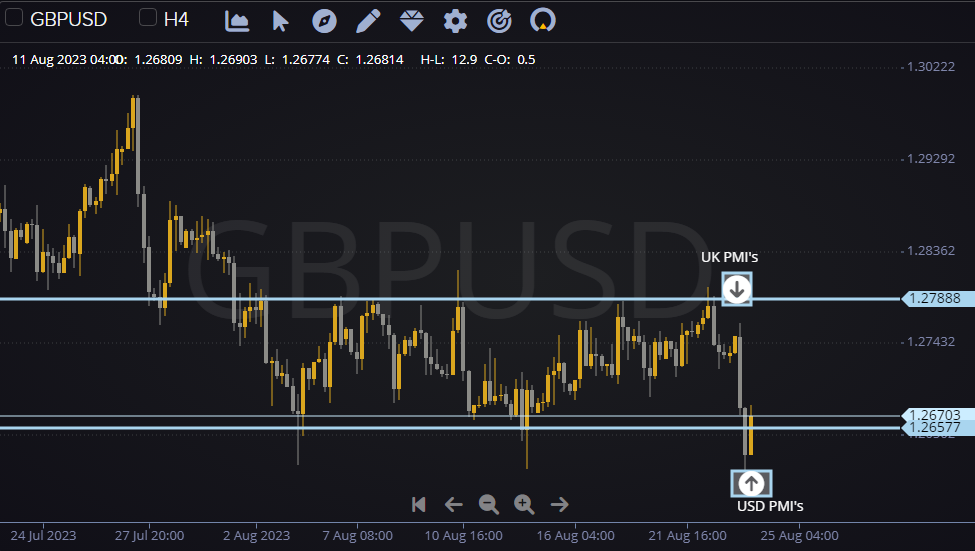

EURUSD and GBPUSD Plunge as Eurozone and UK PMIs Disappoint

The euro and pound sterling fell sharply on Wednesday after the release of disappointing flash PMI data from the eurozone and the UK.

The eurozone flash PMI composite fell to 51.9 in August, from 52.1 in July, and the flash manufacturing PMI fell to 52.0, from 52.3 – both readings were below expectations.

The UK flash PMI composite fell to 51.3 in August, from 52.0 in July, and the flash manufacturing PMI fell to 52.0, from 52.2 – both readings were also below expectations.

The weak PMI data raised concerns about the economic outlook for both the eurozone and the UK. The eurozone is already in recession, and the UK is at risk of entering a recession if the economic slowdown continues.

The weak data also weighed on risk appetite, which supported the dollar. The dollar index (DXY) rose to 103.60 – its highest level in more than two years.

US Treasury Yields Pull Back After Hitting New Cycle High

US Treasury yields pulled back after hitting a new cycle high on Tuesday. The yield on the 10-year Treasury note fell to 3.25% from 3.30%.

The pullback in Treasury yields came after the release of the weak eurozone and UK PMI data. The weak data has raised concerns about the global economic outlook, which led investors to demand safe-haven assets such as Treasuries.

However, Treasury yields are still trading at elevated levels, which suggets that investors are still expecting higher inflation in the future.

S&P Flash PMIs in Focus

The main highlight for the rest of the day will be the release of S&P Flash PMIs for the US. The PMIs are expected to show a slowdown in economic activity in August, but they are not expected to be as weak as the eurozone and UK PMIs.

If the US PMIs come in weaker than expected, it could weigh on the dollar and support gold and other precious metals.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.