In a healthy rebound from the previous day’s losses, Wall Street saw a notable recovery on Wednesday, driven by a mix of better-than-expected earnings reports and a steadying of economic indicators. The Dow Jones Industrial Average climbed by 151.52 points, while the S&P 500 and Nasdaq Composite advanced by 0.96% and 1.3% respectively. This revival comes after a tumultuous session fuelled by concerns over inflation and interest rate expectations, highlighting the market’s resilience in the face of economic uncertainty. Shares of Lyft surged by 35% following a quarterly earnings beat, while Nvidia’s shares also saw a significant rise, briefly propelling its market cap above that of Alphabet’s.

Key Takeaways:

- Dow Jones Recovers with Notable Gains: The Dow Jones Industrial Average saw a positive shift, closing at an increase of 0.4%. This movement marks a significant recovery, demonstrating resilience in the face of market volatility.

- S&P 500 and Nasdaq Composite on the Rise: The S&P 500 progressed, advancing by 0.96% to close at 5,000.62, while the Nasdaq Composite experienced a 1.3% increase, settling at 15,859.15. These gains highlight a bullish sentiment among investors, keen to recoup losses from the previous session.

- European Markets Rebound Amid Earnings Deluge: The pan-European Stoxx 600 index ended up 0.5%, with tech stocks leading gains by adding 1%. This improvement came as investors digested a flurry of corporate earnings and inflation data, offering a glimmer of hope amidst economic uncertainties.

- UK Inflation Data Surprises Markets: Contrary to expectations, the UK’s inflation rate held steady at 4% year-on-year in January, providing a somewhat optimistic outlook for the economy and possibly influencing the Bank of England’s policy decisions.

- Mixed Responses in Asia-Pacific Markets: While most Asia-Pacific markets experienced declines, Hong Kong’s Hang Seng index defied the trend by gaining 0.96%. This divergence highlights the nuanced impact of global economic data on regional markets, with Hong Kong showing resilience amidst broader market uncertainties.

- Japan’s Nikkei 225 Retreats from Highs: After rallying to 34-year highs, Japan’s Nikkei 225 retreated, falling 0.69% to end at 37,703.32. This pullback from peak levels reflects the market’s sensitivity to both domestic economic signals and global market dynamics, especially in the context of recent rapid movements in the foreign exchange market.

- Sony’s Downward Revision: In contrast, Sony revised its sales forecast for the PlayStation 5 downward to 21 million units, down from the previous estimate of 25 million units. The decision came amidst warnings of weaker transactions in its key gaming division, despite posting record revenue in the December quarter.

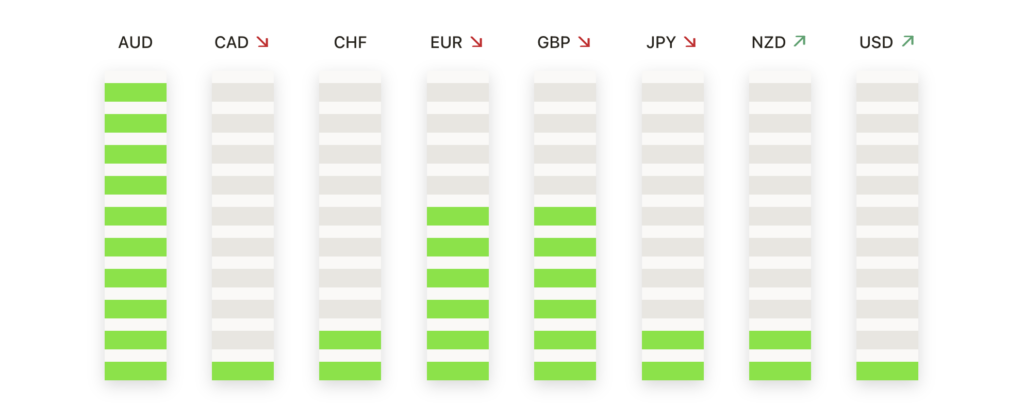

FX Today:

- EUR/USD Stages a Recovery Amid Mixed Signals: After plunging towards 1.0700, EUR/USD attempted a recovery, facing strong headwinds from US inflation concerns. Despite this, the pair struggled to break past the 200-hour Simple Moving Average (SMA) near 1.0760. With a fourth consecutive week of decline and down approximately 3.7% from December’s peak, EUR/USD continues to wrestle with bearish momentum, navigating around the 200-day SMA near 1.0830.

- GBP/USD Adjusts to UK Economic Indicators: The Pound Sterling faced downward pressure, declining by 0.20% to reach 1.2565 against the US Dollar. This was in response to the UK’s inflation rate holding steady at 4% year-on-year in January, slightly below market expectations. The economic data stirred speculations about the Bank of England’s monetary policy path, impacting the GBP/USD pair’s movement.

- USD/CAD Sees Significant Movement: The USD/CAD pair experienced a notable rise, hitting a session high of 1.3578, which marks an increase of over 1% within the day. This movement underscored the bullish momentum for the US Dollar against the Canadian Dollar, with the pair soaring above the 200-day SMA near 1.3477, reflecting the market’s reaction to the US inflation data and its implications for interest rate expectations.

- USD/JPY Experiences Volatility: The USD/JPY pair showed signs of volatility, with a slight retreat from its peak around the 150.80 mark, moving toward 150.52. The fluctuation came amid remarks from Japan’s top currency diplomat regarding the recent rapid movements in the foreign exchange market, sparking a careful watch by authorities.

- Bitcoin Breaks Through $51,000: In a notable rally, Bitcoin’s price surged past the $51,000 mark, with its market capitalisation exceeding $1 trillion for the first time since late 2021. This milestone for the cryptocurrency came amidst a broader rally in digital currencies, with Bitcoin trading around $51,229, up approximately 3% from its price 24 hours prior.

Market Movers:

- Lyft (LYFT)Accelerates with Strong Quarterly Results: Lyft shares surged by an impressive 35% after the ride-hailing company reported earnings that far exceeded market expectations for the fourth quarter. This substantial increase highlights the positive investor sentiment surrounding Lyft’s financial health and future growth prospects.

- Airbnb (ABNB) Faces a Slight Setback: Despite surpassing revenue forecasts for its latest quarter, Airbnb’s stock experienced a minor decline of 1.7%. This suggests that while the company’s financial performance was strong, other factors may have influenced investor confidence negatively.

- Nvidia’s (NVDA) Market Cap Edges Above Alphabet: Nvidia’s shares rose nearly 2.5%, briefly propelling the chipmaker’s market capitalisation above that of Alphabet, a fellow “Magnificent 7” member. This achievement highlights Nvidia’s significant growth and investor optimism about its role in the AI and tech sector.

- Uber (UBER) Announces $7 Billion Share Buyback: Uber Technologies witnessed its stock jump more than 14% following the announcement of a massive $7 billion share repurchase program. This move reflects the company’s robust financial momentum and commitment to delivering shareholder value.

- Charles River Laboratories International (CRL): Charles River Laboratories International saw its shares climb more than 11% after announcing Q4 adjusted EPS of $2.46, exceeding the consensus of $2.42. The company’s optimistic forecast for 2024 adjusted EPS of $10.90-$11.40, stronger than the consensus of $10.87, underscores its positive growth outlook.

- Akamai Technologies (AKAM): Akamai faced a downturn, closing down more than 8% after reporting Q4 revenue of $995 million, below the consensus of $1 billion. The company’s cautious revenue forecast for Q1 further pressured the stock, reflecting challenges ahead.

- MGM Resorts International (MGM): MGM was among the significant losers, closing down more than 6% after its Q4 regional operations net revenue came in below expectations. This decline underscores the challenges facing the hospitality and entertainment sectors.

- Kraft Heinz (KHC) Decline: Kraft Heinz also saw a decline, closing down more than 5% after reporting Q4 net sales of $6.86 billion, falling short of the consensus of $6.98 billion. The dip reflects the ongoing pressures in the consumer goods sector.

- Cisco’s Revenue Woes Lead to 5% Stock Plunge: Cisco’s stock dropped 5% after the company provided guidance for its fiscal third quarter, revealing a decline in revenue. The announcement of a restructuring plan, including a 5% reduction in jobs, added to investor concerns.

- Twilio Slides 10% on Disappointing Revenue Guidance: Twilio’s stock declined 10% after the company issued revenue guidance for the current quarter that fell below analysts’ expectations. Additionally, the number of active consumers came in lower than anticipated.

- Tripadvisor Leaps 7% on Strong Q4 Performance: Tripadvisor’s stock jumped 7% after the company reported better-than-expected earnings of 38 cents per share on revenue of $390 million for the fourth quarter.

As the trading day concludes, the financial markets offer a vivid snapshot of the dynamic relationship between economic indicators, corporate earnings, and investor sentiment. The remarkable recovery on Wall Street, highlighted by significant gains across major indices and standout performances from companies like Lyft and Nvidia, shows the market’s resilience and adaptability. Meanwhile, the movements in the FX market and the surge in Bitcoin’s valuation reflect the broader trends influencing global finance. Investors, navigating through the complexities of inflation concerns and interest rate speculations, remain alert to the shifting economic landscape, balancing optimism with strategic vigilance. Today’s market activities, from tech giants’ rebounds to emerging market currencies’ adjustments, illustrate the ongoing balancing act between risk and opportunity in a world where financial markets are increasingly interconnected and influenced by many factors.