In a noticeable step back from their recent highs, both the S&P 500 and the Nasdaq Composite took a step back on Wednesday, indicating a decreasing enthusiasm in the tech sector, particularly marked by a decline in Nvidia shares. The S&P 500 dipped slightly to close at 5,165.31, showing a mild downturn, while the Nasdaq Composite experienced a more noticeable drop, reflecting a cooling off period after significant excitement around big tech and AI innovations. On the other hand, the Dow Jones Industrial Average saw a slight increase, highlighting a divergent path amid the tech sector’s profit-taking and the market’s broader anticipation of economic developments. This shift underscores the market’s reactive nature to the latest inflation trends and upcoming financial indicators, despite the continued optimism in technology and AI domains.

Key Takeaways:

- Tech Stocks Retreat Leads Market Pullback: The S&P 500 edged down 0.19%, retracting from its recent peak, while the Nasdaq Composite saw a more pronounced decline of 0.54%, ending the day at 16,177.77. This downturn reflects a cooling off in the tech sector, particularly impacting leading players such as Nvidia, Meta Platforms, and Apple, which fell 1.1%, 0.8%, and 1.2% respectively.

- Dow Jones Inches Up Amid Mixed Sentiment: Contrary to the broader market, the Dow Jones Industrial Average managed a slight gain, adding 37.83 points or 0.1%, to settle at 39,043.32, showcasing resilience amid a general market pullback.

- European Markets Rise as Investors Digest US and UK Economic Data: European stocks found some footing, with the Stoxx 600 climbing 0.2%, lifted by strong performance in the retail sector, including significant gains for Zalando and Inditex. This uptick came as investors weighed the implications of US inflation figures and signs of moderate growth in the UK.

- Asia-Pacific Markets Show Mixed Reactions to Global Cues: The Asia-Pacific markets presented a mixed picture in response to US inflation data and its implications for global economic dynamics. The Nikkei 225 dipped 0.26%, while Australia’s S&P/ASX 200 rose 0.22%, highlighting the diverse impacts of international economic developments on regional markets.

- US Mortgage Demand Surges as Interest Rates Dip Below 7%: A slight decrease in mortgage rates to 6.84% spurred a 7.1% jump in mortgage applications, with refinancing applications rising by 12%. This increase signals a responsive market to minor fluctuations in interest rates, despite ongoing challenges of high home prices and limited inventory.

- Bank of Japan’s Policy Outlook Spurs Market Speculation: Anticipation builds over the Bank of Japan’s potential shift from its negative interest rate policy, with expectations leaning towards a rate hike in April. This has set the stage for potential market repositioning, particularly affecting Asian currencies and global monetary policy trends.

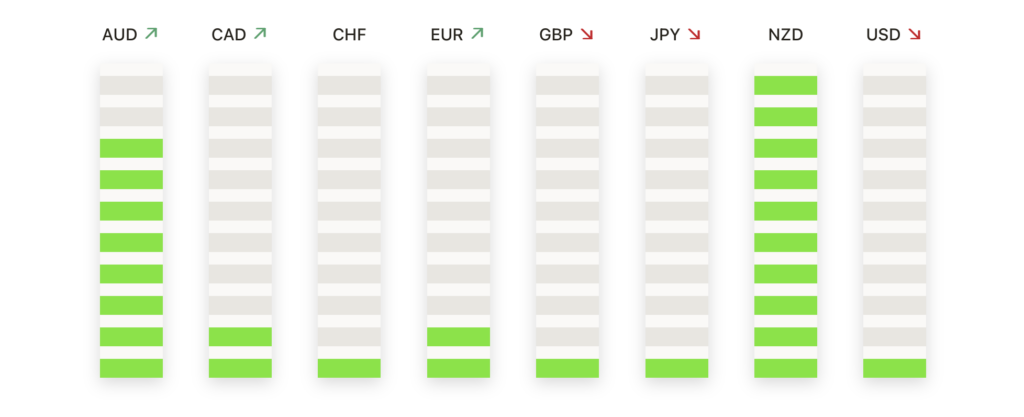

FX Today:

- EUR/USD Extends Recovery to Three-Session High: The EUR/USD pair extended its recovery to three-session tops near 1.0960, shifting its target to the monthly high around 1.0980. The euro’s strength was supported by the prevailing risk-on sentiment, as well as expectations of potential policy divergence between the European Central Bank and the Fed.

- GBP/USD Regains Ground: The GBP/USD pair regained some composure and flirted once again with the 1.2800 neighbourhood amid the dominating risk-on mood. The pair’s movements were influenced by the broader market sentiment, as well as optimism surrounding the UK’s economic recovery, as evidenced by the latest GDP figures showing a return to moderate growth in January.

- USD/JPY Advances on BoJ Speculation: The USD/JPY pair saw its upside bias revived, briefly advancing past the 148.00 barrier despite investors’ speculation of a potential Bank of Japan rate hike next week. The pair’s strength was fuelled by expectations of policy divergence between the BoJ and other major central banks.

- AUD/USD Surpasses on Commodity Strength: In line with the risk-related assets, the AUD/USD pair set aside two daily drops and rose past the key 0.6600 barrier, helped by the jump in copper prices and overall positive sentiment toward commodity currencies.

- Supply Concerns Raise Oil Prices: Unexpected drops in weekly US crude oil supplies and gasoline stockpiles, along with increasing geopolitical tensions, motivated WTI crude oil prices to advance to the boundaries of the key $80.00 mark per barrel. The bullish momentum in energy markets supported commodity-linked currencies.

- USD/CAD Experiences Decline: The USD/CAD pair saw a notable decrease, touching a new low for the week near 1.3460. Technical resistance for the pair is identified around the 200-hour Simple Moving Average (SMA) at 1.3520, with the pair’s movement suggesting a consolidation phase as it hovers near the 200-day SMA at 1.3478, pointing to a cautious market stance.

- Gold Prices Rally: Gold witnessed a significant rebound, approaching the $2,150.00 level. For gold to continue its ascent, overcoming the March 12 high of $2,184.76 is crucial, setting its sights on the year-to-date peak of $2,195.15. A successful breach above this level could open the door to testing the $2,200.00 threshold. Conversely, a fall below $2,150.00 might trigger a further drop towards $2,123.80, with subsequent support levels at $2,100.00.

Market Movers:

- Nvidia and Tech Shares Under Pressure: Nvidia’s shares declined by 1.1% as the tech sector faced a pullback, contributing to the broader market’s downturn. Meta Platforms and Apple also experienced dips, falling 0.8% and 1.2% respectively. This sector-wide slide was mirrored by the VanEck Semiconductor ETF (SMH), which dropped about 2%, marking its third losing session in the past four.

- Zalando and Inditex Post Gains: European retail stocks found a bright spot, with Zalando surging 19% and Inditex also posting notable gains. Their performance stood out against a mixed trading session, lifted by strong financial results that exceeded market forecasts.

- Chip Stocks Suffer: The semiconductor sector generally witnessed a fall, with Rackspace Technology plunging 18% after issuing a weaker-than-expected forecast for Q1. Marvell Technology, Advanced Micro Devices, and Micron Technology saw declines ranging from 3% to 5.77%, highlighting the sector’s sensitivity to shifting market sentiments and future growth prospects.

- Tesla Adjusts to Market Realities: Tesla’s shares fell by 4.54% following a downgrade by Wells Fargo, citing concerns over the efficiency of price cuts to spur EV sales volumes. This adjustment reflects broader market recalibrations as investors reassess the growth outlook for the electric vehicle sector.

- Bitcoin Reaches New Heights: Bitcoin’s valuation soared, achieving a new record high and closing the day up (over $73000) approximately 3.3%, signalling a continued supply of capital into the cryptocurrency space. This movement contrasts the broader tech sector’s performance, indicating divergent investor sentiments across different asset classes.

- Intel Faces Setback: Intel’s shares declined by 4.44% following news that the Pentagon withdrew plans to grant up to $2.5 billion in chip funding, highlighting the challenges within the semiconductor industry and the impact of government decisions on corporate strategies.

- Eli Lilly Partners with Amazon: Eli Lilly saw a slight increase of 0.10% after announcing a partnership with Amazon to expand sales of its weight-loss drugs directly to patients. This collaboration underscores the pharmaceutical sector’s adaptability and the growing trend of leveraging e-commerce platforms for healthcare solutions.

- Dollar Tree’s Strategic Closures: In addition to its quarterly earnings miss, Dollar Tree announced plans to close approximately 600 Family Dollar stores in the first half of fiscal 2024 and another 400 stores as leases expire. This decision reflects the company’s efforts to optimize its store portfolio amidst challenging retail conditions, impacting its stock by a 14.45% decline.

- Balfour Beatty’s Strong Performance: U.K. construction group Balfour Beatty saw its shares rise 9% following robust full-year earnings, highlighting the company’s resilience and potential growth opportunities in infrastructure sectors across the U.K. and the U.S.

- Restaurant and Financial Sectors Show Strength: Texas Roadhouse and Moelis & Co. experienced gains of 2.6% and 3.7%, respectively, following positive analyst upgrades. These movements indicate pockets of optimism within the market, as certain sectors and companies navigate economic uncertainties more successfully.

Major US stock indexes closed mixed, with the S&P 500 and tech-heavy Nasdaq pulling back from recent highs as investors took profits in the technology sector amid lingering concerns over persistent inflationary pressures. The retreat came despite an initial rally following the latest US inflation data, which showed the core consumer price index rising 0.4% in February, exceeding expectations. This caused concerns that the Federal Reserve may need to maintain its aggressive monetary tightening stance for longer. Nevertheless, the overall market sentiment remained cautiously hopeful, with the Dow Jones Industrial Average edging higher. Meanwhile, European and Asian markets were mixed as investors digested the inflation figures alongside regional economic data.