Major News for The Week Ahead

China’s Financial Turmoil Casts a Shadow Over Global Markets

China’s financial turmoil took centre stage in this week’s headlines, casting a shadow over global markets. The spotlight was on China’s growing financial distress, underscored by property developers forecasting poor profits and investment funds defaulting on payouts.

Evergrande Group, a significant player facing longstanding issues, filled for Chapter 15 bankruptcy in New York. This prompted a swift response from Chinese officials, who initiated reforms to curtail foreign capital outflows and stabilize the yuan. Nonetheless, the yuan and Chinese socks are still under pressure.

US Dollar Rally Uncertain, EU Flash PMIs and Jackson Hole Symposium to Watch

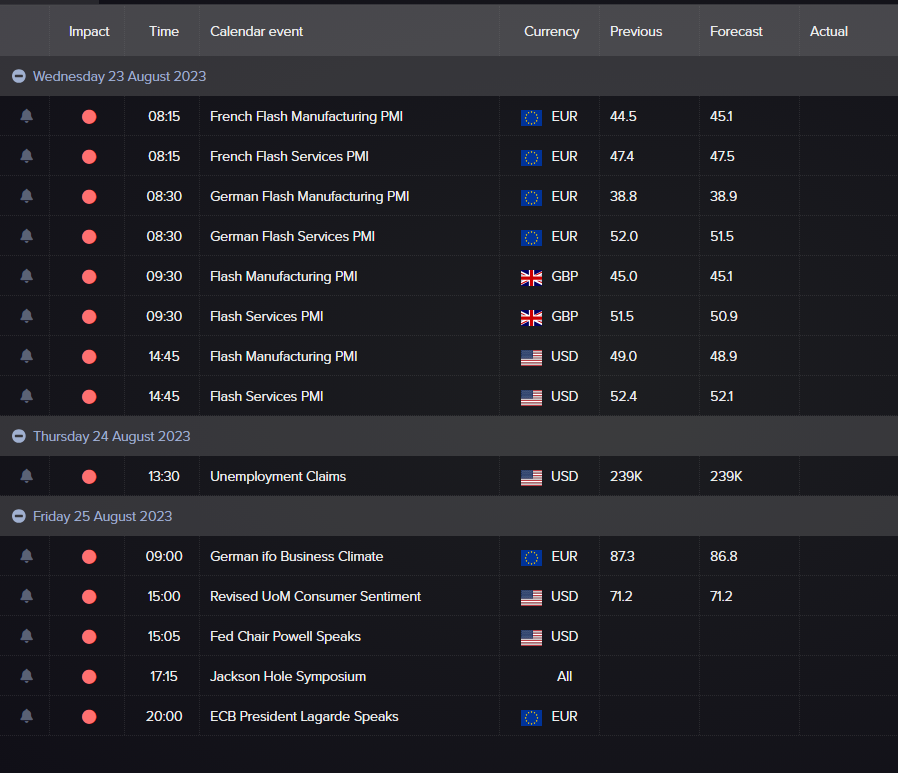

As we look to the coming week, China’s challenges persist. The future of the dollar‘s rally is uncertain, and upcoming Flash PMI data will offer insights into global economic health. Europe may still grapple with potential recession, but US and UK indicators could showcase unexpected robustness.

All eyes will be on Jackson Hole, where Fed Chair Powell and ECB President Lagarde are confirmed attendees. With US inflation waning and the Fed’s unity in question, the market will keenly watch for any shifts in Powell’s stance on future rate hikes.

EU Flash PMIs Expected to Show Continued Slowdown

The latest round of flash PMIs will be the main data release out of the UK next week and a key update on the state of the UK economy.

Last month’s edition showed the UK economy continuing to cool, with the composite measure recording a 50.8 print. Whilst still showing the UK economy has continued to expand, this was notably weaker than the 52.8 seen in June.

Granted, a slowdown was expected, especially given the cumulative effects of monetary tightening to date. However, surprisingly, markets only expect a modest further step down in August, with consensus looking for a print 50.3.

UK PMIs Expected to Show Modest Further Slowdown

The latest round of flash PMIs will be the main data release out of the UK next week and a key update on the state of the UK economy. Last month’s edition showed the UK economy continuing to cool, with the composite measure recording a 50.8 print.

Whilst still showing the UK economy has continued to expand, this was notably weaker than the 52.8 seen in June. Granted, a slowdown was expected, especially given the cumulative effects of monetary tightening to date. But surprisingly, markets only expect a modest further step down in August, with consensus looking for a print of 50.3.

Jackson Hole Symposium to Focus on Structural Shifts in the Global Economy

The upcoming 46th annual Jackson Hole Economic Policy Symposium, set for August 24th-26th, is eagerly awaited by the financial community.

This global gathering sees central bankers, scholars, and finance leaders discuss today’s pressing economic issues.

So far, we only have limited details about this year’s event, but its theme, “Structural Shifts in the Global Economy,” hints at discussions that could range from emerging markets seeking alternatives to USD trade, impacts of the pandemic, technological rivalries, and classic economic principles.

One of the most anticipated moments will be Fed Chair Powell’s talk on Friday at 10:05 EST / 15:05 BST.

There’s growing speculation about the future direction of US monetary policy, especially after some officials hinted at their reservations about recent rate hikes.

Last year, Powell’s Jackson Hole speech created a massive amount of volatility with the Fed trying to smack markets back into focus. Heading into this upcoming speech, even though markets are getting every excited about the speech, I doubt whether we’ll get the same type of excitement as we did last year.

Given the controlled inflation and increasing disagreements within the Federal Open Market Committee (FOMC), there’s curiosity about whether the Fed might ease off on its aggressive rate hike stance.

It’s worth noting that market data hints at a strong appetite for the US dollar, while sentiment towards the euro remains sceptical given Europe’s economic challenges. Despite this, the ECB remains cautious about rate hikes. Investors will also closely listen to ECB President Lagarde’s remarks on Friday at 15:00 EST / 20:00 BST.

Could the Symposium be a game changer for the USD?

In terms of content, we can’t be 100% sure, but the possibility is there of course.

Looking at current positioning, I would say the bar is higher for the Fed to surprise hawkish, simply because they won’t want to limit their optionality.

With the recent amount of upside in both the USD and yields, a Fed that just says whatever we already know, which is that they are nearing the peak and that they don’t see rate cuts anytime soon, might be.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.