In a remarkable display of resilience, global markets on Wednesday painted a picture of optimism, navigating through a landscape brimming with anticipation. Investors, poised on the edge of their seats, witnessed the Dow Jones Industrial Average climb over 170 points, a clear signal of the market’s positive sentiment ahead of critical U.S. inflation data and earnings reports. The S&P 500 and Nasdaq Composite followed suit, registering gains of 0.57% and 0.75%, respectively. This ascent comes as market participants keenly await the latest consumer price index figures, a potential indication of the Federal Reserve’s future monetary policy moves. Meanwhile, key players like Intuitive Surgical and Lennar bolstered market confidence with significant gains, underlining the market’s dance between cautious hope and the looming uncertainty of economic indicators yet to unfold.

Key Takeaways:

- Dow Jones Climbs Amid Positive Sentiment: The Dow Jones Industrial Average showcased a notable increase, rising by 170.57 points, a gain of 0.45%. This uptick reflects a growing confidence among investors, as they await crucial inflation data and earnings reports.

- European Markets Show Mixed Responses: The Stoxx 600 index closed slightly lower by 0.17%, with sectors displaying mixed performances. Notably, mining stocks were down by 1.07%, whereas media stocks rose by 0.75%.

- Asian Markets Present Varied Trends: While the Nikkei 225 in Japan surged by 2.1% to a 34-year high, driven by chipmakers and government policies, other Asian markets like Hong Kong’s Hang Seng and the Shanghai Composite index saw declines of 0.4% and 0.2% respectively.

- German Wholesalers Express Economic Concerns: In Germany, wholesalers anticipate a 2% nominal revenue fall this year, continuing a downward trend from last year’s 3.75% decline. This outlook is influenced by a mix of geopolitical challenges and internal economic factors.

- Euro Shows Resilience Despite ECB’s Recession Warning: The Euro demonstrated strength against major currencies, despite ECB’s de Guindos hinting at a potential technical recession in the Eurozone. EUR/USD showed stability, navigating through key technical levels with resistance and support in focus.

- SEC’s Historic Bitcoin ETF Approval: The U.S. Securities and Exchange Commission has given the green light for bitcoin ETFs, a move that sets the stage for the Grayscale Bitcoin Trust’s conversion to an ETF and the launch of similar funds by major players like BlackRock and Fidelity, marking a significant milestone in mainstream finance’s adoption of cryptocurrency.

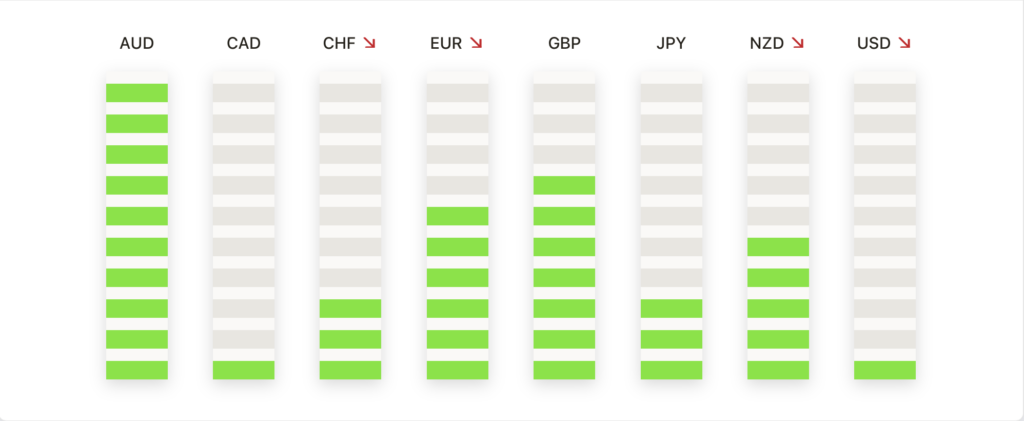

FX Today:

- Euro Exhibits Resilience, Climbs Against USD: The EUR/USD pair witnessed a climb, closing at 1.0950, up by 0.35% for the day. This gain underscores the Euro’s strength, defying the broader economic uncertainties and predictions of a technical recession in the Eurozone.

- British Pound Rises, GBP/USD Makes Gains: The British Pound demonstrated bullish sentiment, with the GBP/USD pair rising to 1.2710, marking an increase of 0.40%. This uptick reflects growing investor confidence, buoyed by the UK’s enduring economic stability and speculation over the Bank of England’s forthcoming policy decisions.

- EUR/GBP Slight Gain Amid Mixed Signals: The EUR/GBP pair registered a modest rise, with a 0.10% increase, trading at 0.8611. The pair experienced a peak at 0.8620, reflecting a cautiously optimistic sentiment among traders.

- Silver Retreats, Affected by Bond Yield Rise: Silver prices saw a marginal decline, trading lower at $22.70 per troy ounce, a decrease of 0.24%. The downtrend in Silver is largely attributed to the rising U.S. Treasury bond yields, currently standing at 2.45%, which adversely affects the appeal of non-yielding assets such as precious metals.

- DXY Shows Mixed Signals Amidst Policy Uncertainty: The U.S. Dollar Index (DXY) presented a complex picture, closing at 101.80, fluctuating slightly by 0.15%. The mixed signals in the DXY reflect an ongoing struggle between bullish and bearish forces, as investors weigh the Federal Reserve’s potential monetary policy shifts amid prevailing economic conditions.

Market Movers:

- Intuitive Surgical Soars on Positive Outlook: Intuitive Surgical emerged as a standout performer, seeing its stock jump over 10%. This surge was fuelled by the company’s optimistic procedure growth forecast for the 2024 fiscal year, igniting investor enthusiasm in its growth prospects.

- Lennar Corporation Gains on Dividend Increase: Lennar Corporation also made notable strides, recording a 3% increase in its stock value. This gain came on the heels of the company’s announcement of an annual dividend increase, reflecting investor confidence in its financial health and strategic direction.

- Greggs Rises on Strong Sales Report: In the European market, British pastry chain Greggs witnessed a 5% uptick in its stock, buoyed by a robust increase in sales. This performance underscores the company’s strong position in the retail sector and its resilience in the face of economic headwinds.

- Sainsbury’s Stock Dips on Lacklustre Sales Growth: Contrasting with Greggs, Sainsbury’s experienced a significant 6.34% drop in its stock value, following reports of disappointing Christmas sales growth. This decline highlights the challenges faced by the retailer in a competitive and ever-evolving market landscape.

- Grifols Bounces Back After Allegations: Spanish pharmaceutical company Grifols saw a notable recovery, with its shares climbing 12%. This rebound followed a sharp 28% drop after allegations by Gotham City Research about its debt ratios. Grifols’ response and legal action for reputational damage seemed to have reassured investors, leading to a regain in its stock value.

- Mining Stocks Struggle in Europe: Mining stocks in Europe remained under pressure, dropping by 1.07%. This downtrend reflects ongoing concerns in the sector, possibly related to global economic uncertainties and commodity price fluctuations.

- Japanese Chipmaker Kyocera Corp Surges: In the Asian market, Kyocera Corp. saw a significant rise of 5.7%, driven by heavy buying in the chipmaker sector. This gain is reflective of the broader strength in the Japanese market, particularly in the technology sector.

Conclusion:

As another day is wrapped up in the global financial markets, a narrative of measured optimism unfolds amidst a backdrop of impending economic data. The uplift in key stock indices such as the Dow and Nasdaq reflects a market that is quietly positive, yet keenly aware of the various economic undercurrents at play. This resilience is compared with an air of uncertainty, stemming from the awaited inflation figures, corporate earnings, and the potential shifts in central bank policies. With critical economic indicators on the horizon, the market finds itself at a pivotal juncture, ready to adapt and respond to the dynamic and evolving story of the global economy.