Wall Street ended Tuesday with mixed sentiments as investors anxiously awaited the upcoming US inflation report, a key factor of the Federal Reserve’s rate decisions. The Dow Jones Industrial Average closed slightly lower, signalling a cautious approach by investors amidst economic uncertainties. Meanwhile, the S&P 500 and Nasdaq Composite made modest gains, despite the drag from underperforming tech giants like Nvidia, Meta, and Netflix. This cautious trading atmosphere highlights a broader market apprehension, as participants gauge the potential impact of imminent inflation data and central bank actions on the financial landscape.

Key Takeaways:

- Dow’s Marginal Decline Reflects Market Trepidation: The Dow Jones Industrial Average slightly dipped by 0.02%, losing 9.13 points to close at 38,883.67. This minor decrease from the session’s low, which saw a drop of 320.71 points or 0.82%, signifies the market’s cautious posture ahead of significant economic indicators.

- S&P 500 and Nasdaq Show Resilience: Contrasting with the Dow, the S&P 500 and Nasdaq Composite recorded gains, closing up 0.14% at 5,209.91 and 0.32% at 16,306.64, respectively. These gains reflect a tentative optimism in sectors outside the immediate pressure facing the tech giants.

- Tech Sector Under Pressure with Nvidia Leading Losses: Nvidia’s shares fell by 2%, marking a significant pullback in the tech sector. Other major tech companies also saw declines, with Meta and Netflix dropping about 0.5% and 1.6%, respectively, contributing to the day’s bearish sentiment in technology stocks.

- Inflation Anticipation Sets the Stage for Federal Reserve’s Next Moves: The market is holding its breath for the US consumer price index report, expected to show a 0.3% month-over-month increase for March. This upcoming data has kept investors on edge, balancing the Federal Reserve’s potential interest rate decisions.

- European Markets Under Pressure Ahead of Inflation Data: European markets faced a downturn, with the Stoxx 600 index closing down 0.6%, largely driven by a sell-off in insurance stocks which declined by 1.4%. This retreat followed a period of solid gains, signalling investors’ caution as they await the US inflation report. Notably, French IT consultancy Atos experienced a volatile trading day, initially rising 5% before plummeting to a 14% loss after unveiling its debt refinancing plan.

- Asian Markets Show Mixed Responses to Local and Global Cues: In Asia, market responses varied, with Japan’s Nikkei 225 rising 1.08% to 39,773.13, buoyed by a surge in consumer confidence to its highest level since May 2019. Meanwhile, South Korea’s Kospi dipped by 0.46%, and the small-cap Kosdaq edged down 0.14%. China’s CSI300 slightly declined, closing at 3,533.49, while Hong Kong’s Hang Seng index climbed 0.7%. In contrast, Australia’s S&P/ASX 200 gained 0.45%, showing a positive rebound from earlier losses.

- Gold and Oil Markets Respond to Global Economic Signals: Gold prices approached a record high, with a near-term peak at $2,350, while oil prices declined, with Brent crude futures dropping 1.1% to $89.42 per barrel amid geopolitical tensions and ongoing ceasefire talks in Gaza.

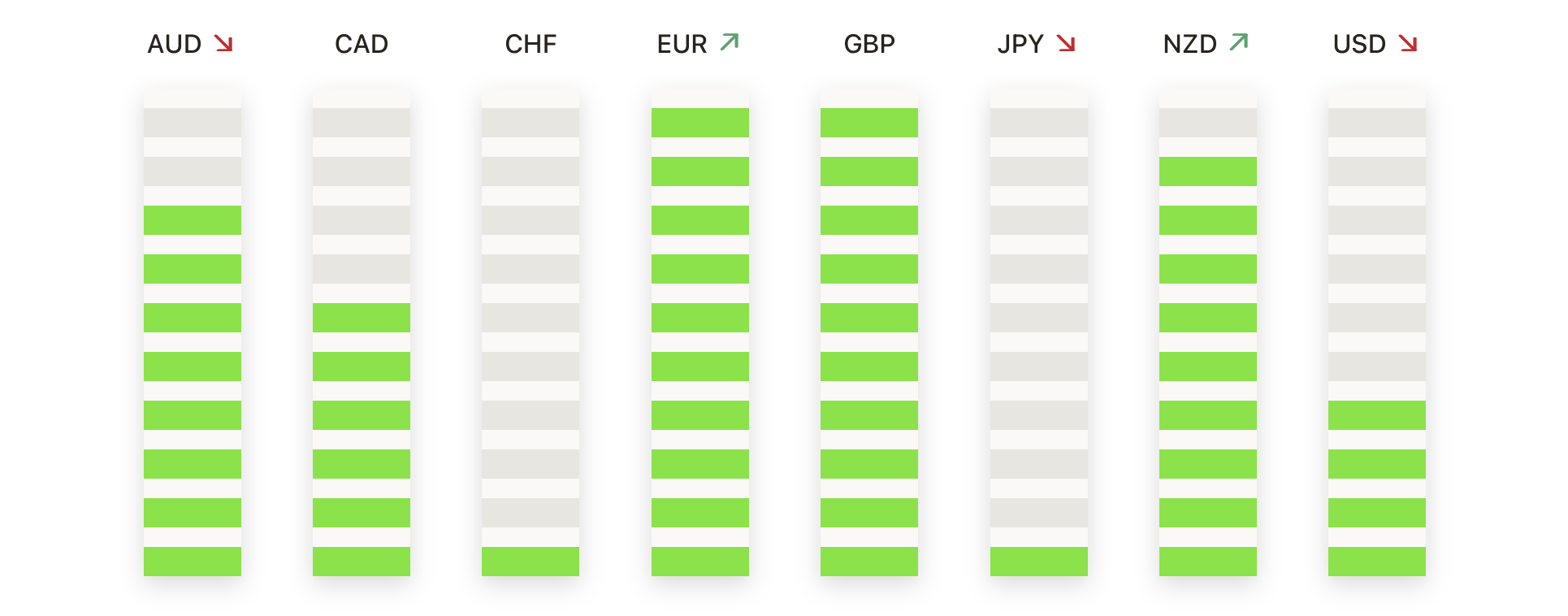

FX Today:

- EUR/USD Encounters Resistance Amid Fluctuating Sentiments: The Euro to US Dollar exchange rate met with resistance, touching near three-week highs around the 1.0900 mark. The pair’s movements are pivotal as market participants gauge the European Central Bank’s upcoming interest rate decision on April 11, reflecting the currency’s sensitivity to broader economic cues.

- GBP/USD Surpasses 1.2700 Before Retreating: The British Pound made a brief foray past the 1.2700 threshold against the US Dollar, highlighting transient bullish sentiment. However, this momentum faded out, underscoring the ongoing scrutiny of the UK’s economic indicators, particularly the forthcoming GDP data.

- USD/JPY Consolidation Within Defined Range: The US Dollar against the Japanese Yen remained in a tight consolidation, with the 152.00 level acting as a pivotal barrier. This pattern reflects market speculation about potential foreign exchange interventions, amid critical economic updates from Japan.

- CAD’s Struggle Below 1.3600 as Inflation Data Looms: The Canadian Dollar lingered under the 1.3600 level against the US Dollar, with eyes turning to the US inflation report. The pair’s trajectory may test the 1.3645 resistance, offering insights into the broader market sentiment and risk appetite ahead of pivotal economic releases.

Market Movers:

- Moderna Surges on Vaccine Trial Optimism: Moderna’s stock soared, leading the gains in both the S&P 500 and Nasdaq 100, as it closed up more than 6%. This surge followed positive assessments of its trial results in partnership with Merk, which showed promising outcomes in head and neck cancer treatments.

- Cisco Systems Gains on Positive Coverage: Shares of Cisco Systems climbed more than 3%, topping the gainers in the Dow Jones Industrial Average after Morgan Stanley resumed coverage with an overweight rating and a target price of $58, signalling strong market confidence.

- Semiconductor Stocks Ride Yield Dip: Companies like ON Semiconductors and Analog Devices saw their stock prices increase by over 3%, benefiting from the drop in T-note yields. Other chipmakers, including GlobalFoundries and Texas Instruments, also enjoyed substantial gains, reflecting renewed investor interest in the tech sector.

- Freeport McMoRan Leaps on Upgrade: Freeport McMoRan’s stock price jumped more than 12% after Bank of America upgraded it to buy from hold, setting a target price of $59, indicating bullish sentiment on the mining and metals sector.

- Insurance and Industrial Sectors Under Pressure: Hartford Financial Services and Eaton Corp experienced significant downturns, leading losses in their respective sectors. Hartford’s stock fell more than 3%, while Eaton’s dropped by a similar margin, highlighting sector-specific challenges.

- Telecommunications Stocks Face Downturn: Verizon Communications and AT&T saw their shares decline by more than 2% and 1%, respectively, as the telecommunications sector faced selling pressure amidst broader market uncertainties.

- Nvidia Reacts to Intel’s AI Chip Launch: Nvidia’s shares decreased by more than 2% after Intel announced its Gaudi 3 AI chip, positioned as a strong competitor to Nvidia’s H100 GPU, reflecting the competitive dynamics within the tech industry.

- Defensive Stocks Retreat Amid Market Realignment: Companies like Huntington Ingalls Industries and Martin Marrietta Materials recorded losses, down more than 3% and 1%, respectively, as part of a broader pullback in defence and materials sectors.

- Earnings Revisions Prompt Stock Reassessments: Inmode and Neogen faced steep declines, down more than 6% and 9%, after revising their full-year revenue forecasts downwards, signalling a recalibration of investor expectations.

As the markets wrapped up a tumultuous Tuesday, investors remained alert, with eyes firmly set on the impending US inflation report. The day’s trading reflected a feeling of anticipation and strategy correction, highlighted by the Dow’s slight decline and gains in the S&P 500 and Nasdaq. In the tech realm, Nvidia faced headwinds amidst Intel’s ambitious venture into the AI chip market, while sectors like insurance and telecommunications experienced notable downturns. On the global stage, mixed performances in European and Asian markets underscored a bit of uncertainty. With the consumer price index data on the horizon and major central banks’ decisions pending, the financial landscape is braced for pivotal shifts that could redefine market trajectories in the days ahead.