In a day of cautious trading, the stock market showed mixed results with the S&P 500 closing nearly unchanged, reflecting the investors’ hesitation ahead of crucial US inflation data and global central bank meetings. While the Dow Jones edged slightly higher, both the Nasdaq and S&P 500 experienced nominal gains, supported by a notable surge in Tesla shares after exciting news of an upcoming robotaxi reveal. Despite these gains, rising Treasury yields, indicating increasing interest rates, tempered the market’s enthusiasm. Investors are now closely watching the upcoming consumer and producer price indexes, anticipating their influence on the Federal Reserve’s interest rate strategies. Meanwhile, in the energy sector, a spike in oil prices has pushed stocks to unprecedented heights, contrasting with the broader market’s cautious hopefulness.

Key Takeaways:

- Slight Gains Amid Interest Rate Concerns: The stock market ended with minimal gains, with the S&P 500 up by 0.03% and the Nasdaq increasing by 0.1%, while the Dow Jones Industrial Average saw a marginal rise. Investors remain wary as the 10-year Treasury yield climbed 5 basis points to 4.43%, indicating potential interest rate hikes.

- European Markets in Recovery: The Stoxx 600 index in Europe increased by 0.5%, with mining stocks leading the way with a 2% gain, rebounding from the previous week’s 1.2% decline, the worst since January.

- Asian Markets Respond to Global Cues: Asian markets showed mixed responses, with Japan’s Nikkei 225 climbing 0.91% to 39,347.04, and the CSI 300 in China decreasing by 0.88% to 3,536.4, as attention turns to central bank decisions and inflation data.

- Economic Indicators Awaited: The financial community is keenly awaiting the US consumer and producer price indexes for March, with forecasts predicting a 0.3% month-on-month increase and a 3.5% year-on-year rise in the CPI, which could influence the Federal Reserve’s monetary policy decisions.

- Energy Sector Outperforms: Surging oil prices have propelled the energy sector, with Exxon Mobil reaching a new high of $122.15. The sector’s year-to-date gain stands at 17%, overshadowing the S&P 500’s 9% increase.

- Semiconductor Manufacturing Boosted by Government Funding: TSMC is set to receive up to $6.6 billion in US government funds to support semiconductor manufacturing, highlighting the strategic importance of the sector and potential implications for the tech industry.

- Commodities Market on the Move: Cocoa prices reached new heights, with May NY cocoa settling up at a 1.02% increase, amid global supply concerns, while US crude oil futures experienced a slight downturn, settling at $86.43 a barrel, a 0.55% decrease.

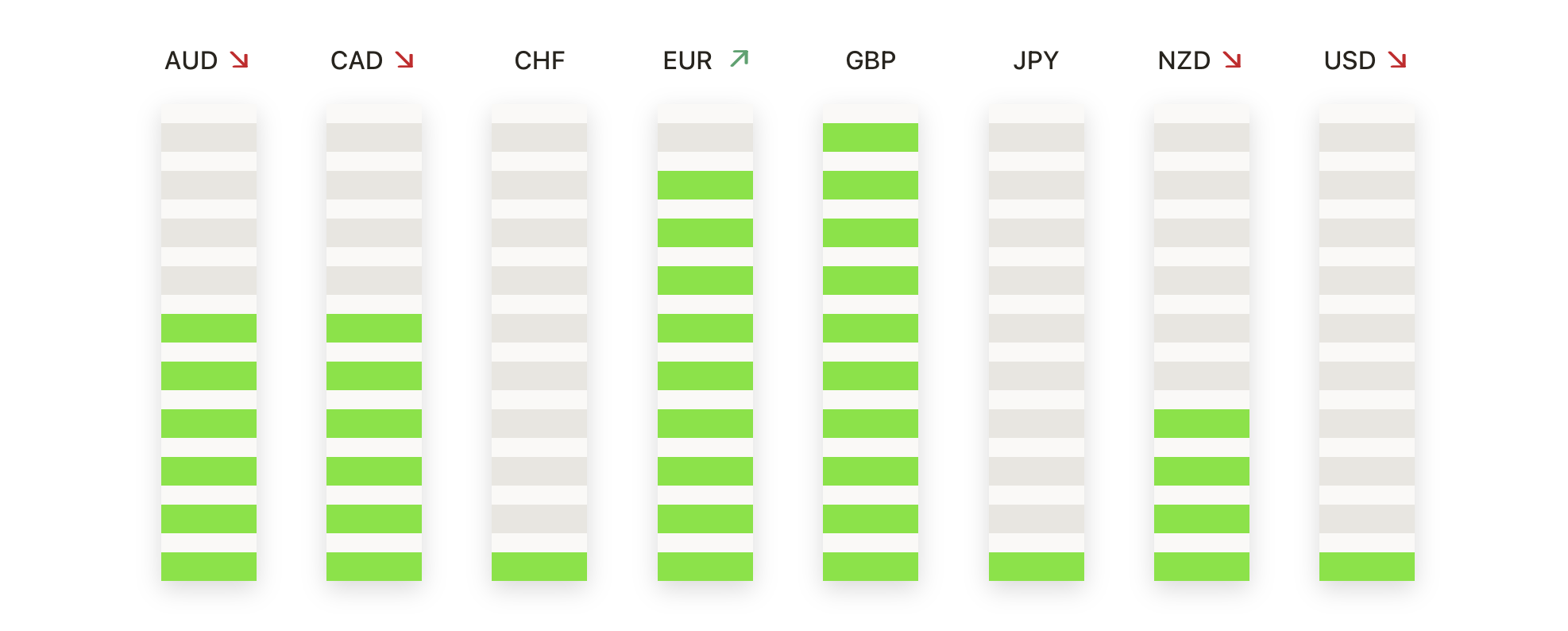

FX Today:

- EUR/USD Holds Steady Amid Market Speculation: The EUR/USD pair closing the session at 1.0862 after touching a high of 1.0867, demonstrating resilience above the pivotal 50-day SMA at 1.0820 and 200-day SMA at 1.0780. The euro’s performance against the dollar is finely balanced, with potential upward movement eyeing the 1.0915 trendline resistance, followed by the notable 1.0980 level. Conversely, downward pressure could see the pair retract to 1.0740, a near-term support, before possibly challenging the psychological 1.0700 benchmark.

- USD/JPY Approaches Yearly Highs: The USD/JPY pair exhibited upward momentum, inching closer to its 2024 high, oscillating between 152.00 and 150.90. Market watchers are closely monitoring these levels for potential breakout or pullback signals, which could set the tone for the pair’s short-term trajectory.

- GBP/JPY Gains as Buyers Reclaim Control: After reclaiming the 192.00 level, GBP/JPY is testing higher ground, with immediate resistance seen at the April 4 high of 192.24. If surpassed, the pair could target 192.50 and potentially extend to 193.00, reflecting renewed buying interest in the cross.

- Canadian Dollar Makes a Stand: The Canadian Dollar demonstrated resilience, with USD/CAD facing resistance at 1.3645. The currency pair found support around 1.3555, near the convergence of the 4-hour 50 and 100 SMAs, suggesting a consolidation phase that could dictate the near-term trend.

- Gold Advances Amid Bullish Sentiment: The gold market exhibited a robust uptrend, closing near $2,340, with the metal’s price trajectory indicating a strong buying momentum that pushed it above the day’s low of $2,303. Resistance looms at the record high of $2,354, and overcoming this level could pave the way to $2,400 and potentially $2,500 as the next psychological milestones. Conversely, if a pullback occurs, gold may find initial support at $2,300, with further downside potentially exposing the levels at $2,250 and $2,200.

Market Movers:

- Taiwan Semiconductor Manufacturing (TSMC) Secures Funding Windfall: TSMC saw a nearly 2% uptick in its stock price after the announcement of receiving up to $6.6 billion in US government funding for its Arizona semiconductor manufacturing operations, signalling strong governmental support and positive market sentiment towards the chip industry.

- GE Vernova Energizes Market Post-Spinoff: GE Vernova, recently separated from General Electric, witnessed a 5.9% increase in its shares following an upgrade by JPMorgan to overweight. The firm’s recommendation came after a pullback attributed to technical selling, suggesting a bullish outlook as the stock now trades at a perceived discount.

- Tesla Accelerates on Robotaxi Buzz: Shares of Tesla climbed 5.4% as excitement built around CEO Elon Musk’s announcement of an upcoming robotaxi reveal on August 8. This news injected optimism into the electric vehicle maker’s valuation, reflecting investors’ high expectations for the company’s future innovations.

- Eaton Faces Downgrade Despite Tech Boom: Eaton’s stock fell by 1.5% after Wolfe Research downgraded the electrical equipment manufacturer to underperform, citing concerns over valuation amidst its strong performance driven by the AI data center demand surge.

- Ulta Beauty Poised for Rebound: Ulta Beauty’s stock rose by about 2.2% following an upgrade to buy from hold by Loop Capital, which anticipates improvement in the company’s performance throughout the year, offering a potential turnaround story after recent declines.

- Take-Two Interactive Gains on Positive Outlook: Shares of Take-Two Interactive Software increased by 1.5% as Citi upgraded the video game company to buy from neutral, highlighting an attractive risk/reward scenario given its current market position.

- UiPath Rises on Strategic Optimism: UiPath enjoyed a 2.3% gain in its share price, helped by KeyBanc’s upgrade to overweight. The optimism reflects the firm’s belief in the software company’s recent strategic and leadership enhancements starting to yield positive outcomes.

- SoFi Technologies Draws Bullish View: SoFi Technologies experienced a 4.1% rise after Citi initiated coverage with a buy rating, citing the online personal finance company’s diversified business model and effective deposit attraction strategy as key growth drivers.

- Sociedad Quimica y Minera (SQM) Enjoys Upbeat Analyst Sentiment: Shares of SQM increased by 4.6% following an upgrade by Jefferies to buy from neutral, underscoring the investment firm’s positive outlook on the lithium producer as a valuable commodity play.

- Fastly Sprints on Upgrade Momentum: Fastly’s shares surged 6.9%, propelled by an upgrade to overweight from Piper Sandler, which pointed to the cloud service provider’s compelling valuation and steady business fundamentals.

As the trading day concludes, the market narrative remains closely tied to anticipation of inflation data and central bank policy decisions, with sector-specific developments notably influencing investor sentiment. The energy sector’s robust performance, led by surging oil prices, contrasts with the broader market’s cautious stance, highlighted by minimal gains in major indices. Meanwhile, strategic corporate developments, such as TSMC’s significant US investment and Tesla’s forthcoming innovations, offer a glimpse into potential sectoral shifts. As investors deal with mixed economic signals and geopolitical nuances, the market’s direction seems to be at a balance between uncertainties and emerging opportunities, showing the complex relationship of factors driving financial markets today.