In a day marked by conflicting signals, the stock market had a mixed response as Federal Reserve Chair Jerome Powell indicated a continued high-interest rate environment, causing the S&P 500 to edge lower. Despite this, the Dow Jones Industrial Average managed to break a six-day losing streak, lifted by UnitedHealth’s impressive earnings surge. Investor sentiment was tested by Powell’s comments on persistent inflation pressures, alongside fresh corporate earnings that suggest resilience in parts of the economy. The landscape highlights the complex relationship between monetary policy expectations and corporate performance, shaping the market’s cautious trajectory.

Key Takeaways:

- S&P 500 Slightly Declines Amid Rate Concerns: The S&P 500 fell by 0.1% to 5,051.41 following Federal Reserve Chair Jerome Powell’s remarks indicating that interest rates may need to remain elevated, impacting investor sentiment negatively towards prospects of rate relaxation.

- Dow Ends Losing Streak with a Modest Rise: The Dow Jones Industrial Average climbed 98 points or 0.3%, supported by a strong performance from UnitedHealth, which rallied more than 5% after surpassing its revenue forecasts for the quarter.

- Nasdaq Holds Steady: Despite the overall market uncertainty, the Nasdaq Composite managed to stay relatively flat (0.12% to 15,865.25), reflecting a balanced investor reaction amidst mixed economic signals and corporate financial updates.

- European Markets Close Lower Amid Middle East Tensions: The Stoxx 600 index fell significantly by 1.6%, with all sectors showing a downturn. Mining and banking sectors were particularly hard-hit, dropping 3.1% and 2.6%, respectively. However, telecom stocks like Ericsson offered some resistance, with Ericsson’s shares rising 1.8% after reporting better-than-expected profits. FTSE 100 closed down at 7820.36 (%1.82) and CAC 40 Index lost %1.4.

- Asian Markets Decline Amid Geopolitical and Economic Uncertainty: Major Asian markets experienced losses around 2%. China’s GDP growth of 5.3% in Q1 exceeded expectations, but its industrial output and retail sales for March missed forecasts, adding to regional economic worries. Japan’s Nikkei 225 and South Korea’s Kospi lost 1.94% and 2.28%, respectively, reflecting the broad impact of both local and international tensions.

- Lagarde Signals Potential ECB Rate Cuts: European Central Bank President Christine Lagarde provided a hopeful outlook for the European markets, suggesting that the ECB could begin to moderate its restrictive monetary policy in the near term. This announcement comes as Lagarde highlighted building confidence in the ongoing disinflationary process, with rate cuts possibly starting as early as June, barring any major economic shocks.

- Oil Prices Steady Amid Geopolitical Tensions: Despite the potential for increased geopolitical conflict in the Middle East, oil prices remained steady. US crude oil futures for May delivery saw a minor decrease, settling at $85.36 a barrel, while June Brent futures slightly dropped by 8 cents to close at $90.02 a barrel. These figures reflect a market that, while cautious, has not yet entered a state of volatility despite the recent airstrikes and impending sanctions against Iran.

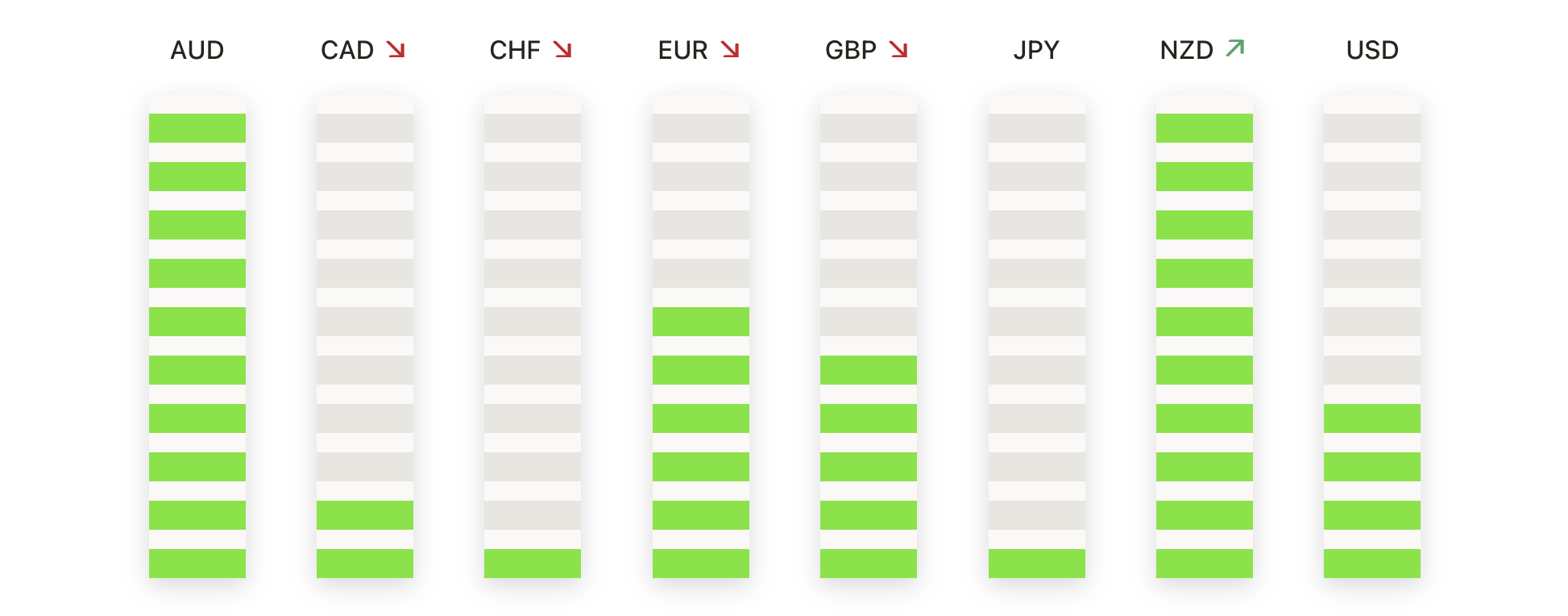

FX Today:

- EUR/USD Continues to Slide Amid Hawkish Fed Signals: The EUR/USD pair continued its descent, confirming a bearish breakdown as it slipped from 1.0635 to explore lower levels near the 2023 low of 1.0450. The absence of significant support near current levels suggests further downside potential, with the next key resistance observed at 1.0700, should a rebound occur.

- GBP/USD Holds Above Key Support Levels: Amid a backdrop of rising unemployment rates in the U.K. and ongoing economic concerns, GBP/USD managed to stay above the crucial support level of 1.2430. The currency pair exhibited modest weakness, but bulls defended the support to prevent further dips towards 1.2325.

- USD/JPY Reaches Decades High: The USD/JPY pair marked a significant milestone by consolidating gains above 154.50, reaching levels not seen since June 1990. With bullish momentum intact, the pair eyes the 155.80 resistance, although overbought conditions suggest caution, with potential support at 153.20 on any pullback.

- Sterling Struggles at Five-Month Low: The British pound remained near a five-month trough against the dollar, trading around 1.2444 midday London time. The latest UK jobs data, which showed an uptick in the unemployment rate to 4.2% from 3.9%, has dampened sentiment and added pressure on sterling ahead of upcoming inflation data.

- Dollar Strengthens Against Major Currencies: The dollar index (DXY) slightly advanced by 0.04%, hitting a peak of 106.51, its highest since November 1st. This upward movement reflects broader market adjustments to the sustained high-interest rate environment suggested by the Federal Reserve.

- Gold Prices Respond to Fed Comments: The gold prices showed signs of an upward trend. The price of gold approached the critical $2,400 mark, positioning it near the all-time high of $2,431. The metal’s price dynamics are indicative of heightened market uncertainty, with a potential pullback risk if it falls below the April 12 close of $2,343. On the downside, the next significant support could be around the $2,300 mark, followed by the April 5 swing low of $2,267.

Market Movers:

- UnitedHealth Leads Dow Gainers: UnitedHealth Group significantly outperformed, with its shares climbing more than 5% after reporting first-quarter revenue of $99.8 billion, surpassing the expected $99.21 billion. This rally provided substantial support to the Dow, helping to end its six-day losing streak.

- Technology Sector Shows Resilience: In the Nasdaq, technology stocks like ASML Holding and KLA Corp each gained more than 2%, reflecting continued investor confidence in tech despite broader market uncertainties. Notably, Nvidia, Applied Materials, Lam Research, Broadcom, GlobalFoundries, and Texas Instruments all saw gains exceeding 1%.

- Morgan Stanley Surpasses Expectations: Shares of Morgan Stanley advanced more than 2% following a robust earnings report that exceeded analysts’ expectations, with Q1 wealth management net revenue reaching $6.88 billion, well above the forecasted $6.69 billion.

- Bank of America Faces Downturn: Contrarily, Bank of America’s shares tumbled more than 3% after the company reported a decline in both profit and revenue, alongside a rise in net charge-offs to $1.50 billion, exceeding the consensus of $1.26 billion.

- Health Insurers Respond to UnitedHealth’s Surge: Following the lead of UnitedHealth, other health insurers such as Elevance Health and Humana also experienced gains, closing up more than 1% and 0.9%, respectively, indicating a sector-wide positive reaction to strong earnings.

- Live Nation Faces Regulatory Scrutiny: Live Nation Entertainment faced a significant drop, leading the losers in the S&P 500 by falling more than 7%, as reports emerged of a potential antitrust complaint by the Department of Justice concerning its Ticketmaster business.

- Super Micro’s Stock Soars: Super Micro Computer saw a remarkable increase, closing up more than 10% after Loop Capital Markets significantly raised its price target on the stock from $600 to $1,500, highlighting investor optimism about the company’s future growth potential.

The market reflects a landscape tempered by slight optimism and prevailing uncertainties. Jerome Powell’s confirmation of high interest rates casts a shadow over growth prospects, dampening the S&P 500, while the Dow finds support in strong corporate performances, particularly from UnitedHealth. The Nasdaq’s resilience amidst technological strength contrasts with the broader market’s response to hawkish monetary policies and heightened geopolitical tensions after Iran’s attack on Israel. Steady oil prices suggested markets were not yet bracing for a broader conflict. The environment shows the ongoing balancing act between policy adherence and market reactions, shaping investor strategies in a complex economic area.