about easing inflationary pressures and supportive central bank policies.

- GBP/USD Nears Key Resistance Levels as Market Sentiment Improves: The GBP/USD pair demonstrated momentum, pushing towards the 1.2800 threshold, with a peak at 1.2797. This move comes ahead of the anticipated Spring Budget, signalling that investors are bullish on economic policies and their impact on the British pound. The currency pair’s movements suggest a watchful market eye on policy developments that could influence future trading ranges.

- USD/JPY Adjusts as BoJ Stance Anticipated: In light of dovish comments from Bank of Japan officials, the USD/JPY pair saw an uptick, breaching the 150.00 mark and aiming for higher resistance levels. The yen’s strength against the dollar highlights market scrutiny of Japan’s economic policies and the potential for interest rate adjustments, reflecting broader global monetary policy trends.

- AUD/USD Surges on Rate Cut Hopes and Commodities Rally: The Australian dollar gained against the US dollar, spurred by Jerome Powell’s hints at future rate cuts and a rebound in commodity prices. The AUD/USD pair’s ascent past key resistance levels, such as the 0.6640 mark, underscores the market’s reaction to global economic indicators and central bank signals.

- CAD Strengthens as Oil Prices Influence Market Dynamics: The Canadian dollar showed notable strength against its US counterpart, with the USD/CAD pair testing support around the 1.3460 level. This movement is closely tied to fluctuations in oil prices and Powell’s remarks on interest rate directions, illustrating the interconnected nature of commodity and currency markets.

- Gold Soars to New Highs Amid Economic Uncertainty: Gold prices surged, reaching a new all-time high of $2,164.78 per ounce. This rally, propelled by investors seeking safe-haven assets amidst economic uncertainties, underscores the precious metal’s appeal during times of inflation concerns and global economic instability.

- Crude Oil Fluctuates on Global Demand and Supply Dynamics: Oil prices experienced volatility, with WTI crude navigating around the $78.93 mark and Brent crude adjusting to $82.77 a barrel. These fluctuations are influenced by changing global demand forecasts, OPEC+ production decisions, and geopolitical tensions, underscoring the complex interplay affecting energy markets.

Market Movers:

- Nvidia and Apple Spearhead Nasdaq’s Rise: The Nasdaq’s leap was significantly supported by a more than 3% gain in Nvidia, an AI technology frontrunner, with its shares up over 11% for the week. Apple also contributed to the momentum, aiming to end a six-day losing streak, underscoring the tech giants’ influence on market dynamics.

- Virgin Money Skyrockets on Acquisition News: Financial services firm Virgin Money saw its shares leap by 36% after the announcement of its acquisition by British bank Nationwide for £2.9 billion. This dramatic rise highlights the impact of mergers and acquisitions on investor sentiment and stock valuations.

- Teleperformance Tumbles Amid Growth Concerns: Shares of Teleperformance plunged by 17.7% after the company fell short of its full-year revenue target and signalled limited growth prospects for the year ahead. This notable decline reflects the market’s reaction to potential challenges in achieving forecasted growth rates.

- Gap Surges on Strong Holiday Earnings: Gap’s shares jumped approximately 9% in extended trading following a report that significantly surpassed Wall Street’s expectations for the holiday quarter, indicating a return to growth for its Old Navy brand and improved gross margins.

- Kroger Outperforms with Upbeat Earnings Forecast: Kroger shares closed up more than 9%, leading gains in the S&P 500 after the company reported a stronger-than-expected Q4 adjusted EPS and provided a favourable earnings forecast for 2025, highlighting its solid financial health and market position.

- Edwards Lifesciences Receives a Boost from Upgrade: Edwards Lifesciences’ stock benefited from an upgrade by Bank of America Global Research to buy from neutral, with a price target of $105, closing up more than 5%. The upgrade reflects confidence in the company’s growth trajectory and innovation pipeline.

- Victoria’s Secret Faces Downturn on Sales Forecast: Victoria’s Secret shares tumbled more than 29% after its Q4 net sales fell slightly below expectations and the company forecasted a mid-single-digit decrease in Q1 net sales, raising concerns about its growth outlook.

- Methode Electronics Plummets on Sales Miss: Methode Electronics experienced a dramatic decline of more than 31% after reporting Q3 net sales significantly below market expectations, highlighting the challenges the company faces in meeting revenue targets.

- Ciena Adjusts to Market Realities with a Decline: Ciena’s stock fell more than 14% as the company’s CEO noted delays in service providers working through high inventory levels, indicating potential headwinds for the company’s sales and growth prospects.

As the trading week unfolds, the record achievements of the S&P 500 and Nasdaq show the excitement coursing through Wall Street, primarily fuelled by advancements in technology and easing inflationary pressures. Central banks’ dovish stances, particularly the European Central Bank’s revised forecasts and the Federal Reserve’s signals on interest rate cuts, have injected a renewed energy into the financial markets. Notably, tech giants like Nvidia and Intel have emerged as pivotal players, reflecting the sector’s critical role in driving market trends. Amid these developments, investors remain aware of the shifting economic indicators and policy directions, with an eye keenly focused on sustaining momentum in the face of global economic uncertainties.