In a healthy start to the week, global stock markets posted significant gains, driven by the anticipation of potential rate cuts from the Federal Reserve in response to the latest US employment figures. The Dow Jones Industrial Average rose modestly by 0.46%, while the S&P 500 and Nasdaq Composite saw more pronounced advances of 1.0% and 1.2%, respectively. This positive momentum, echoing last week’s upward trend, comes after a softer-than-expected April jobs report suggested a cooling US economy, thus relieving concerns about an overheating labour market. Amidst these developments, significant corporate earnings reports and geopolitical news also played pivotal roles in shaping investor sentiment across different sectors and regions.

Key Takeaways:

- Dow Marks Fourth Consecutive Win: The Dow Jones Industrial Average continued its upward trajectory, with a 0.46% increase, marking its fourth consecutive day of gains. This upward movement reflects growing optimism among investors about potential rate cuts by the Federal Reserve.

- S&P 500 and Nasdaq Composite Gain Ground: The S&P 500 advanced by 1% to reach $5,180, while the Nasdaq Composite outperformed with a 1.2% gain to reach $16,350. These increases are a direct response to the US jobs report, which showed a lower-than-expected addition of 175,000 jobs in April, easing fears of an overheating economy.

- European Markets Respond Positively: In Europe, the markets also reacted positively to the US labour data, with the French CAC 40 up by 0.47%, the German DAX rising by 0.95%, and the Italian FTSE MIB increasing by 1.02%. The UK’s FTSE 100 was closed for a public holiday. This collective rise underscores the interconnected nature of global financial markets and their sensitivity to US economic indicators.

- Asian Markets Echo Wall Street’s Gains: Following Wall Street’s lead, Asia-Pacific markets saw gains with Australia’s S&P/ASX 200 up by 0.7% and Hong Kong’s Hang Seng index rising 0.47%. The CSI 300 in mainland China significantly outpaced its peers with a 1.48% increase, highlighting regional optimism.

- Indonesia’s GDP Growth Exceeds Expectations: Indonesia reported a robust first-quarter GDP growth of 5.11% year-on-year, surpassing the forecasted 5%. This marks the fastest pace in three quarters, although the economy saw a quarter-on-quarter decline of 0.83%.

- Oil Prices Steady Amid Geopolitical Tensions: Crude oil futures remained steady amidst uncertainties regarding the Gaza ceasefire proposal. The West Texas Intermediate for June was slightly up by 16 cents, or 0.2%, at $78.27 a barrel. Similarly, Brent futures for July edged higher by 18 cents, or 0.22%, to $83.14 a barrel.

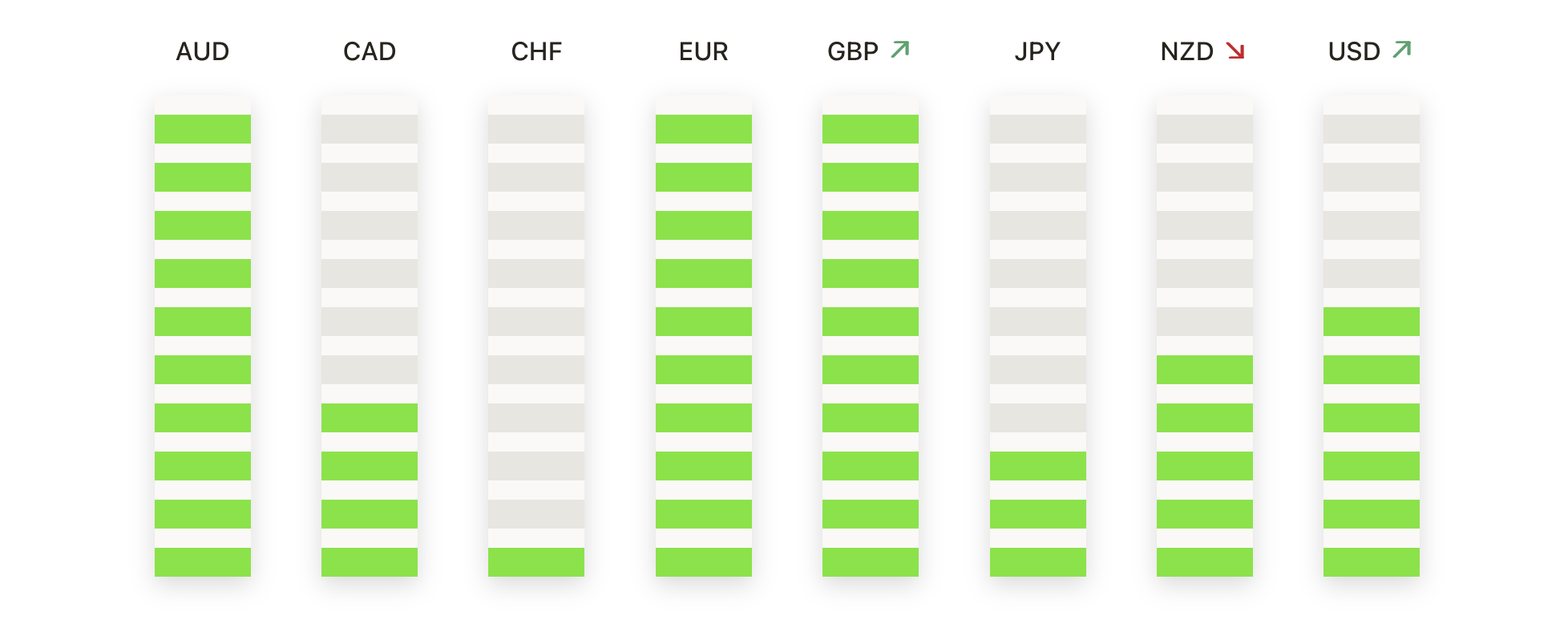

FX Today:

- EUR/USD Gains Amid Dollar Weakness: The EUR/USD pair saw an upward movement, approaching the 1.0800 handle as it flirted with crossing both its 50-day and 200-day Simple Moving Averages (SMAs). The pair’s bullish momentum could see it challenge the trendline resistance at 1.0830, followed by a key barrier at 1.0865 if the bullish sentiment persists.

- GBP/USD Recaptures Key Technical Levels: The GBP/USD advanced significantly, recapturing its 200-day SMA and is now edging towards a major resistance zone between 1.0610 and 1.0630. This area marks a confluence of the 50-day SMA and significant trendlines, posing a potential hurdle for further bullish action. A breakout above could push the pair towards 1.2720.

- USD/JPY Eyes Further Upside: USD/JPY remains bullish, having bounced off the 50-day Moving Average. The currency pair cleared the recent high at 153.80, setting sights on the 154.00 level. Overcoming this could lead to further upside with potential targets at 155.52 and 155.78, with 156.05 in sight.

- USD/CAD Struggles for Direction: The USD/CAD pair traded around 1.3660, hovering just below the 200-hour Exponential Moving Average (EMA) at 1.3695. Despite a slight bullish outlook supported by trading north of the 200-day EMA at 1.3550, the pair faces challenges in breaking past the recent low side of the year-to-date peak near 1.3850.

- Quiet Movements in US Dollar Index: The US Dollar Index (DXY) indicated mild losses, trading around 105, as inflation concerns continue to exert pressure. The short-term technical outlook is bearish, suggesting possible further declines unless there is a significant shift in market conditions.

- Gold Prices Approach Critical Thresholds: Gold prices experienced a significant surge, drawing near to the $2,400 mark as speculation around Federal Reserve rate cuts intensified. Key resistance levels await at April’s 26 high of $2,352 and then at $2,417, the April 19 high. If the momentum sustains, the all-time high of $2,431 could be tested. However, if the price dips below $2,300, a pullback towards the April 23 daily low of $2,291 is likely, with potential for further losses towards $2,223 and $2,200.

Market Movers:

- Palantir Technologies Sees a Decline: Shares of Palantir Technologies dropped nearly 5% after the company provided a full-year revenue forecast that fell short of expectations. While its first-quarter adjusted earnings per share met estimates at 8 cents, its revenue of $634 million exceeded forecasts of $625 million, according to LSEG.

- Lucid Group Faces Setback: The stock of electric vehicle maker Lucid Group tumbled by 7.5% following its first-quarter earnings announcement. Despite a slight revenue beat, Lucid reported a loss of 30 cents per share and reaffirmed its 2024 production guidance for about 9,000 vehicles.

- Hims & Hers Health Surges: Shares of Hims & Hers Health jumped 10% in postmarket trading after the company projected second-quarter revenue that exceeded analysts’ expectations, ranging between $292 million and $297 million, against forecasts of $288 million. The company’s first-quarter results also surpassed expectations.

- Simon Property Group Advances: Shares of Simon Property Group rose 1.4% after reporting quarterly revenues that beat expectations. The company posted revenue of $1.30 billion, slightly above the $1.29 billion estimated by analysts.

- Microchip Technology Under Pressure: Microchip Technology’s stock fell by 4% after issuing revenue guidance for the current quarter that was below analyst expectations, with projected revenue between $1.22 billion and $1.26 billion versus estimates of $1.34 billion. The company also provided earnings guidance that missed expectations, forecasting adjusted earnings per share between 48 cents and 56 cents, below the expected 59 cents.

- Vertex Pharmaceuticals Edges Upward: Vertex Pharmaceuticals’ shares increased by less than 1% after reporting first-quarter results that beat expectations. The company posted adjusted earnings of $4.76 per share on revenue of $2.69 billion, surpassing analysts’ forecasts of $4.06 per share and $2.58 billion in revenue.

- International Flavors & Fragrances Climbs: Shares of International Flavors & Fragrances gained 3.7% following first-quarter revenue results that exceeded expectations. The company reported $2.9 billion in revenue, above the $2.78 billion anticipated by analysts. It also indicated that its full-year sales, adjusted operating earnings before interest, taxes, depreciation, and volume are expected to be near the higher end of its previously shared guidance ranges.

As the trading day wrapped up, the key indicators from global markets suggested a trend of slight optimism, spurred by rate cut hopes and favourable corporate earnings. The advances across major indices, including the Dow’s fourth consecutive gain and notable climbs in the S&P 500 and Nasdaq, reflect a market responsive to softer US jobs data and potential shifts in monetary policy. With significant movements in technology and airline stocks, alongside active trading influenced by geopolitical events and corporate updates, investors remain keenly alert to upcoming economic indicators and corporate earnings that could decide the next shifts in market dynamics.