In a subtle shift of gears, Wall Street experienced a modest retreat on Monday, pausing the robust rally that had propelled major indices upward for four consecutive weeks. The Dow Jones Industrial Average closed lower by 56.68 points, a decline of 0.16%, signalling a momentary easing in the market’s recent ascent. Meanwhile, the S&P 500 and the tech-focused Nasdaq Composite also witnessed slight downturns, dipping 0.2% and 0.07% respectively. This cooling off comes on the heels of a notable surge in stock values, where the S&P 500 had previously soared 8.6% within the month, complemented by nearly 9% and 12.8% upticks in the Dow and Nasdaq.

Despite the optimism stirred by the recent rally, concerns over consumer spending have cast a shadow, particularly in light of mixed signals from U.S. retailers and varied Black Friday e-commerce results. Some sectors, notably e-commerce, showed resilience, with companies like Amazon and Shopify registering gains of about 1.1% and 4.5%. These developments, coupled with the expectation of a consumer slowdown, offer a complex backdrop against which investors and strategists are weighing the potential impact of the Federal Reserve’s interest rate policies and the broader global economic outlook.

Key Takeaways:

- Dow Jones Industrial Average Sees a Minor Setback: The Dow closed down by 56.68 points, marking a 0.16% decrease, as the market’s recent upward trajectory took a brief pause. This indicates a slight cooling off after a period of consistent gains.

- Consumer Spending Data Draws Attention: Mixed signals from U.S. retailers and Black Friday sales results have put consumer spending under the spotlight. These data points are critical in evaluating the potential effects of the Federal Reserve’s interest rate decisions on the economy.

- Interest Rate Policy Remains a Focal Point: The market’s response to the Federal Reserve’s rate policies continues to be a key factor. The anticipation of a consumer slowdown, which could validate the recent rally, is tangled with expectations regarding the Fed’s future actions.

- Sector-Specific Movements Noteworthy: Different sectors are responding uniquely to the current economic environment. The performance of e-commerce stocks, in contrast to other sectors, highlights the varied impact of current economic conditions across different market segments.

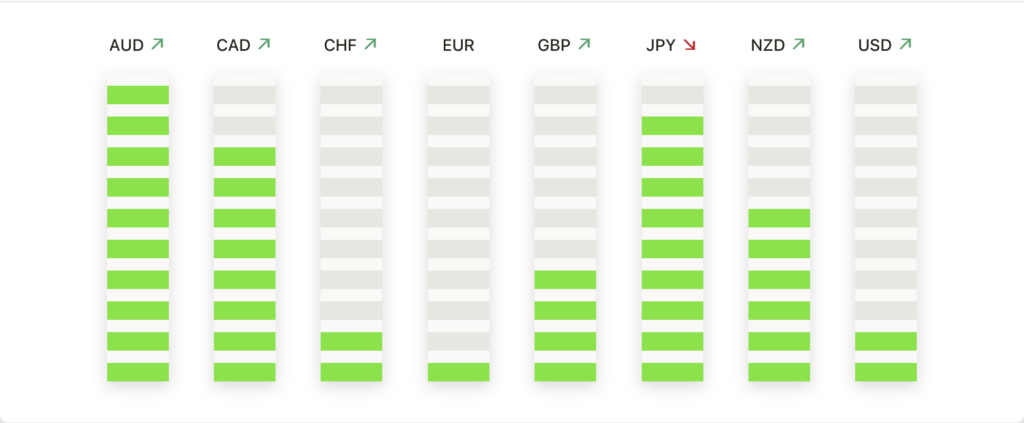

FX Today:

- USD Struggles as Major Currencies Show Strength: The US Dollar faced a challenging day, showing signs of weakness against major counterparts. This shift in dynamics is closely monitored by investors, considering its implications on global currency markets and international trade.

- EUR/USD Gains Ground Amid Dollar’s Retreat: The Euro saw a notable uptick against the Dollar, moving towards the 1.0900 mark. This movement is reflective of the Dollar’s current weakness and is being closely watched for potential resistance near 1.0900 and support around 1.0650.

- GBP/USD Reaches New Heights: The British Pound continued its ascent against the US Dollar, reaching levels not seen since September. The GBP/USD pair is trading comfortably above 1.2600, buoyed by positive economic indicators from the UK. Key support is observed at the 200-day SMA at 1.2437, with resistance looming around 1.2650.

- EUR/GBP – Pound Gains Against Euro: In the EUR/GBP pair, the British Pound has shown strength, leading the pair to trade around 0.8675. This marks a decline from the week’s high, with the upcoming economic data releases expected to further influence the pair, especially around the 0.8700 level for potential support or resistance.

- CAD Shows Sideways Movement Ahead of Key Data: The Canadian Dollar exhibited a muted performance against the US Dollar, with investors awaiting key economic data releases later in the week. The USD/CAD pair’s movement is expected to be influenced by upcoming GDP and employment figures from Canada and the US PCE inflation and ISM Manufacturing data.

- AUD Maintains Stability: The Australian Dollar held its ground, demonstrating resilience amidst fluctuating market conditions. Investors continue to watch for economic indicators that could impact the AUD’s movement in the near term.

- NZD Steady Amid Asian Market Concerns: The New Zealand Dollar remained stable despite uncertainties stemming from the Asian market, particularly China. The NZD/USD pair’s performance is under scrutiny, given the close trade ties between New Zealand and the Asian economies.

Conclusion:

The slight downturn in Wall Street’s major indices served as a reminder of the market’s susceptibility to a myriad of global economic forces. The subtle yet noticeable shifts in the Dow, S&P 500 and Nasdaq Composite indicate a market in contemplation, balancing optimism with caution. This pause in the rally, while modest, underscores the interconnectedness of consumer behaviour, monetary policy, and global economic health.

Looking ahead, investors and strategists are poised to navigate a landscape marked by potential shifts in central bank policies, particularly the Federal Reserve’s rate decisions, and the implications of consumer spending trends. The FX market continues to be a critical barometer for the global economic pulse. As the week progresses, the focus will intensify on key economic data releases and their potential to sway market sentiment.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.