Wednesday’s trading session closed with mixed sentiments across major indexes as investors navigated through a landscape of earnings reports and economic indicators. The Nasdaq Composite edged lower for the third consecutive day, reflecting a wary stance among traders eagerly awaiting Nvidia’s quarterly earnings revelation. Contrasting this, the Dow Jones Industrial Average and the S&P 500 modestly climbed, signalling resilience in diverse sectors. Amid these fluctuations, Nvidia emerged as a beacon of success, reporting a staggering 265% revenue jump fuelled by its booming AI business, setting the stage for a deeper analysis of tech-driven market dynamics and Federal Reserve’s latest insights on interest rate policies.

Key Takeaways:

- Nasdaq Composite’s Downward Trend Continues: The tech-heavy Nasdaq Composite dipped by 0.32%, closing at 15,580.87, marking its third consecutive session in the red. This decline contrasts with the gains seen in other major indexes, highlighting sector-specific vulnerabilities amidst earnings anticipation.

- Dow Jones and S&P 500 Edge Higher: In a modest uptick, the Dow Jones Industrial Average increased by 48.44 points or 0.13%, closing at 38,612.24. Similarly, the S&P 500 saw a gain of 0.13%, ending the day at 4,981.80, suggesting a cautious optimism in broader market segments.

- Nvidia Soars on AI-Driven Revenue Boost: Nvidia emerged as a standout performer, with shares rising less than 8% in extended trading after announcing a record revenue increase of 265%, primarily driven by its AI business. The company’s earnings of $5.15 adjusted per share and revenue of $22.10 billion exceeded analyst expectations, highlighting the significant market interest in AI technology and Nvidia’s leading position in the field.

- Fed Maintains Cautious Stance on Interest Rates: The Federal Reserve’s minutes from January’s meeting repeated a hesitant approach towards rate cuts, emphasising the need for “greater confidence” in inflation slowing down. This stance aligns with the central bank’s strategy in navigating economic recovery amid fluctuating data.

- Bond Yields Climb on Economic Outlook: Following the Fed’s minutes, yields on U.S. and European government bonds saw an uptick, with the 10-year T-note yield rising by 4.2 basis points to 4.317%. This reflects growing investor anticipation regarding the economic direction and interest rate policies.

- European and Asian Markets Show Mixed Responses: European stocks closed slightly lower, with the Stoxx 600 down by 0.2%, whereas Hong Kong’s Hang Seng index jumped by up to 3% in a mixed day for Asia-Pacific stocks. These movements underscore the global market’s sensitivity to regional economic indicators and corporate earnings reports.

- Nat-Gas Stocks Rally on Production Deferrals: Natural gas producing stocks saw a surge, with EQT Corp leading the S&P 500 gainers by closing up more than 10%. This rally was fuelled by announcements from major U.S. natural gas producers about deferring new production, which led to a significant increase in natural gas prices and investor optimism towards the sector.

FX Today:

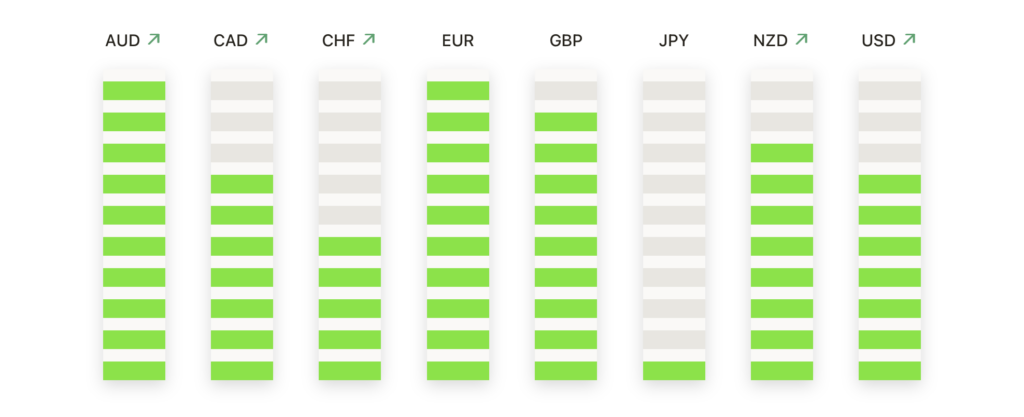

- EUR/USD Finds Equilibrium Amid Fed’s Policy Signals: The EUR/USD pair experienced a day of mixed signals but ultimately found some equilibrium, reflecting the broader market’s attempt to digest the Federal Reserve’s minutes. The currency pair managed to stay above the 200-hour SMA near 1.0767, showcasing resilience despite the Fed’s hesitance to cut rates. This level of stability suggests a cautious but persistent bullish sentiment within the trading community.

- USD/JPY Ascends, Eyeing Higher Resistance Levels: the USD/JPY pair climbed above the 150.00 threshold, marking a notable uptick to 150.30, a 0.20% increase. This movement underscores the yen’s sensitivity to U.S. monetary policy signals and investor sentiment regarding the balance between inflation control and economic growth.

- USD/CAD Dips to New Weekly Low, Reflecting Market Sentiment: The USD/CAD pair found itself under pressure, touching a new low for the week after the Federal Reserve’s minutes were released. The currency pair dipped to a low near the 1.3500 level, indicating a bearish sentiment influenced by the Fed’s cautious stance on rate cuts and Canadian economic data. The decline to a lower bound suggests a critical support zone around 1.3480-1.3470, further emphasising the market’s reaction to both domestic and international economic signals.

- Gold Prices Stabilise Amid Rate Cut Uncertainty: In the wake of the Fed’s latest policy insights, gold prices maintained a steady stance, reflecting the market’s balanced view on future interest rate movements. The precious metal traded within a narrow range of $2020 to $2030, signalling investors’ restrained optimism. This stability near the 50-day SMA at $2,033.54 underscores a critical resistance level, with a breakthrough potentially leading to retests of the $2,050 mark and possibly setting the stage for further gains.

- EUR/JPY Sees Uptick After Fed’s Release, Targeting New Highs: The EUR/JPY pair capitalised on the Federal Reserve’s minutes, marking a gain to 162.47, a 0.22% increase. This positive movement indicates a growing investor confidence in the Euro against the backdrop of U.S. monetary policy developments. The pair’s trajectory towards the 163.00 mark and subsequent resistance levels highlights a robust momentum, potentially challenging previous highs and setting a bullish tone for future sessions.

Market Movers:

- Etsy Faces Earnings Hurdle: Shares of the online marketplace Etsy dipped 6% in after-hours trading following an earnings report that didn’t live up to Wall Street’s forecasts. The company managed to earn 62 cents per share, missing the 78 cents per share estimate provided by LSEG. Despite this earnings stumble, Etsy showcased resilience with revenue figures that surpassed expectations, hinting at an interplay between profitability challenges and sustained sales performance.

- SolarEdge Technologies Retreats on Guidance: Shares of SolarEdge Technologies took a hit, dropping approximately 12.2% following the company’s announcement of weaker-than-expected guidance for the first quarter. This decline underscores the market’s reaction to adjustments in company expectations and broader concerns over the renewable energy sector’s near-term outlook.

- Cybersecurity Stocks Retreat Amid Sector-wide Concerns: The cybersecurity sector witnessed a broad retreat, led by a notable 28% plunge in Palo Alto Networks, followed by declines in other major players like Zscaler (down over 14%), SentinelOne (down over 12%), Crowdstrike Holdings (down over 9%), and Fortinet (down over 4%). These movements reflect growing investor caution towards the sector’s future revenue and growth prospects.

- Lucid Group Navigates Rough Terrain: Lucid Group’s shares experienced a notable decline, sliding nearly 7% in extended trading, as the electric vehicle manufacturer reported quarterly revenues that fell short of market expectations. The company announced a revenue of $157 million, which did not meet the anticipated $180 million projected by LSEG. This shortfall, coupled with widening losses, has prompted investors to reassess the company’s financial health and future growth prospects in the competitive EV market.

- Rivian Automotive Hits a Bump: Rivian Automotive’s stock took a sharp 13% downturn after the electric vehicle maker disclosed significant losses and a decision to reduce its salaried workforce by 10%. Despite these challenges, Rivian’s fourth-quarter loss of $1.36 per share was slightly better than LSEG’s estimate, and its revenue of $1.32 billion exceeded expectations.

- Garmin Ltd Surpasses Earnings Estimates: Garmin Ltd closed up more than 8% after reporting Q4 pro forma EPS of $1.72, significantly above the consensus of $1.38. This performance underscores the company’s robust growth in its navigation and fitness technology segments, surpassing market expectations.

As the trading day wraps up, the diverse reactions in the currency and commodities markets highlight the complex relationship of economic indicators, corporate earnings, and investor sentiment. Nvidia’s standout performance contrasts sharply with the broader declines seen in cybersecurity stocks, highlighting the sector-specific risks and opportunities within the current market landscape. The Federal Reserve’s cautious stance on interest rates further adds layers to investor strategies, as market participants navigate through a maze of inflation expectations and monetary policy adjustments. Amidst this backdrop, today’s market movers, from tech giants to energy producers, offer a glimpse of the challenges and potential rewards that lie ahead for investors keen on better understanding the subtle cues of a dynamically evolving economic environment.