In a remarkable testament to market resilience, stocks reached new peaks on Thursday, driven by optimism over potential Federal Reserve rate cuts and strong earnings reports. The Dow Jones Industrial Average soared to a new record, joined by the S&P 500 and the Nasdaq Composite, each marking their own milestones. This surge reflects a growing confidence among investors in the Fed amid a backdrop of impressive corporate performances, especially within the tech sector. The rally gained particular momentum from Micron Technology’s standout earnings, which highlighted the vibrant demand for technology-driven growth, setting a positive tone across the semiconductor industry.

Key Takeaways:

- Dow Jones and S&P 500 Reach New Heights: The Dow Jones Industrial Average surged 269.24 points, or 0.68%, closing at a record 39,781.37. The S&P 500 wasn’t far behind, advancing 0.32% to a new high of 5,241.53, showcasing investor optimism toward the Fed’s economic management.

- Nasdaq Composite Posts Modest Gains: With a 0.20% increase, the Nasdaq Composite edged up to 16,401.84, driven by strong performances in the tech sector, despite Apple’s 4% slump following an antitrust lawsuit by the Justice Department.

- Fed Rate Cut Anticipation Boosts Confidence: The market’s rally was largely due to expectations of Federal Reserve rate cuts, with traders pricing in a 67% chance of a cut starting in June. This optimism is based on the Fed’s recent reiteration of its forecast for three interest rate cuts this year.

- European Markets Hit New Record on Rate Decisions: The pan-European Stoxx 600 index closed at a fresh all-time high of 509.95 points, with the UK’s FTSE 100 logging its best day since September, surging 1.8% after the Bank of England’s dovish policy stance.

- Asian Markets Rally, Nikkei Hits Lifetime Peak: Japan’s Nikkei 225 closed at a new all-time high of 40,815.66, up 2.03%, while South Korea’s Kospi advanced 2.41% to 2,754.86, its highest level since April 2022, as Asian markets cheered the Fed’s rate outlook.

- Investors Navigate Antitrust Concerns: Apple’s shares dipped 4% following a significant antitrust lawsuit, underscoring the ongoing regulatory challenges faced by tech giants. However, the broader market momentum remained largely unaffected by these concerns.

- Dubai’s Parkin Surges 30% on Trading Debut: Dubai parking operator Parkin saw its shares soar more than 30% on its trading debut in the United Arab Emirates, marking the country’s first initial public offering of the year and underscoring the broader market enthusiasm.

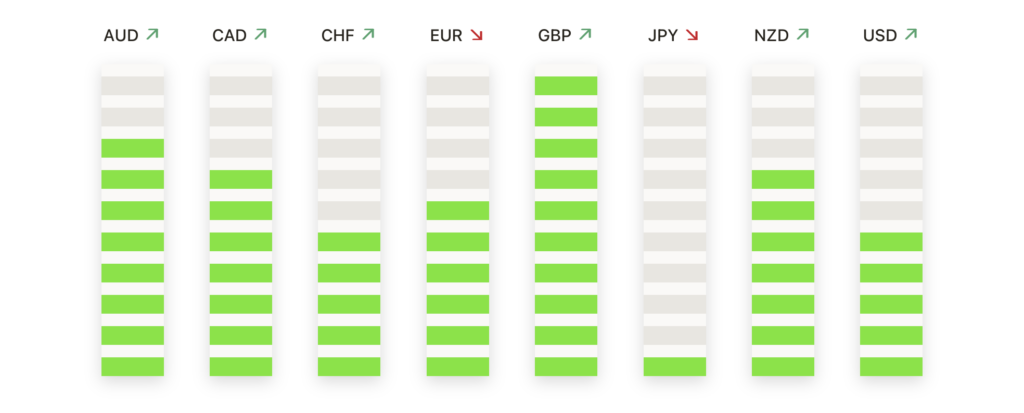

FX Today:

- EUR/USD Sees Volatile Trading: The Euro to US Dollar exchange rate experienced a notable swing, initially climbing to a daily high of 1.09426 before retreating to close at 1.0857. The currency pair’s fluctuation reflects market reactions to the broader economic indicators and Federal Reserve policy expectations, ending the day with an eight-tenths of a percent drop from the peak.

- USD/CAD Gains as Dollar Strengthens: The US Dollar to Canadian Dollar pair witnessed upward momentum, appreciating approximately 0.6% as it bounced from the 1.3460 region to reclaim the 1.3500 level. This recovery highlights a technical rejection at the 200-day Simple Moving Average (SMA) at 1.3485.

- GBP/USD Adjusts After BoE’s Dovish Signals: The British Pound to US Dollar exchange rate struggled to maintain its footing beyond the 1.2800 mark, eventually succumbing to the mid-1.2600s. This movement was influenced by a stronger dollar and the Bank of England’s dovish tilt.

- USD/JPY Approaches Year-to-Date Highs: The exchange between the US Dollar and Japanese Yen played with the year-to-date peak near 151.80. The yen’s depreciation is a direct response to continued selling pressure amid expectations set by the Bank of Japan’s monetary policy.

- Gold Rally Loses Steam Below $2,200: The XAU/USD price fell below the $2,200 mark, retreating from its recent surge, as sellers moved in amid US dollar strength and high U.S. Treasury yields. The precious metal’s ascent stalled just shy of the all-time high of $2,223, reached earlier this month, as the gleam of the gold rally diminished temporarily.

Market Movers:

- Nike Climbs on Earnings Beat: Nike’s stock added 3% after reporting earnings and revenue above Wall Street’s expectations, with earnings of 77 cents per share on $12.43 billion in revenue, showcasing its strong brand and operational efficiency.

- FedEx and UPS Gain on Earnings and Buyback Announcement: FedEx saw its shares jump nearly 13% after beating quarterly earnings expectations and announcing a $5 billion share buyback, a move that also lifted UPS shares by 4%.

- Micron Technology Leads with Stellar Earnings: Micron Technology saw its shares soar by over 14%, closing as one of the top gainers across major indexes. The jump came after the company reported Q2 adjusted revenue of $5.82 billion, surpassing expectations and forecasting Q3 adjusted revenue of $6.4 billion to $6.8 billion, well above the consensus.

- Broadcom Jumps on Upgrade: Broadcom’s shares advanced more than 5.6% after receiving an upgrade from Cowen to ‘Outperform’ from ‘Market Perform’, with a new price target set at $1,500, reflecting strong confidence in its growth trajectory.

- Tech Giants Show Varied Performance: Amid a generally bullish day for tech stocks, Apple went against the trend by dropping 4% after the Justice Department filed an antitrust lawsuit against it, potentially challenging the company’s business model.

- Financial Sector Rallies on Fed’s Outlook: Bank stocks experienced significant gains in response to the Federal Reserve’s projection for rate cuts. Goldman Sachs led the Dow Jones Industrials with an increase of more than 4%, highlighting the sector’s hopeful outlook.

- Accenture Faces Setback: Accenture’s shares dropped over 9%, marking it as a notable loser in the S&P 500 after cutting its full-year adjusted EPS forecast to $11.97-$12.20, below the consensus estimate of $12.22.

- Guess Inc Surges on Strong Revenue Report: Guess Inc closed up more than 20% after outperforming revenue expectations with a Q4 net revenue of $891.1 million, demonstrating the company’s robust market position.

- Lululemon Faces Pressure: Shares of Lululemon Athletica dropped 10% after the company provided weak guidance and reported slowing growth in North America, despite posting a fiscal fourth-quarter earnings and revenue beat.

- Dutch Bros Slides on Secondary Offering News: Dutch Bros shares slipped about 5% following the announcement of a secondary offering by stockholders associated with TSG Consumer Partners L.P., indicating potential market dilution.

- Reddit Soars 48% in Market Debut: Social media company Reddit (RDDT) surged an impressive 48% on its first day of public trading, reflecting investor enthusiasm for the platform’s growth potential.

As the curtains close on a remarkable trading day, the record-breaking performances of the Dow Jones, S&P 500, and Nasdaq Composite underscore the resilience and optimism of global financial markets. Investors, lifted by the Federal Reserve’s dovish stance and promising corporate earnings, navigated through antitrust lawsuits and sector-specific challenges with an eye on long-term gains. Notably, the tech sector, led by stellar performances from Micron Technology and Broadcom, demonstrated its pivotal role in driving market sentiment, despite Apple’s regulatory headwinds. Meanwhile, the anticipation of rate cuts has injected a new vigour into the markets, balancing caution with hope as investors recalibrate their strategies in a landscape shaped by central bank policies and corporate prowess. As we move forward, the day’s events serve as a reminder of the relationship between policy, corporate performance, and investor sentiment in sculpting the future of financial markets.