As the curtain rises on 2024’s financial stage, the global markets continue to perform a delicate dance, driven by persistent uncertainties. The S&P 500 and Dow Jones navigated through a maze of modest losses and gains, reflecting the complex dynamics at play. This divergence mirrored global market dynamics, where European markets exhibited a restrained mood and Asia-Pacific markets, led by Japan’s Nikkei, finding solace in a rebound. All eyes remain focused on the economic data and corporate earnings, set to cast further light on the path ahead, especially regarding the Federal Reserve’s rate cut strategies and the ongoing recalibration of the global economic landscape.

Key Takeaways:

- S&P 500’s Measured Retreat: The S&P 500 witnessed a minor pullback, closing down by 0.2%. At one point, it dipped to a 0.7% loss, indicating the market’s oscillation between gains and setbacks, reflective of broader economic uncertainties.

- Dow Jones’ Modest Fluctuations: The Dow Jones Industrial Average experienced a drop of 201 points or 0.5%, with a notable dip of as much as 309.71 points during the day. This movement underscores the market’s sensitivity to evolving economic indicators.

- Nasdaq’s Tech-Driven Resilience: Bucking the day’s downward trend, the Nasdaq Composite managed a slight rise of 0.1%, thanks in large part to tech giants like Nvidia, which soared over 3.5% to an all-time high, and gains in Amazon and Alphabet.

- European Markets Staying Muted: The Stoxx 600 index in Europe closed 0.2% lower, extending its subdued start to 2024. This reflects the region’s cautious stance amidst global economic shifts and upcoming U.S. inflation data.

- Nikkei’s Historic High: Asia-Pacific markets saw a brighter day, with Japan’s Nikkei 225 hitting a 33-year peak, closing 1.16% higher at 33,763.18, signalling a robust performance in tech stocks amid a regional rebound.

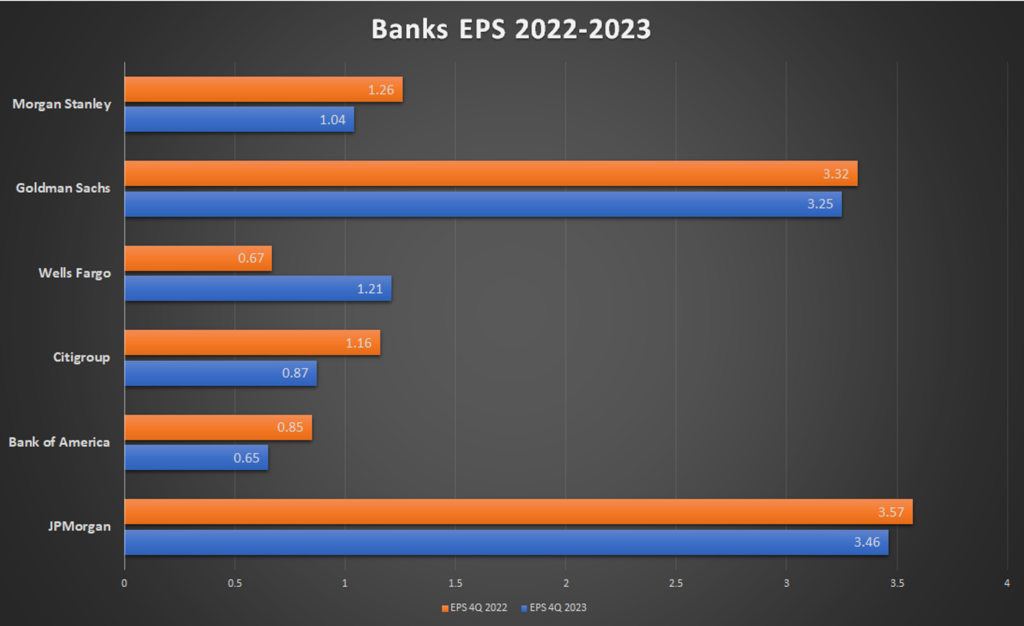

- US Banks Are Bracing For A Dip In Profits In The Upcoming Fourth Quarter: The largest banks are likely to see an average 10% decline in net interest income (NII), which represents the gap between loan earnings and deposit payouts, according to Goldman Sachs analysts. Additionally, a projected 15% decrease in trading revenue will further impact earnings. Major players like JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo are set to report their Q4 and full-year results this week, with analysts anticipating a significant drop in earnings per share (EPS) for some, including a 23% decline for Bank of America, 25% for Citigroup, and 17% for Morgan Stanley. Wells Fargo, on the other hand, could see improved profits due to reduced expenses, while Citigroup investors will be closely watching for signs of improved returns resulting from their extensive restructuring efforts.

FX Today:

- EUR/USD Experiences Minor Retreat: The Euro edged lower against the U.S. Dollar, with the EUR/USD pair falling to $1.0911, marking a decrease of 0.24%. This movement reflects market anticipation of upcoming inflation data and its potential influence on monetary policy.

- GBP/JPY Navigating Resistance: The British Pound against the Japanese Yen (GBP/JPY) encountered resistance around the 184.00 level. If this level holds firm, a retracement towards the 181.00 support zone might ensue.

- EUR/JPY’s Tentative Recovery: The Euro versus the Japanese Yen (EUR/JPY) attempted a recovery but was capped by a significant resistance at approximately 158.75. A sustained trade below this level might suggest a loss of upward momentum, potentially leading towards the 156.75 support region.

- Stabilizing Oil Prices: Both U.S. crude and Brent crude saw a rebound in prices, with U.S. crude settling at $72.24 per barrel and Brent crude at $77.59. These movements are indicative of the market’s response to global supply and demand dynamics, alongside geopolitical considerations.

- USD/JPY Shows Bullish Signs: The USD/JPY pair maintained its position above the 100-hour Moving Average, suggesting a bullish short-term trend. A break above the 144.698 resistance could further confirm this trend.

- US Dollar Index (DXY) Finds Strength: The US Dollar Index (DXY) advanced to around 102.50, buoyed by risk-averse market sentiment and anticipation of U.S. inflation data. Key support levels for DXY are currently seen at 102.30 and 102.00 (20-day SMA), with a further support level at 101.80. On the resistance side, significant levels include 102.70, 102.90, and the critical 103.00 mark.

Market Movers:

- HP Enterprise (HPE) Leads S&P 500 Decliners: HP Enterprise’s stock plummeted more than 8%, leading the losers in the S&P 500. This drop followed reports by the Wall Street Journal of the company’s advanced talks to acquire Juniper Networks for about $13 billion.

- Verizon Communications (VZ) Down in the Dow: Verizon Communications saw a decrease of more than 2%, leading the losers in the Dow Jones Industrials. This decline came after Headwater Partners II LLC sued the company for patent infringement related to 4G and 5G base stations technology.

- MSC Industrial Direct (MSM) Reports Weaker Sales: MSC Industrial Direct’s stock fell more than 2% following its Q1 report of net sales amounting to $964 million, which was below the consensus estimate of $972.3 million.

- Boeing (BA) Continues Its Downward Trajectory: Boeing’s shares dropped more than 1%, adding to Monday’s 7% plunge. The decline intensified as the National Transportation Safety Board considered expanding its investigation into other Boeing 737 Max jets.

- Newmont (NEM) Dips on Downgrade: Shares of Newmont fell more than 2% after TD Securities downgraded the stock from buy to hold, reflecting a cautious market sentiment towards the mining company.

- Netflix (NFLX) Downgraded by Citigroup: Netflix saw its shares fall more than 1% after Citigroup downgraded the stock from buy to neutral, indicating a shift in investor sentiment towards the streaming giant.

- Morgan Stanley (MS) Down on Downgrade: Morgan Stanley experienced a decrease of more than 1% in its stock value after HSBC downgraded the firm to hold from buy.

- Illumina (ILMN) Leads Nasdaq 100 Gainers: Illumina’s stock rose more than 7%, topping the gainers in the Nasdaq 100 after reporting preliminary Q4 revenue of $1.12 billion, surpassing expectations.

- Acuity Brands (AYI) Surges on Earnings Beat: Acuity Brands saw its shares increase more than 10% following a Q1 adjusted EPS of $3.72, significantly higher than the market consensus.

- Match Group (MTCH) Gains on Investment News: Match Group’s stock climbed more than 5% after reports emerged that Elliot Investment Management had built a sizable stake in the company.

- ResMed (RMD) and CrowdStrike Holdings (CRWD) Up on Positive Updates: ResMed and CrowdStrike Holdings saw their stock values rise more than 5% and 4% respectively, fuelled by positive market news and upgrades.

- Samsung’s Profit Forecast: Samsung Electronics projected a 35% decline in fourth-quarter profit, missing expectations.

- VW Brand Sees 2023 Sales Rebound: Volkswagen brand’s 2023 sales reached 4.87 million cars, up 6.7% from 2022, driven by a revival in supply chains and a notable 21.1% increase in fully-electric vehicle sales, totalling 394,000 units.

- Grifols Plummeted, Amid Allegations but Nexans Soars: Spanish pharmaceutical firm Grifols tumbled 26.8% on Tuesday as allegations from Gotham City Research regarding inflated debt ratios overshadowed earlier losses. Meanwhile, French cable company Nexans surged 3.2% after earning.

Conclusion:

The stock market continues to navigate a landscape riddled with uncertainties and shifting dynamics. The S&P 500, although boosted by robust tech shares like Nvidia, Amazon, and Alphabet, still concluded the day with modest losses, reflective of the broader market’s cautious sentiment. The fluctuating fortunes of the Dow Jones and the Nasdaq Composite further underscore the delicate balance investors are maintaining in response to varying economic signals. This backdrop is set against a global canvas where European markets grapple with their own challenges, while Asia-Pacific markets, especially Japan’s Nikkei, show signs of resilience. The attention now turns to imminent economic data releases and key corporate earnings, poised to provide deeper insights into the health of the global economy. As investors brace for these revelations, the market remains a complex mosaic of anticipation and adaptability, signalling an era where strategic agility is more crucial than ever.