In a remarkable turn of events, global stock markets experienced a surge on Tuesday, lifted by the prospects of a shift in the Federal Reserve’s interest rate policy. The MSCI global stock index witnessed an upswing, a clear response to Federal Reserve Governor Christopher Waller’s hint at a potential pause in rate hikes, and even the possibility of cuts if inflation continues its downward trajectory. This comment sent the U.S. dollar spiralling to a more than three-and-a-half-month low against a basket of major currencies, underscoring the market’s sensitivity to Fed policy directions.

While stocks generally rose, marked by the Dow Jones Industrial Average’s modest gain and the S&P 500’s slight uptick, the trading landscape remained choppy, reflecting the market’s cautious optimism. Gold prices rallied, hitting their highest levels since May, as a weaker dollar and renewed interest in safe-haven assets painted a dynamic financial canvas. These developments come ahead of key economic reports, including the U.S. October personal consumption expenditures and Eurozone consumer inflation figures, poised to offer further insights into the global economic trajectory.

Key Takeaways:

- Dollar Weakness and Currency Movements: The U.S. dollar index plummeted to a 3.5 month low, reflecting the changing landscape of Fed policy expectations. The euro and the Japanese yen strengthened against the dollar, while the British pound also saw a notable rise, indicating a broad-based shift in currency markets.

- Gold Prices Surge on Dollar’s Decline: The declining strength of the U.S. dollar and heightened investor interest in safe-haven assets propelled gold prices to their highest levels since May, marking the metal’s fourth consecutive session of gains.

- Oil Prices Rebound Amid OPEC Speculation: Oil prices witnessed a significant rebound, fuelled by speculations around OPEC’s potential production cuts and external factors such as a storm-related drop in Kazakh oil output. This rise in oil prices indicates market responsiveness to geopolitical and economic factors.

- Upcoming Economic Reports in Focus: Investors are keenly awaiting the release of the U.S. October personal consumption expenditures report and the Eurozone consumer inflation figures. These reports are critical for providing further clarity on the direction of inflation and monetary policy in major economies.

- Consumer Confidence Sees Uplift: In the U.S., consumer confidence improved in November, offering a glimmer of hope amidst prevalent recessionary concerns. This rise in consumer sentiment could play a crucial role in shaping future market trends and consumer spending behaviours.

FX Today:

- EUR/USD Strengthens As Dollar Retreats: The Euro gained against the U.S. Dollar, with the EUR/USD pair reaching a high of 1.099. This surge comes as the dollar index fell 0.398%, marking a significant shift in the currency landscape in response to the Fed’s outlook. Key resistance for EUR/USD is eyed around 1.1000, while support is seen near 1.0900.

- GBP/USD Rallies to New Heights: The British Pound rose sharply against the Dollar, with the GBP/USD pair touching a high of 1.2698, up 0.58% for the day. This marks the highest level since September, fuelled by positive UK economic data. The pair’s immediate resistance lies near the 1.2700 level, with support found at around 1.2500.

- Japanese Yen Strengthens, USD/JPY Declines: The USD/JPY pair weakened, with the yen strengthening by 0.86% against the dollar, trading at 147.41 per dollar. The yen’s rise reflects broader market shifts and investor risk assessment in light of the Fed’s statements. Resistance for USD/JPY is seen near 148.00, while support is around 146.50.

- Commodity Currencies Show Mixed Response: The Australian Dollar (AUD) and the Canadian Dollar (CAD) displayed varied reactions to global market dynamics. AUD/USD moved up to 0.6789, while USD/CAD fell to 1.2815, as commodity-linked currencies responded to fluctuations in commodity prices and risk sentiment.

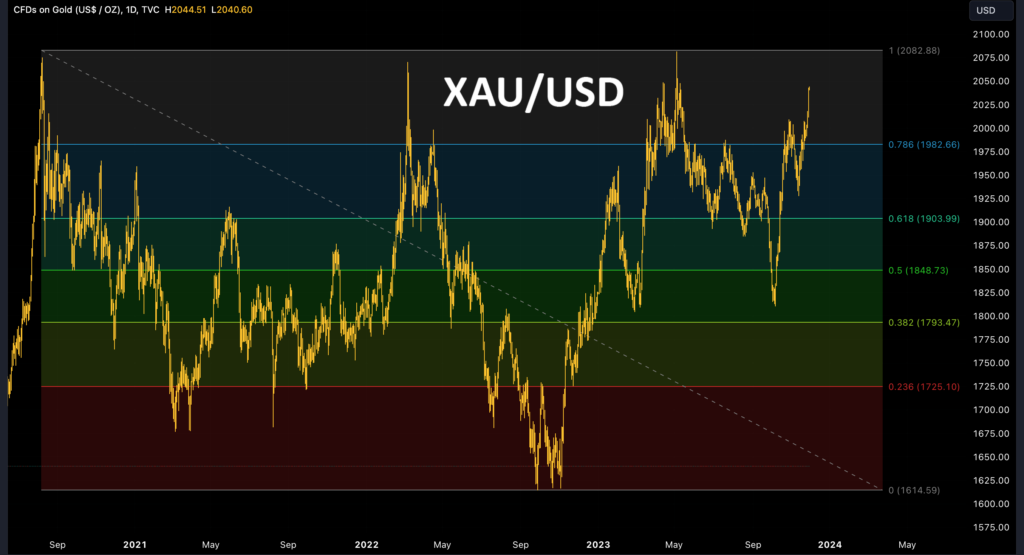

- Gold Prices Rally, Eyeing Key Levels: Gold prices surged 1.4%, with the precious metal last traded at $2,040.82 an ounce, its highest level since May. Gold’s upward trajectory is boosted by the dollar’s weakness. Immediate resistance for gold is found at $2,049, followed by a significant barrier at $2,082. On the downside, support levels are identified at $2,000 and $1,949, offering potential fallbacks in case of retracements.

In summary, the Federal Reserve’s dovish indications have not only spurred a rally in global stock markets but have also set in motion a reshaping of currency values, underpinning a significant shift in investor sentiment. The dollar’s dip, accompanied by a surge in gold prices and the revival of oil markets, paints a picture of a financial landscape in flux, responsive to the slightest whispers of policy change. Looking ahead, the focus sharpens on upcoming economic reports, including the U.S. personal consumption expenditures and Eurozone inflation figures, which are crucial in shaping the trajectory of global monetary policies.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.