In a landscape marked by contrasting movements, the stock market today presented a tale of divergence. The Nasdaq Composite extended its losing streak, marking its fifth consecutive day in the red, the longest since October 2022, signalling a cautious sentiment among tech investors. In stark contrast, the Dow Jones Industrial Average displayed remarkable resilience, advancing modestly as it sought to recover from an early-year dip. This mixed picture mirrors global market trends, where European stocks experienced a rebound, led by unexpected surges and plunges within the retail sector. The varied market responses show the complexity of investor sentiment, grappling with rate cut speculations, shifting central bank policies, and a read on economic health from recent inflation and job market data.

Key Takeaways:

- Nasdaq’s Losing Streak Intensifies: The tech-heavy Nasdaq Composite dropped 0.3%, marking its fifth consecutive day of losses, a trend not seen since October 2022. This decline is a continuation from Wednesday’s fall of more than 1%, reflecting investor wariness in the technology sector, particularly around mega-cap stocks like Apple, which saw a 1% drop on Thursday and a more than 5% decrease this week.

- Dow Jones Shows Resilience: In a contrasting move, the Dow Jones Industrial Average rose by 77 points, or 0.2%, recovering part of its near 300-point loss from the previous day. This rebound hints at underlying strength in certain market segments, despite the broader market’s fluctuations.

- S&P 500 Experiences Minor Retreat: The S&P 500 index, while having ended the previous year with a significant gain of over 24%, witnessed a slight decline of 0.1%. This movement reflects the ongoing recalibration of the market in the face of new economic data and investor sentiment.

- European Markets Rebound with Retail Sector Highlights: The Stoxx 600 index in Europe closed up 0.7%, with banking stocks leading the charge, rising 1.7%. However, the technology sector fell by 0.4%, and retail stocks dropped by 0.8%. Notable movements were seen in individual retail stocks, such as Next climbing 5.6% to a record high, while JD Sports plummeted by 23%.

- Oil Prices Dip on U.S. Inventory Build-Up: Oil prices declined with West Texas Intermediate (WTI) settling at $72.19 a barrel, a 0.7% decrease, and Brent crude settling at $77.59 a barrel, down by 0.84%. This fall was influenced by a significant build-up in U.S. fuel inventory, overshadowing concerns about Middle East tensions.

- Solar Stocks Continue Downward Trend: Key solar stocks like Enphase Energy and Sunrun faced downgrades, contributing to their respective 10% and 12% declines in early 2024, continuing the sector’s poor performance from the previous year.

- U.S. Labor Market Shows Signs of Easing: Weekly U.S. jobless claims dropped to 202,000 – a decrease of 18,000 – indicating a gradually cooling labour market. This data, combined with a private payroll increase of 164,000 in December, continues to shape expectations for the Federal Reserve’s monetary policy.

FX Today:

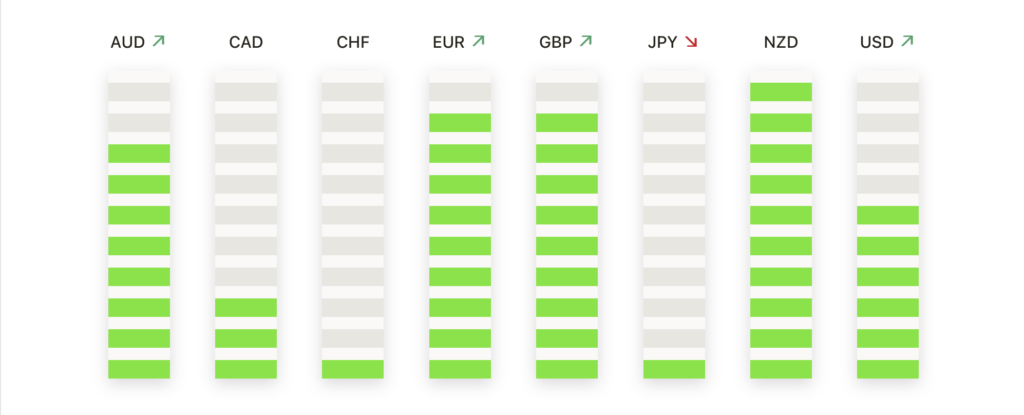

- Euro Gains on Inflation Data; Eyes on ECB’s Policy: The Euro experienced a mild recovery against the dollar, with the EUR/USD pair reaching the 1.0970 zone. This movement was influenced by the latest inflation figures from Germany and France, which showed a year-on-year rise to 3.7% in December. Investors are now closely watching the European Central Bank’s policy decisions, considering the possible impact on the currency.

- Sterling Strengthens Amid Positive Economic Data: The British Pound saw an uptick against the dollar, with the GBP/USD pair rising to 1.2692, a 0.24% increase. The surge was supported by stronger-than-expected UK mortgage approvals and lending data, indicating resilience in the British economy despite high-interest rates and potential BoE policy shifts.

- Japanese Yen Weakens; USD/JPY Pushes Higher: The Japanese Yen continued to weaken against the dollar, with the USD/JPY pair nearing the 145.00 mark. This decline reflects the ongoing adjustments in risk appetite and yield movements in the U.S., as well as Japan’s economic outlook.

- AUD/USD Declines Amid Commodity Weakness: The AUD/USD pair extended its downward trend, approaching a crucial support area around the 0.6700 level. This level is pivotal for bulls to maintain, as a breach could lead to a further decline towards the 0.6640 mark, aligning with the 38.2% Fibonacci retracement of the rally from October to December. If the pair rebounds, it will face resistances at 0.6820 and the 0.6870 level. A significant bullish push might set the stage for targeting the 0.7000 threshold.

- Gold Prices Steady; Silver Recovers: Gold prices showed stability, hovering around the $2,040 per troy ounce mark, while Silver reclaimed the $23.00 per ounce level after a recent drop. The precious metals’ market is responding to shifts in the U.S. dollar and global economic indicators, with investors seeking safe-haven assets amid uncertainties.

Market Movers:

- Allstate (ALL) Gains on Upgrade: Shares of Allstate saw an uplift of more than 3% after Morgan Stanley upgraded the stock to overweight from equal weight, setting a target price at $171. This positive sentiment reflects the market’s confidence in Allstate’s growth potential and strategic positioning.

- Lamb Weston Holdings (LW) Surges Post Earnings Report: Lamb Weston Holdings reported a robust Q2 adjusted EPS of $1.45, surpassing the consensus estimate of $1.41. Following this announcement, the company’s stock traded higher, buoyed by an upward revision in its full-year adjusted EPS forecast to a range of $5.70-$6.15 from the previously anticipated $5.50-$5.95.

- Cruise Line Operators Rebound: After a notable drop of over 10% in the past two sessions, cruise line stocks witnessed a recovery today. Norwegian Cruise Line Holdings (NCLH) saw an increase of more than 4%, Carnival (CCL) rose over 3%, and Royal Caribbean Cruises Ltd (RCL) gained more than 2%. This rebound suggests a renewed investor interest in the travel and leisure sector.

- Merck & Co (MRK) Climbs on Upgrade: Merck & Co experienced a jump of more than 1%, leading the gainers in the Dow Jones Industrials, after Cowen upgraded the stock to outperform from market perform with a price target of $135. The upgrade is a testament to Merck’s strong market position and future growth prospects.

- Walgreens Boots Alliance (WBA) Dips After Dividend Cut: Shares of Walgreens Boots Alliance fell by more than 9%, leading the losers across the S&P 500, Dow Jones Industrials, and Nasdaq 100. This decline came in response to the company’s decision to cut its quarterly dividend from 48 cents to 25 cents per share – a move aimed at conserving cash amid challenging market conditions.

- Mobileye Global (MBLY) Plummets on Revenue Forecast: Mobileye Global’s shares tumbled more than 24% after the company projected 2024 revenue well below market expectations. This significant downgrade in revenue outlook raised concerns among investors about the company’s growth trajectory.

- Mattel (MAT) Drops on Downgrade: Shares of Mattel fell more than 1% after Roth MKM downgraded the stock to neutral from buy. This move indicates a shift in market sentiment towards the toy manufacturer, possibly due to concerns over future growth and market dynamics.

Conclusion:

As the first week of the new year unfolds, the divergent trends across global markets underscore the complexity of the current financial landscape. The resilience of the Dow Jones amongst the Nasdaq’s continued decline reflects a nuanced investor sentiment, grappling with big tech valuations and central bank policy expectations. The market’s response to corporate moves, from Walgreens’ dividend cut to Apple’s downgrade, highlights the ongoing recalibration in investor strategies. The overarching narrative remains one of wary hope, tempered by a keen awareness of the intricate interplay between policy shifts, economic indicators, and corporate performance. As investors continue to adapt, the focus shifts towards the upcoming economic data releases, particularly the nonfarm payroll numbers, poised to offer critical insights into the health and direction of the global economy.