What’s Making The Headlines

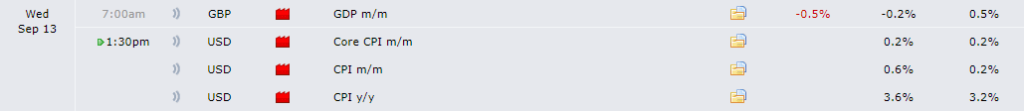

- Sterling takes another push lower as growth data disappoints

- Apple continutes to weigh on the S&P and Nasdaq with a 2% fall following yesterday’s iPhone event

- All focus for major asset classes is firmly fixed on today’s US CPI data

This morning’s UK growth data showed a faster than expected contraction in UK growth for July. The lower growth data combined with yesterday’s lower labour data continues to paint a stagflation picture for the UK economy, and has as a result seen Sterling tank lower after the release.

Even though markets are still pricing in a hike for next week for the BoE, if the bank does follow through with a hike, it is likely to be the last of the cycle given the current growth and labour market dynamics.

The bottom line is that the bias for Sterling remains bearish in our view until the economy improves.

The DXY remains above the 104.50 psychological level, with US 10-year Treasury yields trading around 4.3%.

Gold is trading a smidge above 1910, with all the focus on this afternoon US CPI data. It’s the main risk event for the week – so well worth paying attention to this one today.

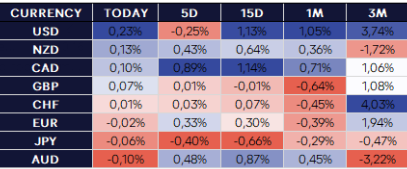

FX Strength Matrix

In FX, the USD is leading the major currencies to the upside as the index bounced from key support around 104.50, with eyes looking towards CPI.

The GBP is the weakest of the majors following another contraction in UK growth, alongside yesterday’s drop in labour as well.

The main highlight for today will be the incoming US CPI print.

A couple important things to keep in mind for today:

- A hot number probably won’t change expectations for a September hike (especially with Fed being in the blackout period), but it could alter November expectations.

- Markets are already expecting a higher number based on the recent moves in commodities (especially oil).

The biggest surprise for markets today will be a miss and not a beat.

With the Cleveland Fed inflation nowcast at 3.8% for the headline and 4.4%, markets are leaning towards a higher number.

Now that doesn’t mean that the USD can’t push higher on a beat of course, but it does mean the bar is higher for it to do so.

In other words, the risk to reward is far more attractive for USD shorts on a miss, than it is for USD long on a beat.

We can also see that the forecast distribution for both is quite high with a big margin between the low and high estimates.

A surprise miss would support commodities and equities, which should be good for the AUD. The other alternative option is gold longs.

A miss in CPI should push both the USD and Yields lower, which should be positive for gold.

This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. INFINOX is not authorised to provide investment advice. No opinion given in the material constitutes a recommendation by INFINOX or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

All trading carries risk.