In a stark contrast to the recent rally, Wall Street encountered a hiccup in its upward climb on Monday, as major indices retreated from their consecutive weeks of gains. The Dow Jones Industrial Average, which had been riding a wave of optimism, experienced a slight contraction, shedding 23 points, a subtle yet telling 0.1% dip. The broader S&P 500 and tech-heavy Nasdaq Composite followed suit, registering declines of 0.5% and 0.8% respectively. This shift in market dynamics marks a moment of recalibration, as investors grapple with the possibility of the market overextending itself after a prolonged period of bullish trends.

As technology shares faced a sell-off, the ripple effects were evident across the trading floor. Big Technology stocks, previously the darlings of Wall Street, led the descent, signalling a potential reassessment of value in the sector that has been a major growth driver. Concurrently, the contrasting surge in Bitcoin, crossing the $41,000 threshold to reach a 19-month high, and gold reaching its highest nominal intraday level ever, painted a complex picture of investor sentiment. These developments come amidst broader economic concerns, including scepticism over OPEC’s promised oil production cuts and mixed reactions to Spotify’s announcement of significant workforce reductions.

Key Takeaways:

- Technology Stocks Lead the Decline: Big Technology stocks, which have been pivotal in driving the market’s gains this year, witnessed a notable sell-off, hinting at a broader market realignment. Key players like Nvidia, Microsoft, and Meta Platforms experienced significant drops, reflecting changing investor confidence in the tech sector.

- Corporate Movements Making Waves: Spotify’s announcement of cutting 17% of its workforce and Uber’s inclusion in the S&P 500 Index were among the significant corporate developments. These moves reflect ongoing adjustments within major companies in response to the current economic climate.

- Oil Prices Dip Despite OPEC+ Cuts: Oil prices continued to fall even after OPEC and its allies announced production cuts. This decline points to market scepticism about the enforcement of these cuts and raises questions about future oil market dynamics.

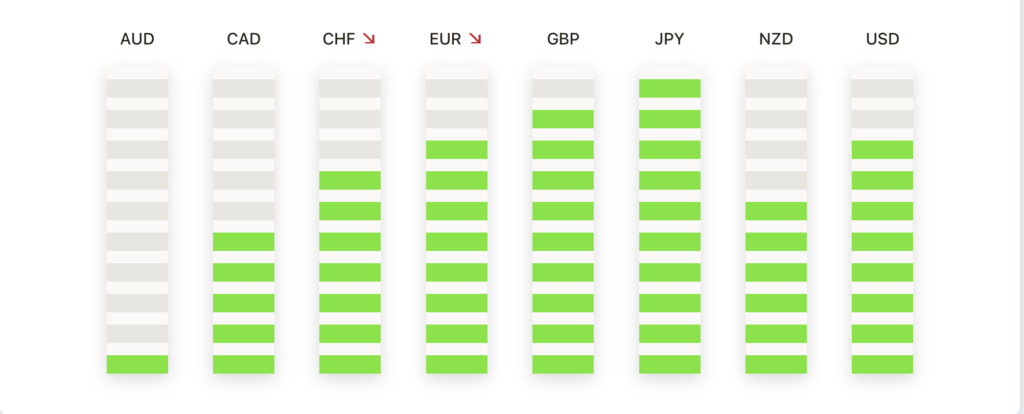

- Bond Yields and Currency Fluctuations: The rise in bond yields and fluctuations in major currency pairs, including the EUR/USD and GBP/USD, underscore the ongoing market recalibration in response to global economic indicators and central bank policies.

- Mixed Responses in Global Markets: U.S. and European bond yields showed mixed responses, while key stock markets in Europe and Asia experienced downturns, reflecting a global pattern of cautious trading amid evolving economic conditions.

FX Today:

- EUR/USD Encounters Resistance Amid Dollar Rally: The EUR/USD pair showcased a bearish trend, declining to a 2.5 week low at 1.0800, a drop of 0.65%. Resistance levels are now eyed around 1.0900, with support firmly established near 1.0650. The Euro’s retreat reflects the Dollar’s strength, influenced by rising bond yields and the anticipation of key economic data from the US and Europe.

- GBP/USD Adjusts to Dollar Strength: The GBP/USD pair fell towards the 1.2600 level, retreating approximately 100 pips. The pair faces resistance near the 1.2700 mark and finds support at 1.2500. The Pound’s weakness is attributed to the resurgence of the Dollar, driven by safe-haven demand amidst geopolitical tensions and a critical week for US economic data.

- USD/JPY Advances as Yen Retreats: The USD/JPY pair rose by 0.17%, reversing its downtrend from a near-3-month low. Resistance is currently seen around 147.50, while support lies near 146.20. The shift in investor sentiment towards the Dollar is evident, as T-note yields increase amongst global market uncertainties.

- USD/CHF Recovers Amid Swiss Economic Data: The USD/CHF pair rebounded from monthly lows, reaching around 0.8750. The pair encounters resistance at 0.8800 and support at 0.8700. The Franc’s weakening is linked to the release of lower-than-expected Swiss inflation figures.

- USD/CAD Rises as Canadian Dollar Faces Pressure: The USD/CAD pair moved upwards from the 1.3500 level, with a notable increase. The pair is testing resistance near 1.3610 and has support at 1.3480. The Canadian Dollar’s slide is a result of the broader market risk aversion and the strength of the US Dollar.

- AUD/USD Struggles As Commodities Decline: The AUD/USD pair faced downward pressure, retracting from highs near 0.6700. The pair now faces resistance at 0.6700 and support at 0.6580, influenced by the stronger US Dollar and a downturn in commodity markets.

- Gold Reacts to Market Volatility: Gold prices, after hitting a record high of $2,146, experienced a sharp pullback to around $2,020 – a significant drop from the peak. The precious metal faces resistance at the $2,100 mark, with support emerging near $2,000. Gold’s volatile movement is a response to shifting investor sentiment and the fluctuating strength of the US Dollar. The metal’s trajectory remains closely watched, as it reflects broader market uncertainties and central bank policies.

Conclusion:

As Wall Street’s recent surge takes a breather, the day’s trading activities underscore a pivotal moment in the global financial markets. The pullback across major indices, led by a recalibration in the technology sector, signals a market in the process of reassessment, weighing optimism against prevailing economic realities. This cautious sentiment is further echoed in the surge of alternative assets like Bitcoin and gold, reflecting a diversifying strategy among investors in the face of uncertainty.

Meanwhile, the FX market continues to echo the tune of global economic indicators and central bank policy shifts, with major currencies displaying volatility against a strengthening US Dollar. The oil market, too, remains a focal point, with OPEC’s production cuts failing to mitigate the slide in prices, raising questions about future supply dynamics. As investors and analysts look ahead, the emphasis will be on discerning the durability of these trends and the potential implications for long-term market trajectories.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.