Market Sentiment Bounces as US Treasury Yields Hit New Cycle Highs

The DXY has also pulled back from the key 103.50 trend and horizontal resistance, which has given base metals and precious metals a bit of room to recover as well. With upside in base and precious metals, the commodity-sensitive AUD and NZD have been leading the major currencies to the upside.

US Treasury Yields Hit New Cycle Highs

US Treasury yields hit a new cycle of high yesterday, taking out the previous high from last year October. The recent move in yields have been driven partly by better growth prospects, higher risks of inflation, and of course a huge amount of supply expected to hit the markets in the months ahead.

Watching US10Y Closely

It is important to watch US10Y closely as its new cycle high.

If we see a swing failure at the previous cycle highs and yields push lower, it could provide a decent opportunity for risk assets, especially the AUD, which is sensitive to both equities and commodities.

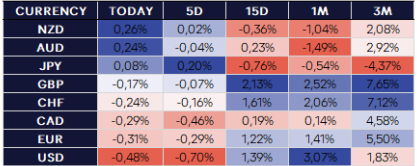

FX Strength Matrix

The strongest currecy so far today is NZD (+0.26%), with the weakest currency being the USD (-0.48%).

AUD Leading the Majors

In FX, the AUD is leading the major currencies to the upside following this morning’s continued risk-on tone as commodities and equities trade higher. The USD is the weakest of the majors with the USD pullinh back after rejecting major resistance at 103.50.

Pound Still Running on Stretched Long Positioning

The Pound is still running on a very stretched long positioning among institutional investors, and since, the economic outlook remains bleak.

We would prefer to trade EURGBP higher from the current levels if wesee FR and DE data better, and if we UK Flash PMIs surprise lower.

Overall, the market is still in a state of flux as investors try to assess the impact of rising yields on risk assets.

However, the recent bounce in sentiment can be considered a positive sign, and we could see further gains in risk assets if we see a swing failure in US10Y.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.