- Equities under pressure, testing major support levels

- JPY drops after BoJ keeps policy unchanged

- Flash PMI data today will be key to watch for growth differential landscape

Equities

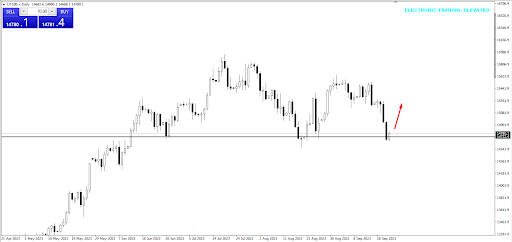

Equities remain under pressure, with futures like the ES, NQ, and STOXX50 testing major support levels. A break and close below these levels could open up more selling pressure. The VIX, a measure of volatility, has been in bearish momentum since November 2022. If volatility breaks above the 200DMA, that could open up some vol-based selling in equities. It is interesting to note though that bond volatility does not share the current angst we’ve seen in equities and could suggest some possible exhaustion. INSERT NAS100 Chart

FX

The CAD is leading the major currencies to the upside on slightly better risk sentiment and yesterday’s move higher in oil prices. The JPY is the weakest of the majors after the BoJ offered no surprises and kept to their ultra-easy monetary policy outlook.

PMI Data

With the BoJ and UK Retail Sales out of the way, the market’s attention today will be firmly focused on the incoming flash PMI data for France, Germany, UK, and the US. The EUR is looking a bit stretched on the short side and the USD looking a bit stretched on the long side. The key driver for the EUR downside and US upside in recent weeks has been the relative growth differentials between them. With the EZ data continuously surprising to the downside while the US data has continuously surprised to the upside, a significant upside surprise in EZ data would be needed to offer an opportunity.

Disclaimer This is not financial advice. Please do your own research before making any investment decisions.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.