In a day marked by fluctuating fortunes, the stock market narrative took a divergent turn as corporate earnings cast a long shadow over the Dow Jones Industrial Average, leading to a notable retraction from its recent historic surge. Contrasting this pullback, both the S&P 500 and Nasdaq Composite continued their ascent. This mixed bag of market movements, stemming from varied corporate earnings reports and investor sentiment, highlighted the complexity of the current financial landscape. With key players like 3M and Johnson & Johnson reporting less-than-favourable outcomes, whereas others like United Airlines exceeding expectations, the market’s reaction underscores the intricate balance between corporate performance and economic indicators. As investors and traders navigate this terrain, eyes remain keenly focused on upcoming economic data releases.

Key Takeaways:

- Dow Jones Experiences a Setback: The Dow Jones Industrial Average closed lower by 96.36 points, a decline of 0.25%, settling at 37,905.45. This downturn interrupts a three-day winning streak, pulling the index back from its historic crossing of the 38,000 mark achieved on Monday.

- S&P 500 and Nasdaq Ascend: In contrast, the S&P 500 index edged higher by 0.29%, achieving a new all-time closing high at 4,864.60. Similarly, the Nasdaq Composite saw a growth of 0.43%, reaching 15,425.94, indicating continued investor confidence in technology-heavy stocks.

- European Markets Retreat from Early Optimism: European markets concluded the day on a lower note, shedding the initial positivity observed at the week’s start. The pan-European Stoxx 600 index dipped by 0.25%, with a mixed sector performance. Notably, Volkswagen stood out with a significant 5% increase, defying the broader market trend.

- Hong Kong Market Surges on Stimulus Hopes: The Hong Kong stock market rebounded robustly, jumping 3% following reports of a potential substantial stimulus package by China. This surge occurred amidst a backdrop of the Bank of Japan maintaining its unchanged monetary policy stance.

- Bank of Japan Stays Committed to Ultra-Loose Policy: The Bank of Japan reiterated its commitment to an ultra-loose monetary policy, keeping interest rates at -0.1% and maintaining its yield curve control. The bank also expressed confidence in approaching its 2% inflation target, reflecting a cautious yet persistent approach to economic stimulation.

- Malaysia’s Inflation Rate Remains at Two-Year Low: Malaysia reported a steady consumer price index, with the inflation rate holding firm at a two-year low of 1.5%. This stability reflects a balanced economic environment, primarily driven by controlled price increases in key sectors like food, beverages, and hospitality services.

- Netflix’s Subscriber Growth Fuels Share Price Surge: Netflix reported a significant increase in subscribers, adding 13.1 million in the fourth quarter, which pushed its total to 260.8 million paid subscribers and exceeded revenue expectations. Following this announcement, Netflix shares saw a notable jump of 7% in after-hours trading.

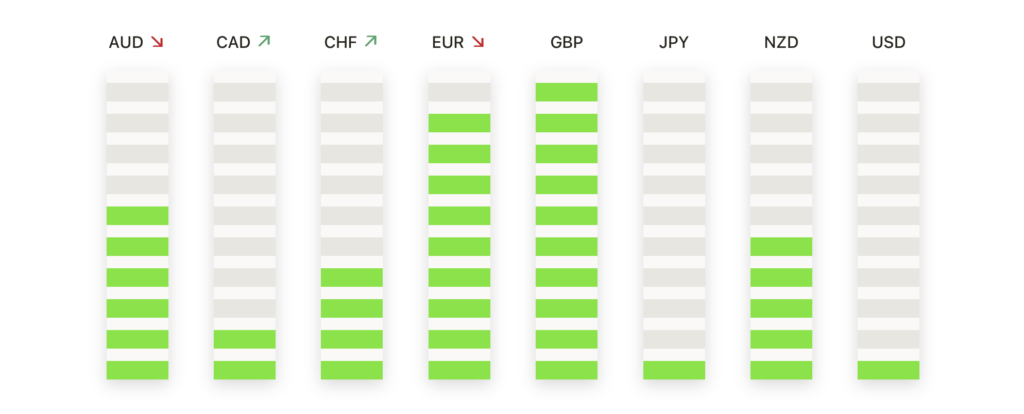

FX Today:

- EUR/USD Encounters Downward Pressure: The EUR/USD pair witnessed a downturn this week, maintaining positions above its crucial 200-day simple moving average near 1.0840. As investors brace for the upcoming European Central Bank’s rate decision, the currency pair’s movement is marked by caution. Should the pair fail to hold above this level, it could see a pullback towards 1.0770, with a critical trendline support at 1.0710. Conversely, resistance is found near 1.0920 to 1.0935, with potential rallies facing hurdles to reach 1.1020, and on further momentum, the 1.1080 mark.

- USD/JPY Poised for Potential Uptick: Following the Bank of Japan’s decision to retain its ultra-loose monetary policy, the USD/JPY pair appears ready for an upward trajectory. Currently eyeing a key resistance near 149.00, a breach of this level could pave the way for a retest of the 150.00 threshold. Should the pair reverse, initial support lies near 147.40, around the 100-day simple moving average, with a further pullback potentially heading towards the 146.00 handle.

- USD/CAD Recovers Ground: USD/CAD has seen a notable rebound in recent days, overcoming key obstacles such as the 200-day and 50-day simple moving averages. With an upward trend gaining momentum, resistance is eyed at 1.3500, followed by 1.3540, representing the 50% retracement of the prior downturn. Conversely, a reversal in gains places immediate support at 1.3415, with a potential decline towards the 1.3300 level if downward pressures intensify.

- Crude Oil Dynamics Impact AUD/USD: The AUD/USD pair experienced a retreat, largely influenced by movements in key commodities. WTI Crude Oil’s fluctuation around $74.50, amidst Middle East tensions and supply concerns, adds to the complexity of this currency pair’s trajectory. The Australian Dollar’s sensitivity to commodity market shifts remains a significant factor in its valuation against the US Dollar.

Market Movers:

- 3M Co Leads Dow’s Decline: 3M Co (MMM) experienced a significant downturn, closing down over 11% and leading the losses in both the S&P 500 and the Dow Jones Industrials. This drop occurred following the company’s forecast of 2024 adjusted EPS ranging from $9.35 to $9.75, falling short of the consensus estimate of $9.81.

- Homebuilders Under Pressure: The homebuilding sector faced headwinds, highlighted by DR Horton (DHI) which saw a 9% decline after reporting Q1 EPS of $2.82, below the expected $2.89. Other major players like PulteGroup (PHM), Toll Brothers (TOL), Lennar (LEN), and Builders FirstSource (BLDR) also closed down more than 4%.

- Invesco Faces Unexpected Outflows: Invesco (IVZ) closed down over 7% following its report of unexpected net flows falling by -$8.3 billion, contrary to expectations of an increase of +$8.78 billion, signalling investor retreat from the fund manager.

- Lockheed Martin Slips on Earnings Outlook: Lockheed Martin (LMT) witnessed a decline of over 4%, reacting to its forecast of 2024 EPS ranging between $25.65 and $26.35, significantly below the consensus estimate of $26.74.

- Alkami Technology Downgraded: Alkami Technology (ALKT) saw a drop of over 3% following a downgrade by Goldman Sachs from buy to neutral, reflecting a shift in market confidence about the company’s prospects.

- Johnson & Johnson’s Mixed Results: Johnson & Johnson (JNJ) closed down over 1% despite reporting better-than-expected Q4 sales and earnings. The decline was influenced by the CFO’s remark on expected lower pharma sales in the latter half of the year due to diminishing sales of the psoriasis drug Stelara.

- Verizon Communications on the Rise: Verizon Communications (VZ) rallied, closing up more than 6%, leading the gainers in both the S&P 500 and Dow Jones Industrials, buoyed by its optimistic forecast of 2024 adjusted EPS between $4.50 and $4.70, slightly above the consensus of $4.58.

- United Airlines Soars Post-Earnings: United Airlines Holdings (UAL) saw a surge of over 5% after reporting a Q4 adjusted EPS of $2.00, surpassing the consensus estimate of $1.69, defying the broader market trend.

- Procter & Gamble’s Strong Quarter: Procter & Gamble (PG) ended the day up more than 4% after its Q2 core EPS of $1.84 beat the consensus estimate of $1.70, reflecting solid operational performance.

- Brown & Brown Exceeds Revenue Expectations: Brown & Brown (BRO) closed up more than 4% after reporting a Q4 revenue of $1.03 billion, surpassing the consensus forecast of $987.6 million, highlighting its strong market position.

The trading session painted a many-sided picture of the stock market, reflecting the intricate interplay of corporate earnings, investor reactions, and broader economic indicators. The Dow’s retreat from its recent peak, contrasted with the sustained advances of the S&P 500 and Nasdaq, underscores the diverse undercurrents shaping market dynamics. Notable shifts in individual stocks, from 3M’s significant drop to United Airlines’ unexpected surge, highlight the subtle impact of corporate performance on market sentiment. This environment underscores the critical importance of staying alert to the evolving economic landscape, as it continues to offer both challenges and opportunities in the ever-shifting world of financial markets.