Some analysts are predicting a 25-basis point hike, citing persistent wage pressures and underlying inflation.

The RBA has been under pressure to raise rates in order to combat inflation, which is running at a 20-year high of 5.1%.

However, the bank has been cautious, noting that the economy is still recovering from the COVID-19 pandemic.The latest economic data provides mixed signals about the health of the Australian economy.

The wage price index released on August 15th showed year-on-year growth of 3.6%, which is slightly below expectations. However, this still indicates that wage pressures are contributing to inflationary trends.

Headline CPI figures for August showed a cooling down to 4.9% year-on-year, from 5.4% in July. However, when you exclude volatile items, the underlying inflation rate remains stubbornly high at 5.8%.On the employment front, July’s data revealed an unemployment rate of 3.7%, which is slightly worse than the expected 3.6% and previous 3.5%.

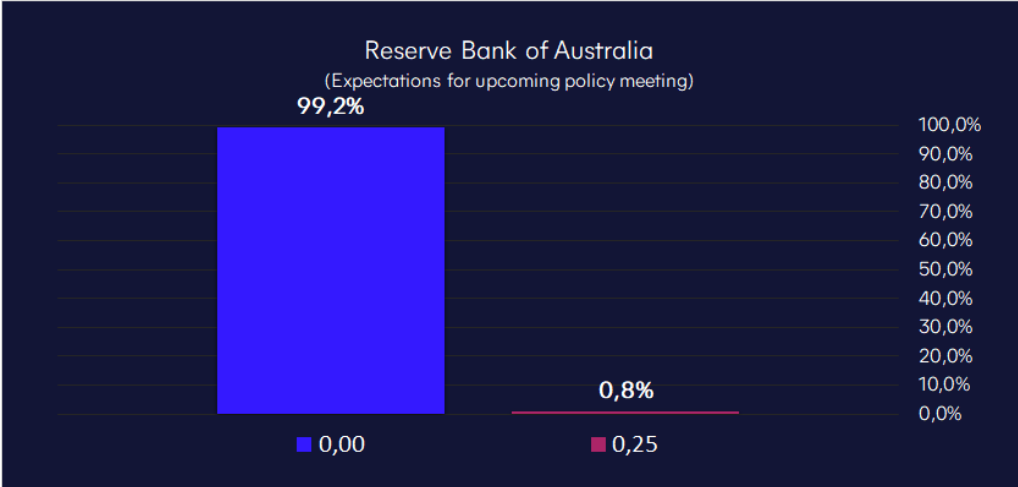

Also, employment decreased by 14.6k as opposed to the expected increase. These labour market metrics and the recent CPI figures seem to support the view that the RBA will be cautious and likely maintain rates while looking for more substantial signs that inflation is under control.

However, the RBA will also be mindful of the global economic environment.

The US Federal Reserve is expected to raise interest rates in September, and this could put upward pressure on the Australian dollar.In conclusion, the RBA is facing a difficult decision tomorrow.

The bank will need to weigh the risks of inflation against the risks of a slowdown in economic growth. A rate hike could help to cool inflation, but it could also damage the economy.

FX Intervention Risks Remain

The risk of central bank intervention in the currency markets remains a focus for traders. The Bank of Japan (BoJ) and the People’s Bank of China (PBOC) have both intervened in the markets in recent months to try to prop up their currencies.

USDJPY and USDCNY are still trading close to the levels at which the BoJ and PBOC intervened last year. If these pairs continue to fall, the central banks may intervene again.

Traders should pay attention to price action on these pairs for any possible signs of intervention. The moves are usually massive, so it is worth paying attention to.

US Services PMI Slows

The US services sector is showing signs of slowing. The ISM services index for August is expected to register at around 52.4 to 52.6, a marginal dip from July’s 52.7.

This would still indicate that the US services sector is in expansion, but it also shows that the pace may be slowing.

The S&P Global flash PMI corroborated this view, recording a six-month low of 51.0 for services business activity in August.This could indicate that the sector-led acceleration seen in Q2 has started to fade.

Fed’s September Meeting Looms

The Federal Reserve’s (Fed) FOMC meeting is set for September 20. Markets are pricing in a 50-50 chance for any further rate hikes, given a more recent string of data misses and signs that inflation pressures may be diminishing.

However, the Fed will also be mindful of the global economic environment. The US economy is still on a trajectory for a soft landing, but there are some risks to this outlook.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.