Robust Weekly Gains as Investors Anticipate a Fed Pivot

The financial markets have come alive with a sense of renewed vigour as signs from the Federal Reserve suggest a possible cessation to the aggressive rate hikes of the past months. The Dow Jones Industrial Average, a pioneer for market sentiment, has not only surged by 5.07% but also witnessed its most significant weekly gain since October 2022, closing at 34,061.32. The S&P 500 and the tech-centric Nasdaq Composite index have followed suit, marking substantial weekly gains of 5.85% and 6.61%, respectively, reaching their peak performance since November 2022.

Key Takeaways:

- Markets Rebound with Enthusiasm: Indices across the board, including the FTSE 100, DAX, S&P 500 have risen to two-week highs. This collective uptick hints at a broader confidence among investors.

- European Indices Edge Higher: The IBEX35’s modest rise of 0.47% alongside the PSI’s 0.18% gain reflects a measured optimism within the European markets, suggesting a balanced reaction to global economic cues.

- Jobs Data Sparks Hope: The softer jobs report, reflecting a cooling economy with 150,000 jobs added against the expected 170,000, reinforces the belief in the efficacy of the Fed’s anti-inflationary measures.

- Yield Curves React: The bond market responded to the jobs data, with the 10-year Treasury yield retracting to 4.57% and the 2-year yield dropping to 4.8%, possible prediction of a shift in monetary policy.

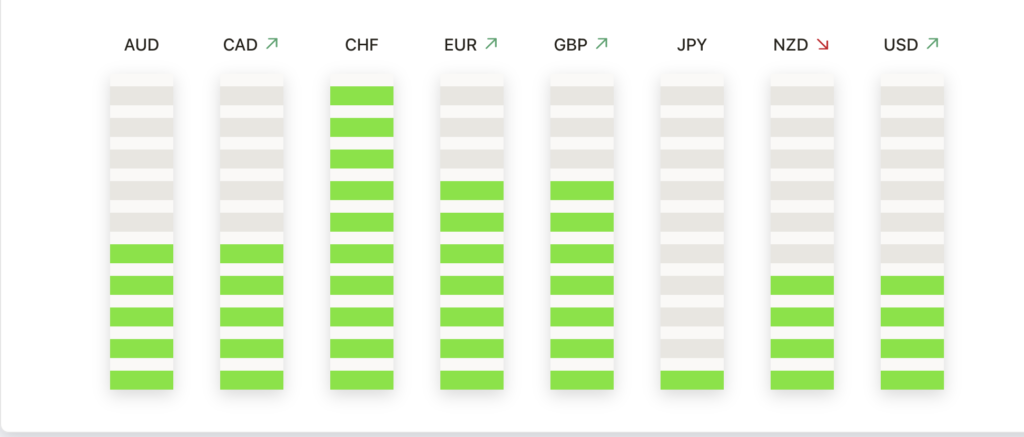

FX Today:

- EUR/USD in the Limelight: The EUR/USD pair remains a focal point, showcasing resilience and potential within its current range of 1.0450 to 1.0760. This is fuelled by evolving interest rate dynamics and a series of mixed signals emanating from ECB representatives.

- Treasury Yield Implications: The forex market has been stirred by a significant drop in U.S. Treasury yields, with the 10-year yield hitting a five-week low and the 2-year yield at its lowest since early September.

- Safe Havens Hold Steady: In a notable divergence from historical trends, safe-haven currencies such as the USD have shown stability amidst geopolitical tensions. However, investors remain vigilant, aware that an escalation could quickly shift this balance.

Trading Strategies:

- Navigating Equity Peaks: Traders are advised to pay close attention to the resistance and support levels in surging indices. For instance, the FTSE 100’s approach towards the 200-day SMA and the DAX’s interaction with trendline resistance from the August record high could offer strategic entry and exit points.

- Forex Market Opportunities: In the FX sphere, the EUR/USD’s current consolidation presents tactical trade opportunities, especially as the pair tests the upper bound of its recent channel. Traders might look to leverage this potential ascent, mindful of central bank meetings and geopolitical events that could prompt market volatility.

- Diversification Across Asset Classes: Given the market’s upward trajectory and the possibility of sudden shifts, a diversified portfolio encompassing equities, currencies, and even muted assets like gold could provide a hedge against uncertainties and take advantage of various market conditions.

In summary, the unfolding narrative in the financial markets points to a significant transition, potentially marking the end of a stringent rate hike regime. As investors and traders chart their course through this evolving landscape, the focus is on interpreting central bank signals, economic data releases, and geopolitical events that will influence the investment climate in the months ahead. Maintaining a flexible and informed strategy will be key to navigating the markets’ shifting tides.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.