Monday’s trading session unfolded with a notable climb in global markets, marking a continuation of the bullish trend that began in late 2022. The Dow Jones Industrial Average, in a remarkable show of strength, soared beyond the 38,000 threshold for the first time, underscoring investor optimism and a resilient economic backdrop. This milestone came in while the S&P 500 and Nasdaq Composite also made strides, reflecting a broad-based confidence in the market. Despite the mixed reactions in the Asian and European markets, the overall sentiment remains cautiously optimistic as investors navigate through corporate shake-ups and keep a keen eye on impending economic reports. The market dynamics, shaped by a blend of corporate news and macroeconomic indicators, offer a window into the complex chemistry of global economic forces and investor sentiment.

Key Takeaways:

- Dow Jones’ Historic Milestone: The Dow Jones Industrial Average surged, gaining 145 points, or 0.36%, reflecting a strong investor confidence and economic optimism.

- S&P 500 and Nasdaq Composite’s Steady Growth: The S&P 500 added 0.22%, hitting a new all-time high, while the Nasdaq Composite advanced 0.32%, indicating a bullish sentiment in the market.

- Asian Markets Show Mixed Responses: The Nikkei 225 in Japan reached a near 34-year high, climbing 1.62% to 36,546.95, while the broader Topix gained 1.39% to close at 2,544.92. Conversely, Hong Kong’s Hang Seng index and China’s CSI 300 index witnessed declines of 2.52% and 1.56% respectively, showcasing the varied investor sentiment across the region.

- European Markets Begin Week on Positive Note: The Stoxx 600 index in Europe rose by 0.67%, driven by gains in banks, travel, and tech stocks, while utilities and mining sectors lagged behind, dropping by 0.8%.

- Corporate Movements Drive Market Dynamics: Macy’s stock increased by over 3% after rejecting a $5.8 billion privatization bid. SolarEdge Technologies, despite announcing a 16% workforce reduction, saw its shares jump more than 4%, showcasing the complex reactions to corporate decisions in the current market environment.

- Commodities Fluctuate: Oil prices saw an uptick with WTI crude rising to $75.19 per barrel and Brent crude settling at $80.06. Gold prices are projected to see a 10% increase by year-end, bolstered by the possibility of Fed rate cuts.

- Bank of Canada’s Rate Decision in Focus: Amid a rise in Canada’s December inflation to 3.4% from 3.1%, the Bank of Canada is expected to keep its key overnight rate unchanged, with markets now anticipating a rate cut by June.

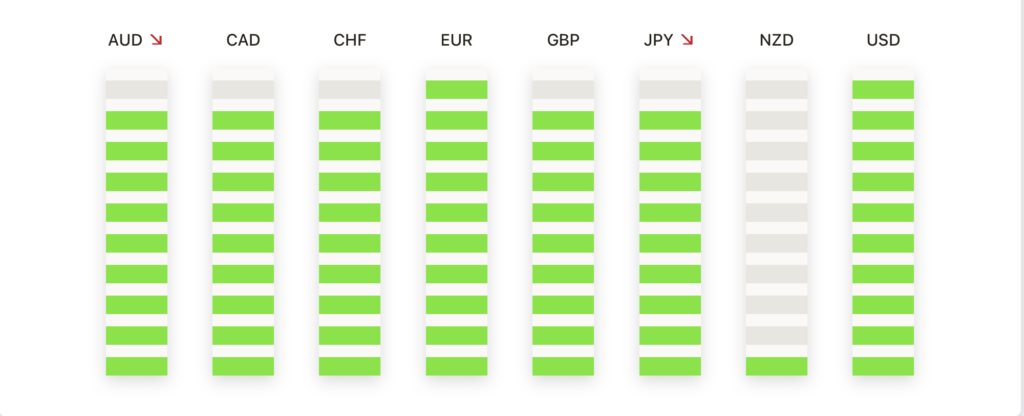

FX Today:

- EUR/USD Sees Modest Movements: The EUR/USD pair traded with slight fluctuations, primarily hovering around the 1.0900 level. This movement was influenced by expectations ahead of the upcoming European Central Bank’s rate decision and the release of key economic data, including the euro area January Consumer Confidence and Purchasing Manager Index (PMI) figures.

- GBP/USD Advances Beyond 1.2700: The British Pound saw an uplift against the US Dollar, crossing the 1.2700 barrier, although the gains were somewhat tempered towards the session’s end. This movement reflects the market’s reaction to both domestic economic indicators and the broader currency market dynamics.

- AUD/USD Drops Amid Commodity Market Weakness: The Australian Dollar retreated against the US Dollar, moving back to the sub-0.6600 region. This downward trend is partly due to negative movements in key commodities like copper and iron ore, which impact the resource-rich Australian economy.

- USD Strengthens Marginally: The US Dollar Index (DXY) trades with mild gains around 103.35. Key US inflation and economic activity data are due this week. Market bets on the Fed cutting rates continue to adjust. Support levels are at 103.20, 103.00, and 102.80, while resistance levels are at 103.40 (200-day SMA), 103.60, and 103.80.

- Yuan’s Market Intervention: The Chinese Yuan saw interventions from state-owned banks to stabilise the currency amid a drop in equities. The onshore Yuan traded at 7.1963 per dollar, showing a decline of nearly 1.4% for the year, while the offshore counterpart was at 7.2047.

Market Movers:

- Archer-Daniels-Midland (ADM) Leads Declines: Archer-Daniels-Midland led the losers in the S&P 500, closing down over 24%. This steep decline came after the company placed its CFO on leave and cut its earnings outlook amid an ongoing investigation into its accounting practices.

- Gilead Sciences (GILD) Drops on Clinical Trial Results: Gilead Sciences experienced a downturn of more than 10%, leading losses in the Nasdaq 100, following news that its Trodelvy drug failed to significantly improve survival in a lung cancer trial.

- Western Digital (WDC) Sees Major Uptick: Shares of Western Digital climbed over 5% following Morgan Stanley’s endorsement of the stock as a top pick among U.S. semiconductor stocks. The firm raised its price target to $73 from $52, a significant increase that underscores the stock’s growth potential in the tech sector.

- JB Hunt Transport Services (JBHT) Gains on Upgrade: JB Hunt Transport Services witnessed a rise of more than 3% after UBS upgraded the stock from neutral to buy, setting a new price target at $234. This upgrade reflects a positive outlook on the company’s operational efficiency and market positioning.

- Zions Bancorp (ZION) Rallies Post Earnings Report: Zions Bancorp’s shares increased by more than 3% after reporting a Q4 net interest income FTE of $593 million, surpassing the consensus estimate of $586.9 million. This better-than-expected performance has increased investor confidence in the bank’s financial health.

- Cybersecurity Sector Experiences Growth: Following a report by JPMorgan Chase about a security breach at Microsoft, cybersecurity stocks saw an upward trend. Zscaler (ZS) closed up more than 4%, and Okta (OKTA) ended the day over 3% higher. Additionally, CrowdStrike Holdings (CRWD) and Palo Alto Networks (PANW) both closed with gains of over 2%.

- NuStar Energy LP (NS) Surges on Acquisition News: NuStar Energy’s stock soared by more than 18% after Sunoco announced its agreement to acquire the company for $7.3 billion, including assumed debt. This acquisition highlights the ongoing consolidation trends in the energy sector.

- SentinelOne (S) Advances on Upgrade: Shares of SentinelOne closed up more than 5% after BTIG LLC upgraded the stock from neutral to buy, with a new price target of $30. This upgrade is a significant vote of confidence in the company’s growth trajectory in the cybersecurity space.

- Home Depot (HD) Falls on Downgrade: Home Depot’s shares declined by more than 1%, leading the losers in the Dow Jones Industrials, after the stock was downgraded from outperform to market perform.

- Bunge Global SA (BG) and Advanced Micro Devices (AMD) Face Setbacks: Bunge Global SA closed down more than 4% after Barclays lowered its price target on the stock. Similarly, Advanced Micro Devices saw a decline of over 3% following a downgrade by Northland Securities.

The landscape of global markets reveals a wealth of divergent trends and emerging narratives. The historic ascent of the Dow Jones, coupled with the steady advancement of the S&P 500 and Nasdaq, paints a picture of underlying confidence in the face of fluctuating corporate fortunes and geopolitical shifts. Today’s market movers, from Western Digital’s surge to Archer-Daniels-Midland’s sharp decline, exemplify the intricacy between investor sentiment, corporate governance, and economic forecasts. With a keen eye turned towards upcoming central bank decisions and pivotal economic reports, the financial world stands at a crossroads, balancing alert with the present undercurrents of global economic complexity.