In a significant reversal, Wall Street experienced a robust comeback on Thursday, with the Nasdaq Composite at the forefront of this revival. Major indices like the Dow Jones and the S&P 500 snapped their three-day losing streaks ahead of Friday’s crucial jobs report. The market’s uplift was largely fuelled by gains in the technology sector, especially with Google-parent Alphabet’s more than 5% surge post the launch of its Gemini AI model and impressive strides by Nvidia and AMD.

Key Takeaways:

- The Nasdaq Composite led with a 1.37% rise to 14,339.99, while the Dow Jones and S&P 500 ended their losing streaks, increasing by 0.17% and 0.80%, respectively.

- Technology stocks, particularly Alphabet and AMD, significantly boosted the market.

- The bond market and major currency pairs like EUR/USD and USD/JPY experienced notable fluctuations.

- Global markets showed mixed responses, demonstrating cautious trading amid economic uncertainties.

- Commodities and precious metals like gold and silver showed mixed trends, influenced by global economic indicators and policy decisions.

- The U.S. 10-year Treasury yield rose nearly 3 basis points to 4.148%, reflecting concerns about the labour market’s strength.

Stock Movers:

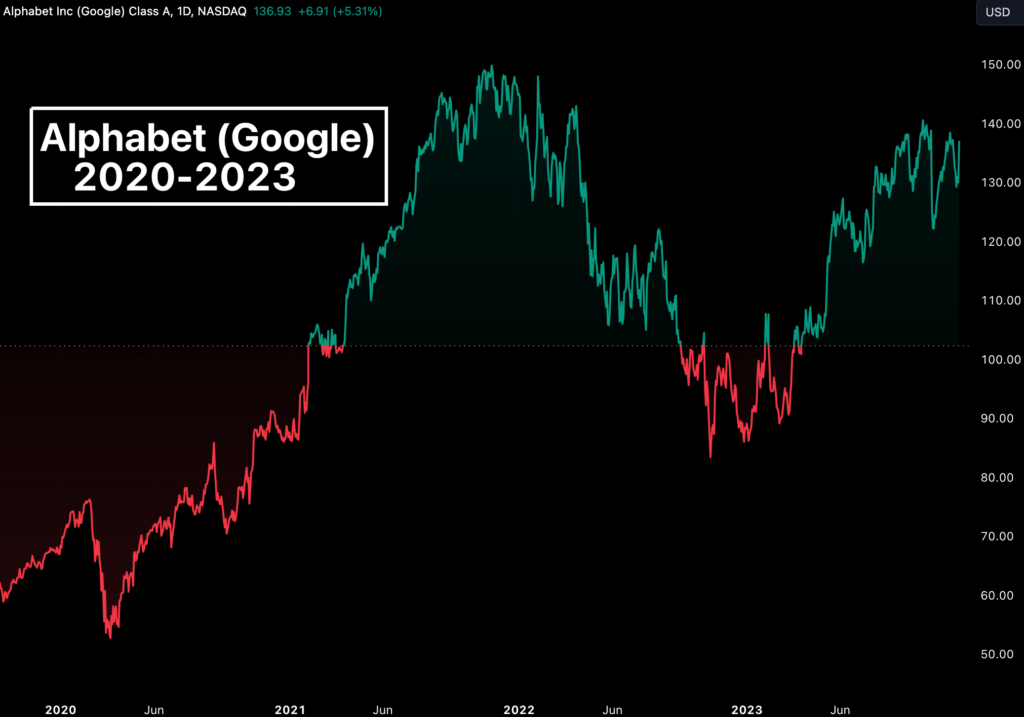

- Alphabet (GOOGL) Soars on AI Advancements: Alphabet Inc. led the charge in the technology sector, with its shares surging over 5% (£136.93) in response to the launch of its Gemini artificial intelligence model. This significant development, marking a notable advancement in AI technology, was met with enthusiasm by traders, reflecting the market’s optimism about Alphabet’s innovation trajectory and its potential impact on the tech industry.

- Advanced Micro Devices (AMD) Gains on Chip Innovation: AMD recorded a robust rise of more than 6%, driven by the unveiling of its new MI300 accelerator chip. This chip, touted as a game-changer for running AI software faster than rival products, positions AMD at the forefront of technological innovation in the semiconductor industry. The market’s positive reaction underscores the growing importance of AI and advanced computing in shaping the future of technology.

- Albemarle (ALB) Benefits from Policy Shifts: Lithium producers, particularly Albemarle Corporation, experienced a boost, with their stock prices increasing by over 4%. This upturn was largely attributed to new U.S. government rules aimed at reducing China’s dominance in the electric vehicle (EV) industry, which were less harsh than feared. Albemarle’s rise reflects the growing significance of lithium in the expanding EV market and investor confidence in the sector’s growth prospects.

- Regional Banks on the Rise: The banking sector saw notable gains, especially among regional banks. Truist Financial (TFC) and Comerica (CMA) led the way with their stock prices climbing over 3% and 2% respectively. These increases highlight the sector’s recovery and adaptation to the changing economic landscape, with regional banks benefitting from a favourable banking environment and investor confidence in their growth potential.

- Challenges in Tech: C3.ai and Take-Two Interactive Under Pressure: On the other side of the spectrum, C3.ai (AI) and Take-Two Interactive Software (TTWO) faced downturns, with C3.ai’s stock falling more than 8% and Take-Two’s over 2%. C3.ai’s decline came in the wake of its Q2 revenue report, which fell short of expectations, while Take-Two’s drop followed a downgrade by Bank of America Global Research. These setbacks underscore the competitive and rapidly evolving nature of the tech sector, where companies are continually challenged to meet high market expectations.

FX Today:

- EUR/USD Gains Ground: The EUR/USD pair rose by 0.12%, reflecting a moderate recovery from a 3-month low. The euro showed resilience despite an unexpected decline in German industrial production, which initially drove the currency to a 3-week low.

- USD/JPY Experiences Sharp Decline: The USD/JPY pair saw a significant drop of 1.76%, marking its biggest one-day jump since January. The yen’s surge, which pushed it to a 3-month high against the dollar, was fuelled by speculation that the Bank of Japan (BoJ) will soon exit its ultra-easy monetary policy. This was bolstered by comments from BoJ Governor Ueda, indicating that handling monetary policy will become more challenging in the coming year.

- GBP/JPY Plummets: The GBP/JPY pair tumbled more than 2.30%, hitting an eight-week low at 178.53. This sharp decline was triggered by the BoJ’s hawkish remarks, signalling a potential shift in Japan’s monetary policy.

- Dollar Index Shows Moderate Decrease: The dollar index (DXY00) experienced a slight decline of 0.27%. The dollar’s overall weakness was primarily influenced by the yen’s rally and a general improvement in risk sentiment ahead of the US non-farm payrolls data.

- Gold Prices React to Market Movements: Spot gold prices edged higher by 0.06%, benefiting from the weaker dollar and lower US Treasury yields. However, the gains in gold prices were limited due to higher global bond yields and the speculation around the BoJ’s policy shift.

- Oil Market Fluctuations: Oil prices showed signs of recovery after a recent dive. Brent crude futures increased by 1%, while US West Texas Intermediate futures rose by 0.6%. The oil market remains volatile, impacted by global economic sentiments and OPEC+ decisions.

Conclusion:

Thursday’s trading session closed with Wall Street showcasing renewed optimism, led by technological advancements and corporate developments. This positive shift in the markets, particularly the technology sector’s significant gains, painted a picture of a market recalibrating in anticipation of the upcoming jobs report. While the broader economic landscape remained complex, with mixed job market data and global market responses, the day’s activities reflected the intricate interplay of economic dynamics. As the financial world awaits the jobs report, there’s a blend of caution and anticipation, signalling a keen interest in how these developments will shape the market’s trajectory.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.